The dollar strengthened quite briskly, although if you look at the US statistics, you just have to throw up your hands, because there was nothing to be happy about. Thus, the number of open positions at JOLTS decreased from 7,474 thousand to 7,449 thousand, and the total number of applications for unemployment benefits increased by 5 thousand, instead of decreasing by 16 thousand. Unemployment increased by 2 thousand instead of decreasing by 13 thousand. Well, the number of initial claims for unemployment benefits did not decrease by 3 thousand, but increased by 3 thousand according to the report of the United States Department of Labor, while the rest further exacerbate the picture. Thus, commercial inventories increased by 0.5%, and the growth rate of retail sales slowed from 3.7% to 3.2%. However, the most disappointing one was the data on inflation, which decreased from 2.0% to 1.8%, together with producer prices, whose growth rates slowed down from 2.2% to 1.8%. Such inflationary dynamics unambiguously suggests that in a short time the Federal Reserve will shift from arguments about the possibility of reducing the refinancing rate to announcing deadlines for easing monetary policy. The only thing that could somehow please investors was the data on industrial production, whose growth rates increased from 0.9% to 2.0%, although they were waiting for an acceleration to 2.5%. So the US data itself obviously did not provide reasons for the dollar's growth.

At the same time, in Europe there was practically nothing at all, except for data on industrial production, the rate of decline of which slowed down from -0.7% to -0.4%. Although the dynamics can be called positive, it rather shows that the patient occasionally, albeit shows signs of life, but still the negative news from the United States came with enviable regularity, and from Europe only once, and only briefly.

But we were somewhat more pleased with some information from the shores of Great Britain, although it was still not as intense as that from North America. Particularly pleased with the data on industrial production, which seems to be tired of growing by 1.3% and is now decreasing by 1.0%. But the data on the labor market caused much more enthusiasm, as it was a miracle that the unemployment rate was kept at the same level, although the number of applications for unemployment benefits increased from 19.1 thousand to 23.2 thousand. However, investors are much more interested in data on wages, since they largely depend on the return on investment. So, if you look only at the average wage, then its growth rate increased from 3.3% to 3.4%. However, the picture begins to paint completely different colors, if you look at the average wage, taking into account bonuses or, more simply, taking into account overtime. The fact is that the growth rate of this indicator has already slowed down from 3.3% to 3.1%, which indicates the obvious unwillingness of Her Majesty's subjects to work overtime, for the benefit of employers.

In other words, it is not very happy everywhere, but negative macroeconomic data came with enviable regularity from the United States. The dollar is still growing. Therefore, the answer to this question lies in a slightly different plane.

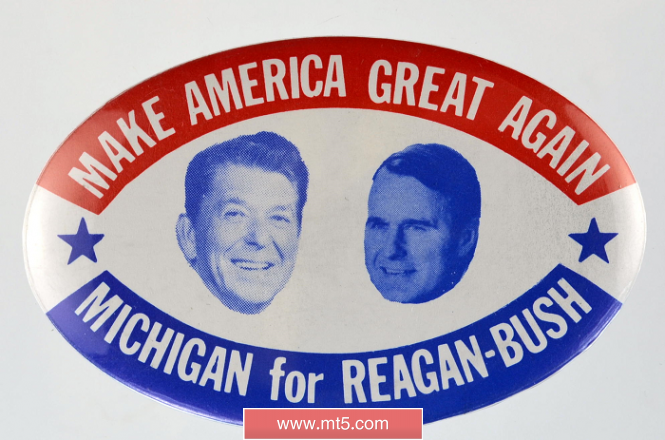

After all, it was not for nothing that Donald Trump did not diligently interfere in the internal affairs of Great Britain, giving everyone advice about who in the course of the next most Democratic elections should be elected head of the Conservative Party, and therefore the prime minister. So, during the most representative elections, with one hundred percent turnout, 312 (THREE TWELVE) members of the Conservative Party decided who would be destined to finally complete the epic with the threefold cursed Brexit. As many as 114 of them chose Boris Johnson, for whom, of course, Donald Trump did not campaign. In the end, a vassal is not a completely sovereign state, so a Suzerain can do anything there, and this has nothing to do with interference in internal affairs. But the piquancy of the situation lies in the fact that the same Boris Johnson is a supporter of the most immediate possible exit from the European family, albeit without a deal. Moreover, by a transaction or agreement, it means only that which includes a clause on payments from Europe in favor of the United Kingdom, and nothing else. And you never know what is written in the rules of this stupid European Union. In other words, the leadership of the Conservative Party brought the unregulated Brexit, with its unpredictable consequences, one more step closer. They are unpredictable only on the scale of the subsequent catastrophe, both for the British economy and for continental Europe. Uncertainty is much worse than understanding negative consequences. After all, when you do not understand what exactly to prepare for, it is much more intriguing than knowing how much you will lose. And for the complete happiness of the Conservative Party, it remains only to make a single step, and in the second round of the party elections to vote again for Boris Johnson.

Another extremely important event was the incident in the Gulf of Oman, when two oil tankers were either torpedoed or blown up by sea mines. The tragedy occurred near the coast of Iran, which immediately sent the boats of the Islamic Revolutionary Guard Corps to rescue the crews of the ships. But they managed to save only the crew of one of the tankers, as the American missile destroyer had already approached the second. The United States immediately accused the Islamic Republic of all, and although two oil tankers are just a drop in the ocean on the oil market and can in no way affect the balance of supply and demand, the very thought of a military clash between America and Iran plunged all market participants into a state of panic. Any panic usually has a positive effect on the dollar, because it is still perceived as a defensive tool.

The coming week can be safely called the week of central banks' meetings, and the main one will be the meeting of the Federal Commission on Open Market Operations. In addition, a meeting of the Board of the Bank of England will take place, but few people are interested in it, since it is obvious that the Mark Carney Office will not take any steps until the epic with Brexit is completed and it becomes clear what to expect in the future. But the meeting of the US central bank interests everyone without exception. It is only known that following the results of the upcoming meeting, no changes in the parameters of the conducted monetary policy will occur. However, everyone is concerned about the future plans of the regulator. So far, the official policy of the Federal Reserve System is to gradually tighten monetary policy. Nevertheless, lately, more and more representatives from the regulator have heard the words about lowering the refinancing rate, however, so far in the sense that there are no prerequisites for this. Also in the text of the minutes of the previous meeting of the Federal Commission on Open Market Operations there were hints of the possibility of revising plans in the direction of easing monetary policy, if the situation requires it. Another extremely interesting factor is that in one of his recent speeches, Jerome Powell focused on the need to develop clear and transparent tools for regulating the financial system in case of unforeseen situations. Thus, everything indicates that some adjustment of the regulator's plans will be announced after the results of the upcoming meeting of the Federal Commission on Open Market Operations. Against this background, investors will not care about the expected decline in inflation, as well as the slowdown in retail sales growth in the UK.

Any changes to the plans of the Federal Reserve System will have a detrimental effect on the dollar, so that the single European currency can rise to 1.1325.

The pound, of course, will be under serious pressure due to the practically guaranteed victory of Boris Johnson, but the realization that the Federal Reserve System is changing course will later make it possible for the pound to rise to 1.2700.