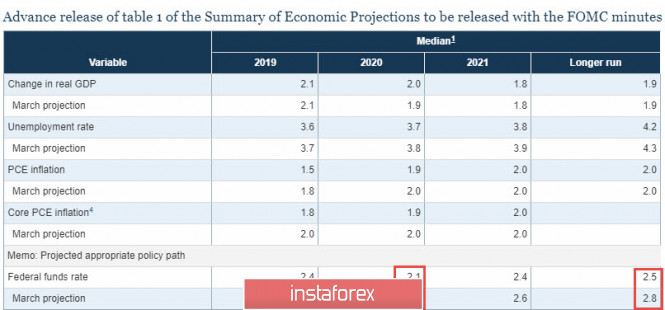

The Fed did not surprise the markets with the outcome of the two-day monetary policy meeting. The rate remained unchanged, but the forecasts for inflation, unemployment and GDP has slightly changed. The most significant changes according to forecasts occurred in 2020.

At the same time, the rate forecast has changed according to a not quite obvious algorithm. In May, the markets began to prepare for a one-time rate cut in the current year, and by June, expectations had shifted by two cuts or even three. This is based on the forecast for the CME futures market rate.

However, the Fed made an emphasis on 2020. The rate forecast was reduced from 2.6% to 2.1%, that is, it implies two cuts. But for 2019, the forecast is left unchanged.

This means that the Fed is trying to prevent panic sales, because its forecast implies that there will be no recession this year. The same conclusion follows from other figures - the inflation forecast is lowered. However, by 2021, it is expected to be fixed at the target level, and the GDP and labor market forecast has been improved altogether.

But if so, then why reduce the rate? Apparently, the focus is on a smooth slowdown. It is absolutely impossible to ignore the record-breaking growth of the budget deficit, which will require emergency measures from the US government. In addition, preparations for these measures should take place against the background of a smooth slowdown, which is beneficial to all parties to the future presidential company.

Thus, it can be assumed that the outcome of the Fed meeting is more political than economic. In favor of this conclusion, the sharp rise in gold to a 14-month high, the rapid strengthening of the yen and the demand for bonds are traditional defensive assets. The dollar is expectedly weakening across the entire spectrum of the foreign exchange market, and this trend will only increase.

USDJPY

The Bank of Japan expectedly kept the interest rate at the level of -0.1%, targeting the yields of 10-year government bonds at the near-zero level which will also be maintained. On the other hand, decisions on the monetary base and the repurchase of assets remained unchanged. The Bank of Japan made it clear that, at least until spring 2020, it does not intend to make changes to its monetary policy, because it has to take into account both the growing uncertainties in the global economy and the need to assess the consequences of an increase in the consumption tax this fall.

Domestic demand in Japan is slowing, leading to an increase in the budget deficit. In the context of slowing demand, export growth is important. Thus, Japan is more interested in global growth than anyone else. The decline in demand from China and South-East Asia led to a marked decline in Japanese exports, which, in turn, affected the strong fall in engineering.

The weakness of the manufacturing sector inevitably extends to domestic demand, which is clearly seen by the sharp drop in retail sales. Accordingly, there is no hope for growth in consumption at the current stage, since wage growth remains modest and real incomes of labor are declining. All of the above explains the cautious position of the Bank of Japan, which has no reason to change anything.

In the previous review, we expected a "slow decline to 107.80 followed by a breakthrough downward". The forecast was fully implemented, but a further decrease is still in question. If the stock markets hold near the highs, the yen will go to the side range with the upper limit of 107.80 / 90, but if panic is going to increase, then the movement to 106.20 / 40 with an eye on 105 will become more likely.

USDCAD

The loonie, as expected, successfully tested support for 1.3250. The movement was supported not only by the results of the FOMC meeting, but also by unexpectedly strong data on inflation in May. The annual index rose from 1.5% to 2.1%, while the expected decline to 1.2%. The result will not allow to expect that the Bank of Canada will take any incentive measures.

Canadian dollar remains in favor and aims at 1.3110 / 20.

The material has been provided by InstaForex Company - www.instaforex.com