To open long positions on EURUSD, you need:

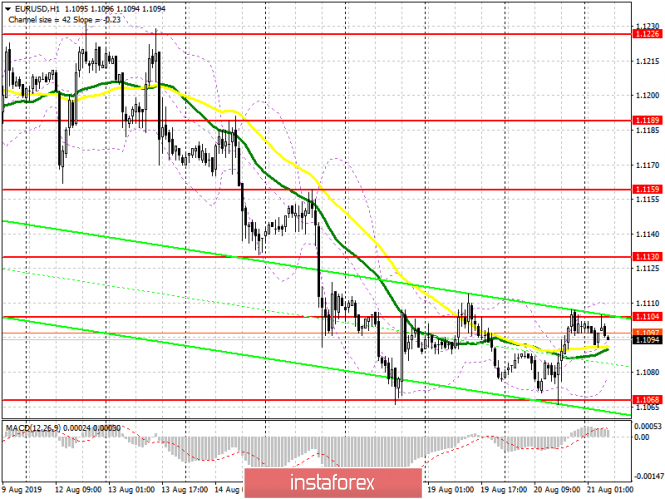

From a technical point of view, nothing has changed. Buyers returned to the market after yesterday's support update of 1.1068, and all are also focused on the large resistance of 1.1095-1.1105, a breakthrough of which will strengthen the demand for the euro and lead to an update of a larger maximum of 1.121, where I recommend taking profit. However, the main goal of the bulls is the area of 1.1153, which will allow to build a new upward trend in the euro. In the scenario of EUR/USD decline in the morning, in the absence of important fundamental statistics, it is best to return to long positions to rebound from a minimum of 1.1068, or slightly lower, from the area of 1.1028.

To open short positions on EURUSD, you need:

Today, the whole focus will be shifted to the minutes of the Fed from the July meeting, so it is unlikely to expect a major growth of the euro in the morning. This scenario will allow the bears to build a false breakdown in the resistance area of 1.1105, which will lead to an update of last week's low, as well as to its probable breakdown, which yesterday was not possible. A further target for sellers will be the support levels of 1.1028 and 1.0990, where I recommend fixing the profit. The absence of important news in the morning may also allow EUR/USD to get above the resistance of 1.1105. In this scenario, it is best to open short positions by rebounding from the highs of 1.1130 and 1.1159.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market.

Bollinger Bands

The break of the lower limit of the indicator in the area of 1.1075 will strengthen the bearish trend, and the break of the upper one in the area of 1.1110 will lead to an upward correction.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20