To open long positions on EURUSD you need:

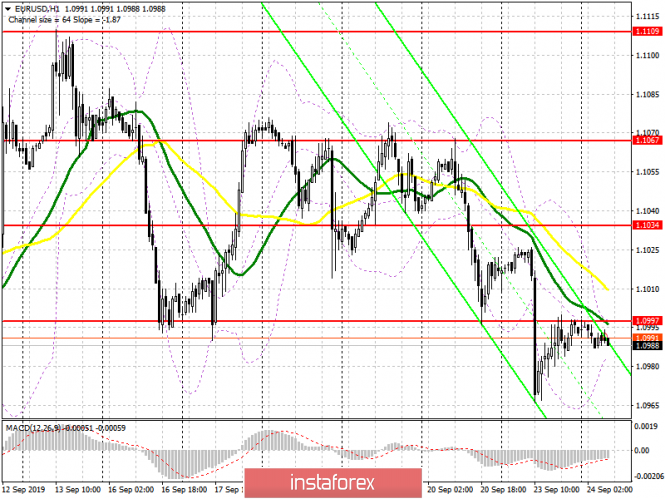

As I noted yesterday, the weak manufacturing activity index in the eurozone countries caused the euro to fall to a support level of 1.0997, which now acts as a resistance. If today the report on business confidence indicates growth, then it is likely that EUR/USD buyers will attempt to return and consolidate above the range of 1.0997, which will lead to the demolition of a number of stop orders and an upward correction of the pair in the resistance area of 1.1034, where I recommend taking profit. In the event of a weak report, which is quite possible, given the current state of the German economy, the bulls only have to rely on a false breakdown in the support area of 1.0960, and recommend opening long positions immediately for a rebound at the low of the month in the area of 1.0927.

To open short positions on EURUSD you need:

Euro sellers will rely on a weak report on confidence in business circles, which will maintain a downward potential in EUR/USD, and a break of support of 1.0960 will only increase the pressure on the pair, which will lead to an update of the low at 1.0927, where I recommend taking profits. If the data turns out to be worse than economists' forecasts, the bulls can take advantage of this and return to a resistance of 1.0997, from where I recommend to open short positions subject to the formation of a false breakdown. Selling the euro for a rebound is best done from a larger resistance of 1.1034.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 moving averages, which indicates an advantage for sellers of the euro.

Bollinger bands

A break of the lower boundary of the indicator in the region of 1.0985 will raise the pressure on the euro, while going beyond the upper boundary in the region of 1.1000 will lead to an increase in the pair.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20