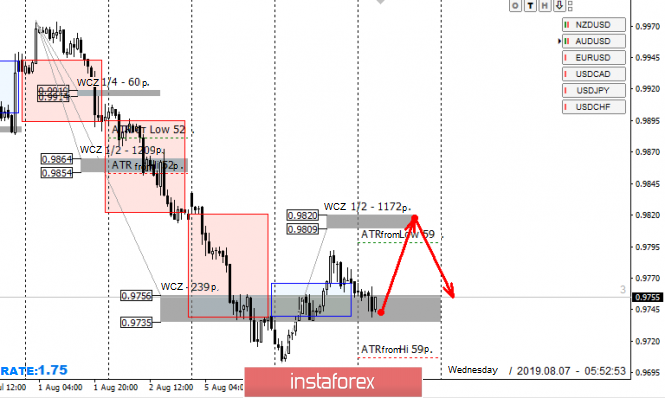

Yesterday's growth became natural, as the pair tested the monthly short-term of August. Further growth is a priority, and it is better to refuse sales. Previously opened sales can be completely closed, since the probability of a strong further decline is 30%.

The zone of the weekly average move was also tested earlier this week. The first upward target is the Weekly Control Zone 1/2 level of 0.9820-0.9809. Testing this zone will partially close yesterday's purchases, and the rest will be transferred to breakeven.

The reversal model will be developed if the closure of today's US session will occur above the level of 0.9820. This will indicate an increase in the probability of further growth to 70%. The search for the pattern for sale with the testing of WCZ 1/2 is also possible because this zone is crucial for corrective upward movement.

Daily CZ - daily control zone. An area formed by important data from the futures market that changes several times a year.

Weekly CZ - weekly control zone. An area formed by the important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. An area that reflects the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com