The euro/dollar bears tested the ninth figure again on Friday, but the downward impulse died away before it started. In the last hours of the trading week, many traders took profits without risking leaving open positions for the weekend. The fundamental background for the dollar is still unreliable, and the events of the last week of September can affect the pair dramatically.

Not so many important macroeconomic reports are expected this trading week. The main focus of the market will be on the dynamics of the development of US-Chinese trade relations and on the comments of Fed and ECB officials. Geopolitics will also play a role in determining the growth or decline of anti-risk sentiment in the foreign exchange market. First of all, we are talking about the situation in the Middle East, where a military conflict between Saudi Arabia and Iran is not ruled out.

If we talk about planned events that are important for EUR/USD traders, then here, we should highlight the speeches of "top officials" of the Central Banks. For example, the head of the ECB, Mario Draghi, will speak in Brussels today at 15:00 UTC. He will voice the report to the members of the Committee on Economic and Monetary Affairs of the European Parliament. Since the topic of the report is directly related to monetary policy, the market will show particular interest in it. Let me remind you that according to the results of the last meeting of the European regulator, the EUR/USD pair actually received support despite the easing of the monetary policy parameters. The euro was supported by two facts: first, the regulator did not meet investors' expectations. According to general forecasts, the Central Bank should have resorted to larger-scale actions (lowering the rate to -0.6% and QE in the amount of 40-50 billion); Second, traders drew attention to the split that occurred in the camp of the ECB as some members of the regulator opposed the resumption of the incentive program.

In this context, what's more interesting is not Mario Draghi's personal position on these circumstances (in the light of his resignation in late October), but his comments on the sentiments that are found among the members of the European Central Bank. If the essence of his rhetoric is reduced to a wait-and-see attitude, the euro will receive some support.

On Thursday, September 26, will be a rather informative day this week. Six members of the Fed will speak at once during the American session: Robert Kaplan, James Bullard, Richard Clarida, Mary Daley, Neil Kashkari, and Thomas Barkin. It is worth noting that the Federal Reserve also did not demonstrate a monolithic position regarding the September rate cut and further prospects of monetary policy; for example, such members of the Federal Reserve as the head of the Kansas Federal Reserve Bank Esther George and the head of the Boston Federal Reserve Eric Rosengrenopposed the interest rate cut again. In addition, ten members of the regulator said they did not see any reason for easing monetary policy by the end of this year, while seven of their colleagues still allowed this option. As for the prospects for 2020, eight members of the Committee stated the need to maintain a wait-and-see attitude, while the rest of the top Fed officials said that the regulator should back raise the rate by at least 25 points. Given such a divergence of opinions, each comment by the Fed representative (especially those with voting rights) is of interest.

If we talk about macroeconomic statistics, the most important releases for the pair will come from the United States. Conference Board Consumer Confidence Index will be published tomorrow, Tuesday. In July and August, it came out at fairly high values at 135.8 and 135.1, respectively, supporting the US currency. According to experts' general forecasts, the September index will reach 134.1 points. This is a good result but still worse than summer performance. The dollar will react to this release only if it comes out much worse than the forecast values, reflecting the uncertainty of American consumers.

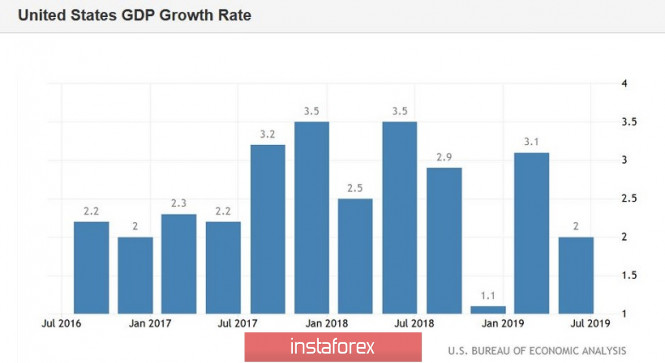

On Wednesday, attention should be focused on the volume of home sales in the primary US market. After a significant decline, positive dynamics are expected. But on Thursday, it will shift to the final assessment of US GDP growth for the 2nd quarter. According to forecasts, this indicator will not be revised. Otherwise, this release may cause increased volatility for the pair.

On Friday, EUR/USD traders will be interested in the main index of personal consumption spending, which measures the core level of spending and indirectly affects the dynamics of inflation in the United States. It is believed that this indicator is monitored carefully by regulator members. According to forecasts, the index will show contradictory dynamics. In monthly terms, it will decrease to 0.1% but it will rise to 1.8% in annual terms. This release may have an impact on the dynamics of the pair only with strong fluctuations when the real numbers differ significantly from the forecast values.

The European currency will respond to the reports of PMI (today) and IFO (on Tuesday), but their impact on the pair is usually short-term.

In general, the tone of the bidding will be set by the comments of representatives of the ECB and the Fed and macroeconomic reports. The dynamics of the development of the trade war will serve as a backdrop to the above fundamental factors. Particularly on Friday, it became known that the US authorities introduced a temporary exemption from duties for more than 400 goods that are imported from China. This is another sign of a de-escalation of the trade conflict. If this week the parties take the next steps in this direction, the dollar will receive significant support. Indeed, in this case, the probability of a further reduction in the Fed interest rate will significantly decrease.

From a technical point of view, the EUR/USD pair needs to leave the range of 1.0950 - 1.1100, which are the lower and upper lines of the Bollinger Bands indicator, respectively. Only in this case will it be possible to talk either about the continuation of the downward trend or about the signs of its fracture. In fact, the pair has been trading in the indicated price range as part of a wide-range flat since the beginning of September.

The material has been provided by InstaForex Company - www.instaforex.com