After the final data on the index of business activity in the manufacturing sector of the United States showed a much better result than the preliminary assessment, many hope that a similar thing could happen with the business activity index in the service sector, as well as with the composite index of business activity. Moreover, the preliminary data and so has shown growth. Thus, there is a possibility that the growth of business activity will be much more significant than originally expected. According to preliminary forecasts, the dollar has serious grounds for growth.

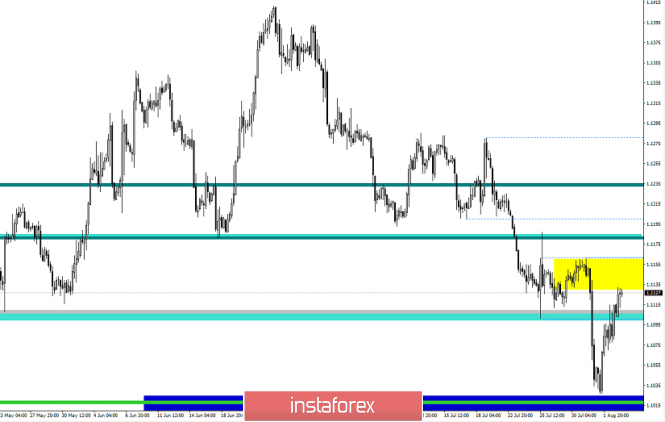

The EUR/USD pair, after an impressive downward move, came very close to the psychological level of 1.1000, where it felt support and moved to a correction stage. Analyzing the trading chart in general terms, we see that the corrective move has returned us to the area of the previously formed cluster of 1.1120/1.1155, which in itself plays the role of a mirror level.

It is likely to assume that fluctuation within this range will lead to a stop and finding a periodic resistance level. In case the forecast is confirmed, there are prerequisites for restoring the original course. The considered coordinates for entry into short positions at the moment is 1.1095, with an estimated decrease to 1.1070--1.1000.

Otherwise, accumulation within 1,1120/1,1155, will continue until tomorrow.

From the point of view of the complex indicator analysis, we see that all smaller periods, including intraday ones, have turned to an upward direction, due to the correction phase. A deep time interval, the daily chart for example, retains a downward interest referring to the early inertial course. Working with indicators, it is worth considering that the current resistance will primarily affect the short-term periods, forming a stagnation in relation to which we will see changeable indicators that will confirm our previously derived theory.