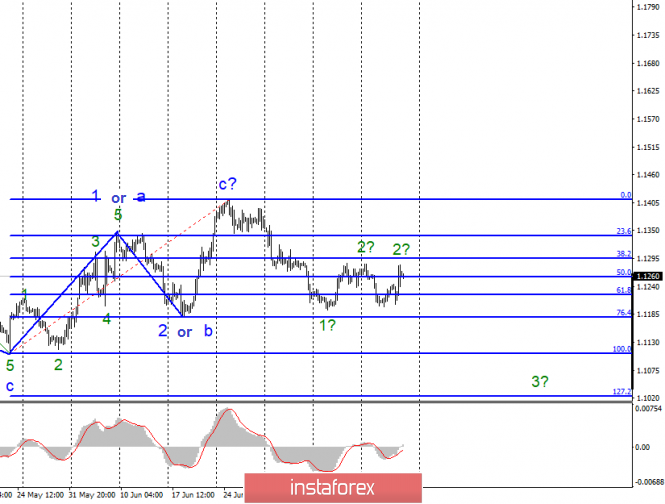

EUR / USD

On Thursday, July 18, trading ended with a 50 bp rise for the EUR / USD pair. Thus, the proposed correction after July 9 is delayed, but the current wave marking still involves building a new downward wave, presumably 3. At the same time, until a successful attempt to break through the minimum of wave 1 or the minimum of wave 2 or b, the option with the complication of the supposed wave with . Thus, I recommend selling the euro-dollar instrument below the indicated minimums. The news background, from my point of view, is definitely not in favor of the euro. Foreign exchange markets have come to terms with the fact that the ECB will also reduce the key rate, which will now become a minus sign. Markets await the resumption of the quantitative incentive program. Markets are waiting for a change in the head of the ECB. Markets do not expect acceleration of inflation and economic growth. From the current news and economic reports there is nothing to highlight on Friday. This is a good opportunity for bears to start selling Eurocurrency again. Although with this, the forex market can wait until next week, when the ECB meeting will be held.

Purchase goals:

1.1412 - 0.0% Fibonacci

Sales targets:

1.1106 - 100.0% Fibonacci

1.1025 - 127.2% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair still holds hopes for the upward trend. I still recommend small purchases of the euro, or simply remain in previously open purchases, with targets located near the estimated mark of 1.1412, which is equal to 0.0% Fibonacci, and an order restricting possible losses, under the minimum of wave 2 or b. Leaving the tool below the mark of 1.1181 will indicate that the tool is ready to build a downward trend.

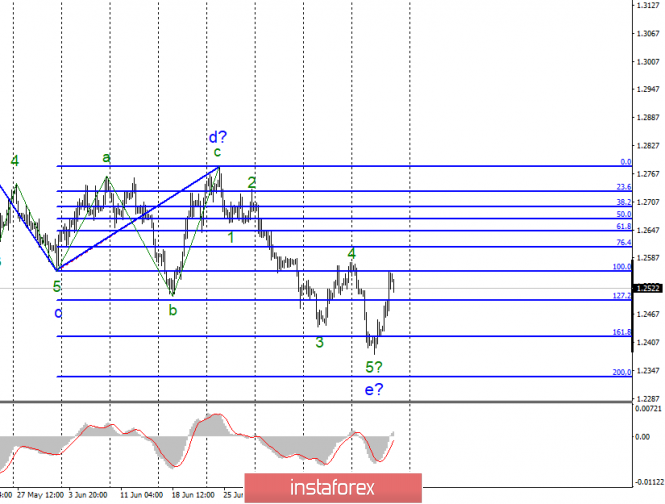

GBP / USD

The GBP / USD pair increased on July 18 by 115 basis points, which fully corresponds to the current wave pattern, which implies the completion of the construction of wave e, the completion of the construction of the downward trend. If this is indeed the case, then at least I am waiting for the pound-dollar tool to build three waves up or to the side, which is also possible. The main opponent of the pound is now the news background. All events in the UK do not contribute to the growth of the pound sterling in the foreign exchange markets. For example, yesterday, the Parliament of Great Britain voted for blocking a possible suspension of Parliament's work, which Boris Johnson had previously allowed in order to make a decision to withdraw from the European Union without a deal on his own. Now, he will not be able to make such a decision, bypassing Parliament. However, what now with the election promises of the country's "no-5-minute prime minister"? After all, he promised new negotiations with the EU, which will not happen, and the exit from the block on October 31, which is now also not a fact that it will be implemented. In general, the situation gets more confusing more and more each day.

Sales targets:

1.2334 - 200.0% Fibonacci

1.2194 - 261.8% Fibonacci

Purchase goals:

1.2783 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument assumes the completion of the construction of the downward wave e. Thus, I recommend small purchases of a pair with targets located around 28 figures and with an order restricting losses under the minimum of wave e. I do not recommend to return to sales yet.

The material has been provided by InstaForex Company - www.instaforex.com