Forecast for August 1:

Analytical review of H1-scale currency pairs:

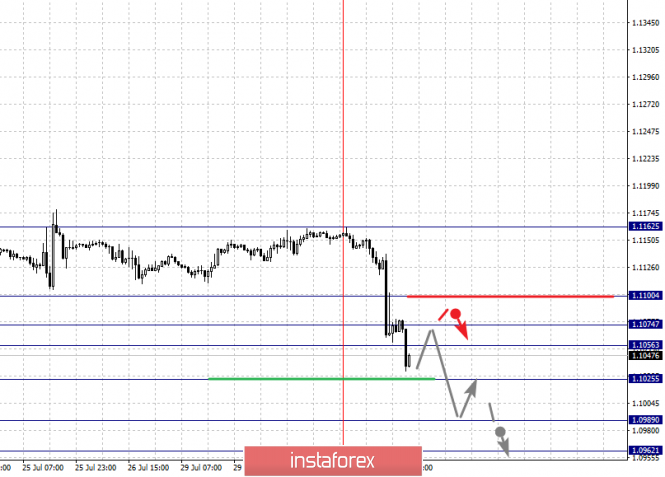

For the euro / dollar pair, the key levels on the H1 scale are: 1.1100, 1.1074, 1.1056, 1.1025, 1.0989 and 1.0962. Here, the subsequent targets for the downward movement are determined from the downward local structure on July 31. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.1025. In this case, the target is 1.0989. Consolidation is near this level. For the potential value for the bottom, we consider the level of 1.0962. After reaching which, we expect a rollback to the correction.

Short-term upward movement is possibly in the range of 1.1056 - 1.1074. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 1.1100. This level is a key support for the downward structure.

The main trend is the local downward structure of July 31.

Trading recommendations:

Buy 1.1056 Take profit: 1.1073

Buy 1.1076 Take profit: 1.1100

Sell: 1.1025 Take profit: 1.0990

Sell: 1.0987 Take profit: 1.0962

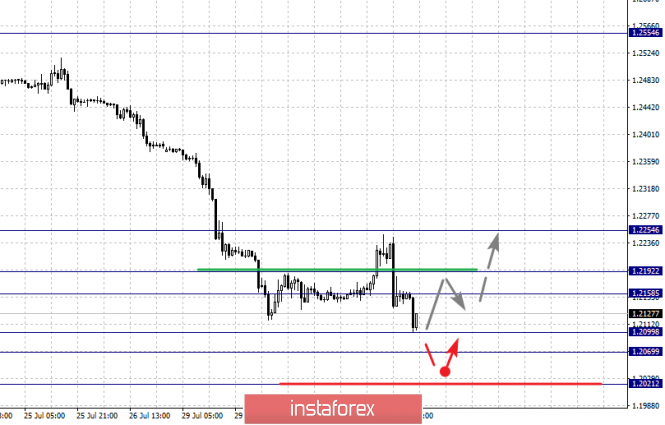

For the pound / dollar pair, the key levels on the H1 scale are: 1.2254, 1.2192, 1.2158, 1.2099, 1.2069 and 1.2021. Here, we are following a downward cycle of July 19th. Short-term movement to the bottom is expected in the range of 1.2099 - 1.2069. The breakdown of the last value will allow to expect movement to the potential target - 1.2021. From this level, we expect a departure to the correction.

Short-term upward movement is possibly in the range of 1.2158 - 1.2192. The breakdown of the latter value will lead to the formation of the initial conditions for the top. Here, the potential target is 1.2254.

The main trend is the downward cycle of July 19.

Trading recommendations:

Buy: 1.2158 Take profit: 1.2191

Buy: 1.2194 Take profit: 1.2254

Sell: 1.2099 Take profit: 1.2070

Sell: 1.2067 Take profit: 1.2025

For the dollar / franc pair, the key levels on the H1 scale are: 1.0016, 0.9999, 0.9974, 0.9952, 0.9937, 0.9915 and 0.9881. Here, the subsequent targets for the upward movement were determined from the local structure on July 31. The continuation of the movement to the top is expected after the breakdown of the level of 0.9974. In this case, the target is 0.9999. For the potential value for the top, we consider the level of 1.0016. After reaching which, we expect consolidation.

Short-term downward movement is possibly in the range of 0.9952 - 0.9937. The breakdown of the latter value will lead to in-depth correction. Here, the target is 0.9915. This level is a key support for the local ascending structure of July 31.

The main trend is the local ascending structure of July 31.

Trading recommendations:

Buy : 0.9975 Take profit: 0.9999

Buy : 1.0000 Take profit: 1.0016

Sell: 0.9952 Take profit: 0.9938

Sell: 0.9935 Take profit: 0.9917

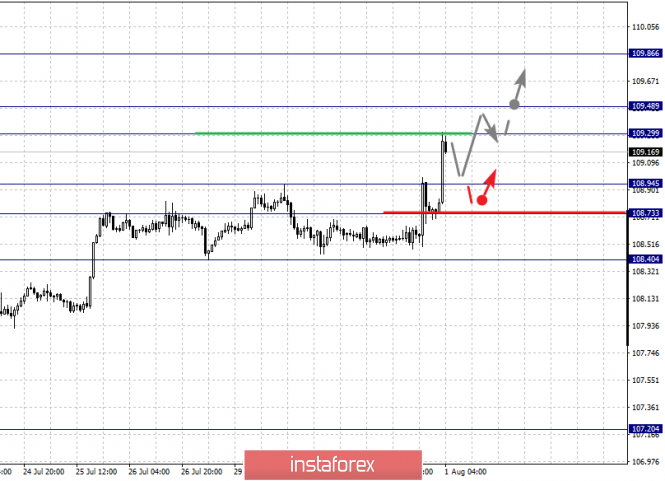

For the dollar / yen pair, the key levels on the scale are : 109.86, 109.48, 109.29, 108.94, 108.73 and 108.40. Here, we are following the development of the ascending structure of July 18. Short-term upward movement is expected in the range of 109.29 - 109.48. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the goal is 109.86. Upon reaching this level, we expect a rollback to the bottom.

Short-term downward movement is possibly in the range of 108.94 - 108.73. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 108.40. This level is a key support for the upward structure.

The main trend: the ascending structure of July 18.

Trading recommendations:

Buy: 109.30 Take profit: 109.46

Buy : 109.50 Take profit: 109.84

Sell: 108.94 Take profit: 108.75

Sell: 108.70 Take profit: 108.45

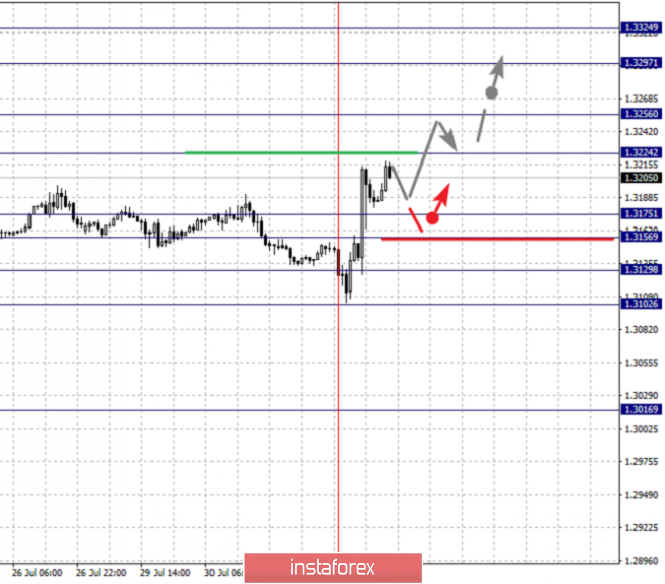

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3324, 1.3297, 1.3256, 1.3224, 1.3175, 1.3156, 1.3129 and 1.3102. Here, the next targets for the top are determined from the local ascending structure on July 31. The continuation of the movement to the top is expected after the breakdown of the level of 1.3224. Here, the goal is 1.3256. Consolidation is near this level. The breakdown of the level 1.3257 should be accompanied by a pronounced upward movement. Here, the target is 1.3297. We consider the level of 1.3324 to be a potential value for the top. Upon reaching this level, we expect consolidation as well as a rollback to the bottom.

Short-term downward movement is possibly in the range of 1.3175 - 1.3156. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 1.3129. This level is a key support for the top.

The main trend is the local ascending structure of July 31.

Trading recommendations:

Buy: 1.3225 Take profit: 1.3255

Buy : 1.3257 Take profit: 1.3295

Sell: 1.3175 Take profit: 1.3156

Sell: 1.3153 Take profit: 1.3130

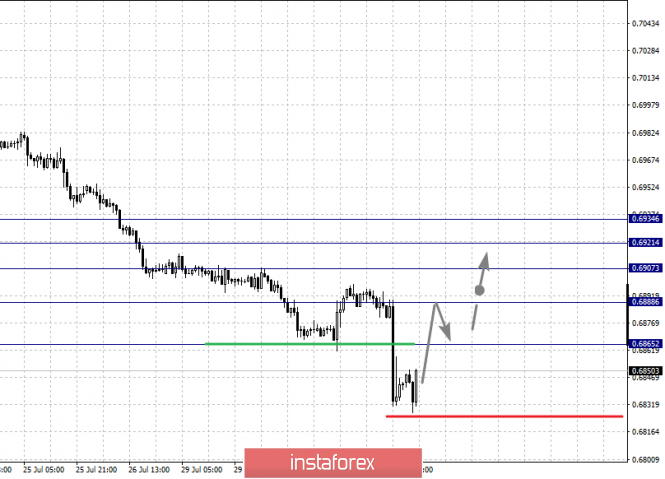

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6934, 0.6921, 0.6907, 0.6888 and 0.6852. Here, we expect a return to the correction after the breakdown of the level of 0.6865. In this case, the first target is 0.6888. The breakdown of the level of 0.6888 will lead to the subsequent development of the ascending structure. In this case, the target is 0.6907. The breakdown of which, in turn, will allow us to count on the movement to the level of 0.6921. For the potential value for the top, we consider the level of 0.6934. Upon reaching which, we expect pronounced initial conditions for the upward cycle.

For the downward movement, we do not yet consider subsequent targets.

The main trend is the downward structure of July 18, we expect a withdrawal to the correction.

Trading recommendations:

Buy: 0.6865 Take profit: 0.6885

Buy: 0.6888 Take profit: 0.6907

Sell : Take profit :

Sell: Take profit:

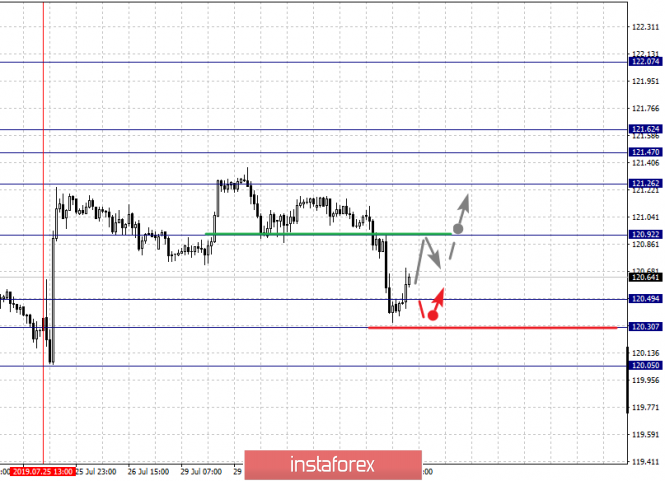

For the euro / yen pair, the key levels on the H1 scale are: 122.07, 121.62, 121.47, 121.26, 120.92, 120.49, 120.30 and 120.05. Here, the cancellation of the ascending structure of July 25 is possible after the breakdown of the level of 120.30. In this case, the first target is 120.05. We expect a short-term downward movement in the range of 120.49 - 120.30.

The continuation of the upward trend on the H1 scale is possibly after a breakdown of the level of 120.92. In this case, the first target is 121.26. The breakdown of which, in turn, will allow us to count on movement towards the noise range of 121.47 - 121.62.

The main trend is the formation of the initial conditions for the upward cycle of July 25, the stage of deep correction.

Trading recommendations:

Buy: 120.92 Take profit: 121.24

Buy: 121.28 Take profit: 121.47

Sell: 120.49 Take profit: 120.30

Sell: 120.28 Take profit: 120.07

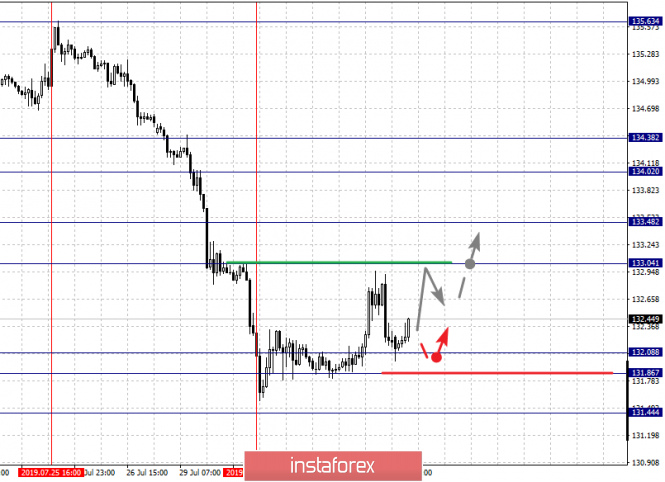

For the pound / yen pair, the key levels on the H1 scale are : 134.02, 133.48, 133.04, 132.08, 131.86 and 131.44. Here, the price is in the adjustment area of the downward structure on July 25th. The continuation to the bottom is possibly after the price passes by the noise range 132.08 - 131.86. Here, the potential target is 131.44. From this level, we expect another rollback to the top.

A more thorough development of the adjustment structure is expected after the breakdown of the level of 133.04. Here, the first target is 133.48. Consolidation is near this level. The breakdown of the level of 133.48 should be accompanied by a pronounced upward movement to the level of 134.02.

The main trend is the downward structure of July 25, the stage of correction.

Trading recommendations:

Buy: 133.04 Take profit: 133.45

Buy: 133.50 Take profit: 134.00

Sell: 131.86 Take profit: 131.50

The material has been provided by InstaForex Company - www.instaforex.com