The number of new jobs in the US non-agricultural sector increased by 224,000 in June, significantly exceeding consensus expectations. However, the unemployment rate increased from 2.6% to 3.7% and the average wage growth slowed down to 0.2% with expectations of 0.3%. The last two parameters have slightly reduced the positive effect of the report, but the chances of a Fed rate cut at the meeting on July 31 are still high.

The growth of new jobs could be largely a response to the threat of increasing tariffs on Mexican imports, since domestic trends in the US economy clearly did not have this result. Moreover, PMI indices are slowing down in both production and services, the trade deficit at record levels, as well as the budget deficit.

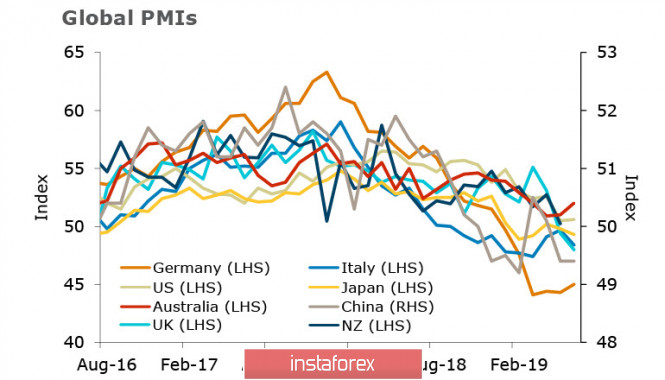

Stock indices are still trading near historical highs, despite the apparent slowdown in global PMI.

Perhaps, the reason is due to the fact that the slowdown in world trade is caused by a decrease in demand due to a trade war, which is regarded by the markets as a temporary phenomenon. Accordingly, the decline in demand is also temporary, which makes it possible in the long term not to take into account the advent of the global recession as inevitable.

NZDUSD

The quarterly poll of ANZ which was published last week, showed that the slowdown in production activity continued in Q2, which could lead to a reduction in jobs in the sector and, as a result, lead to a decrease in household income.

This week, several indicators related to inflation will be published - the price index for food, the dynamics of spending on credit cards and a report on mortgage lending. ANZ Bank believes that the negative dynamics is not temporary, and in the near future, the New Zealand economy can expect serious shocks. The reasons for a two-fold reduction in the rate of the RBNZ in August and November are serious, and the research of NIESR and a number of large commercial banks are simultaneously talking about this.

Following the Aussies, Kiwi leaves in the lateral range of 0.6592 / 6600 ... 0.6719 / 26. This range is quite wide, however there are no reasons to leave it yet. Kiwi was the only commodity currency that has been falling against the dollar in recent months; and now, this trend has stopped.

AUDUSD

The Australian dollar, as expected, declined to the nearest support of 0.6955, but there was not enough momentum to develop the movement.

The decrease in the RBA rate to the historically minimum level, is probably the latest in the current year. The head of the RBA Law stated earlier that the rate cut is a step aimed at supporting employment and increasing inflation in the range of 2-3%. Indeed, the RBA revised the long-term unemployment forecast to 4.5% compared to 5% earlier, which means that the RBA believes that Australia can maintain a lower unemployment rate without significant inflation now.

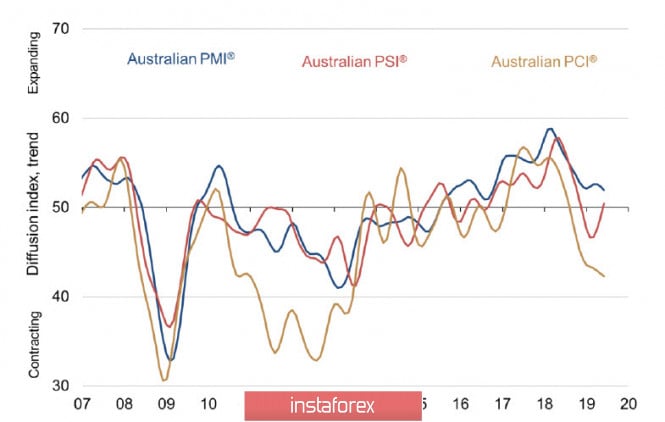

On the other hand, the latest Ai Group business surveys were mixed. Australian manufacturers reported the weakest conditions in almost three years, while the services sector expanded for the second month in a row, although somewhat slower than in May. The construction sector continued to decline in June, but the pace of decline slowed.

If the RBA believes that it will be possible to keep unemployment at a lower level without the threat of rising inflation, then there is no point in further reducing the rate, since these steps will no longer provide economic benefits. The dynamics of construction permits show that the housing boom is over, which means that consumers are targeting lower levels of income in the future, and one or two lower rates will not increase the demand for housing.

The reason is in anticipation of the intensification of the trade war between the US and China, and the Australian economy is closely linked with both states, and in the growing likelihood of a new global crisis. In the current environment, the RBA will observe global trends and will react only when the situation changes radically.

The trend in Aussie, thus, changes to neutral. There are no reasons for the development of a downward movement without a noticeable change in the external situation. The support for 0.6955 transfers to the status of the lower boundary of the range, and the Aussie goes into horizontal drift, in anticipation of the Fed meeting on July 31 and news on trade wars.

The material has been provided by InstaForex Company - www.instaforex.com