The failure of US-Chinese trade talks and President Trump's intention to impose a 10% tariff on Chinese goods worth $300 billion starting September 1, triggering markets' strong backlash. Oil prices are dropping by more than 1% on Monday morning. The Chinese Central Bank has been depreciating the renminbi since 2018 and Asian exchanges are trading in the red zone.

The deterioration of the situation has serious pressure on commodity currencies.

NZD/USD pair

The outlook for New Zealand's economy looks increasingly bleak at the same time, the worse the macroeconomic indicators are published, this gives a higher likelihood of an aggressive reduction in the rate of the RBNZ.

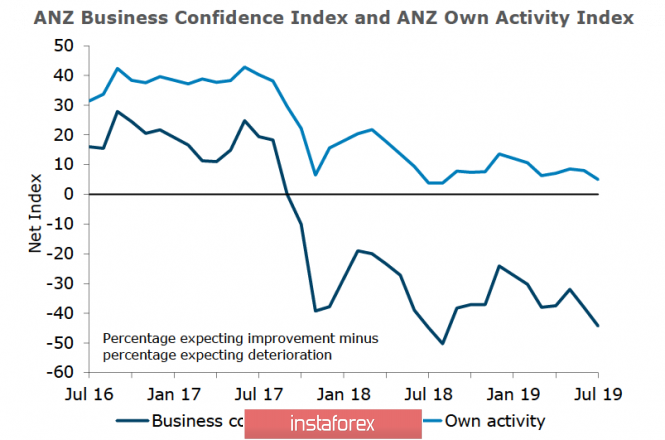

The ANZ business confidence index fell by 6 percentage points in July, while 44% of respondents said they expected deterioration in the general business environment in the coming year. The expectations of firms regarding their own activity fell to 5p, despite the fact that the rise was predicted.

Economic changes are also there, and they are negative. The number of firms expecting a reduction in employment has increased and the capacity utilization, which has a good correlation with GDP growth rates, has fallen by 5 points to zero that has been the lowest since 2009. As a result, forecasts for GDP growth worsen.

Most companies expect a decline in profitability by 42%, adjusting downward forecasts for profits. They are confident that credit conditions will worsen in the future and the lowest figure since 2009. Inflation expectations fell to 1.8 in July while only 1% of firms expect export growth.

The volume of residential and commercial construction is sharply declining. Expectations for profitability in the sector have been at a minimum since 2009 and overall, the outlook for the growth of the New Zealand economy is deteriorating. Despite the fact that prices for dairy products are still at good levels, fears of a relative global slowdown prevail.

In the current conditions, the RBNZ is likely to look for ways to stimulate the economy in the coming months. While the Fed's intentions regarding further rate cuts are still vague, there is a clear consensus on the RBNZ for two rate cuts in the current year.

Kiwi came close to the support of 0.6482, and the chances of a breakdown and movement towards 0.6442 are high. Technically, before the breakthrough, a rollback to the resistance of 0.6570 is possible, however, it is more logical to use any growth attempts to enter short positions.

AUD/USD pair

The Australian dollar is under severe pressure as expectations of a global slowdown have a serious negative effect on commodity currencies. Lowering the rate of the Fed and the failure of trade negotiations between the US and China only reinforce the negative dynamics, but they are not the reason.

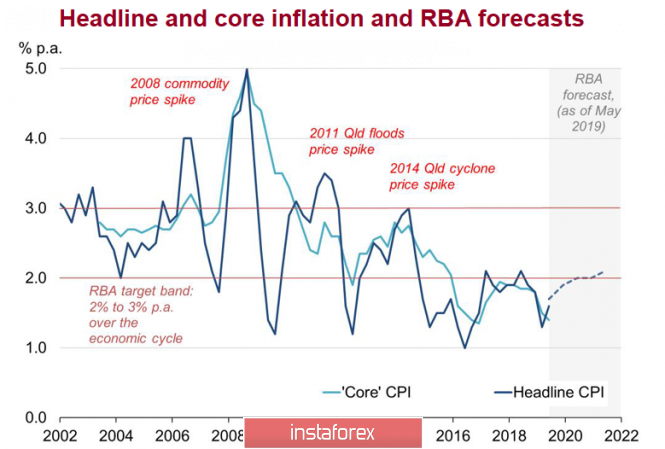

On Tuesday, the RBA will hold a monetary policy meeting and given the fact that the RBA has consistently mitigated conditions from 2011 by lowering the rate from 4.75% to 1%, one would expect a reaction to the deteriorating external conditions. However, the markets seem to adhere to a different principle - "not this time". Indeed, despite a marked deterioration in external conditions, the main macroeconomic indicators, primarily inflation, look stable and do not require an immediate response.

World prices for raw materials are still high and stimulating exports. Meanwhile, the rise in oil prices has led to higher prices for gasoline, which supports inflation and offsets rather weak domestic demand. Inflation in Q2 amounted to 1.6%, higher than in Q1, which means that the RBA is able to refrain from another rate cut.

It should also be noted that in Q2, export prices grew faster than import prices, which supports the industrial sector. The low rate of the AUD has played a certain positive role in this, and if the RBA does not see the danger of its growth in the short term, then this is another factor in favor of the fact that it is not necessary to reduce the rate on Tuesday.

Thus, the Aussie can react in a short-term way with growth to the results of the RBA meeting, returning to resistance 0.6830/40. At the same time, there is no basis for sustainable growth, and in the longer term, a test of support of 0.6747 and a withdrawal below seem inevitable.

The material has been provided by InstaForex Company - www.instaforex.com