Forecast for September 30 :

Analytical review of currency pairs on the scale of H1:

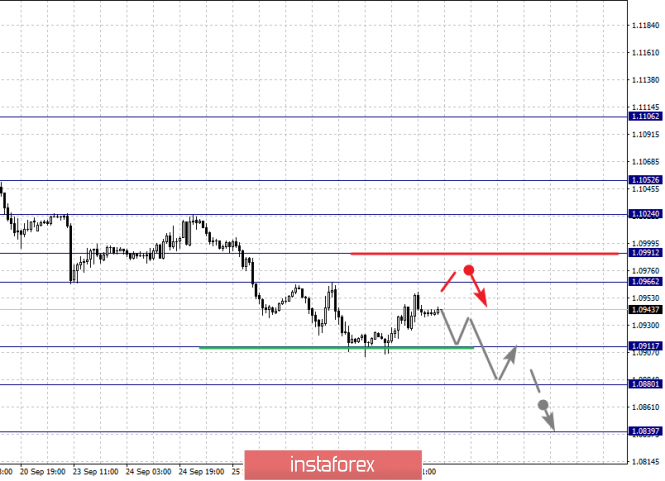

For the euro / dollar pair, the key levels on the H1 scale are: 1.1052, 1.1024, 1.0991, 1.0966, 1.0911, 1.0880 and 1.0839. Here, we continue to monitor the development of the descending structure of September 13. Short-term downward movement is expected in the range 1.0911 - 1.0880. The breakdown of the last value will lead to a movement to a potential target - 1.0839. When this level is reached, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 1.0966 - 1..0991. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1024. This level is a key support for the bottom. Its breakdown will allow you to count on movement to a potential target - 1.1052. We are waiting for the initial conditions for the top to this level.

The main trend is the descending structure of September 13.

Trading recommendations:

Buy: 1.0966 Take profit: 1.0990

Buy 1.0993 Take profit: 1.1024

Sell: 1.0910 Take profit: 1.0882

Sell: 1.0878 Take profit: 1.0840

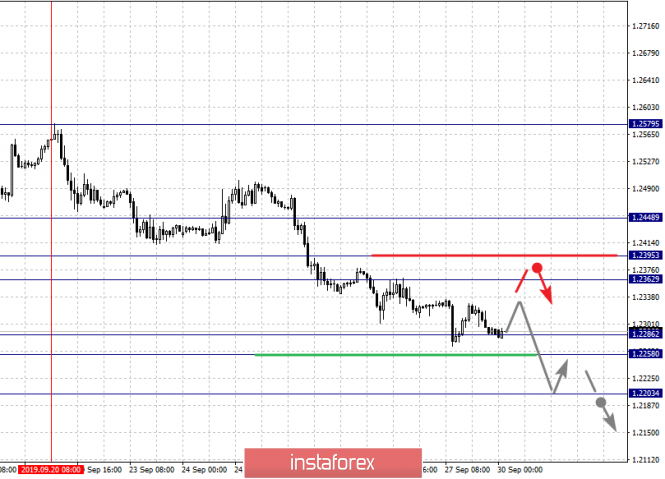

For the pound / dollar pair, the key levels on the H1 scale are: 1.2448, 1.2395, 1.2362, 1.2362, 1.2286, 1.2258 and 1.2203. Here, we are following the development of the descending structure of September 20. Short-term downward movement is expected in the range 1.2286 - 1.2258. The breakdown of the last value will lead to movement to a potential target - 1.2203. When this level is reached, we expect a pullback to the top.

Short-term upward movement is expected in the range 1.2362 - 1.2395. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2448. This level is a key support for the downward structure.

The main trend is the descending structure of September 20.

Trading recommendations:

Buy: 1.2362 Take profit: 1.2395

Buy: 1.2397 Take profit: 1.2446

Sell: 1.2286 Take profit: 1.2260

Sell: 1.2256 Take profit: 1.2204

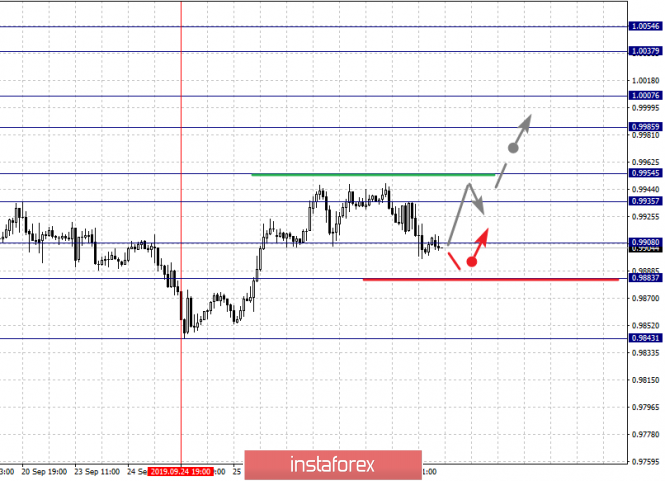

For the dollar / franc pair, the key levels on the H1 scale are: 1.0054, 1.0037, 1.0007, 0.9985, 0.9954, 0.9935, 0.9908 and 0.9883. Here, the price is in the initial conditions for the upward cycle of September 24. The continuation of movement to the top is possibly after the breakdown of the level of 0.9935. In this case, the first target is 0.9935. The breakdown of which, in turn, will lead to movement to the level of 0.9985. Short-term upward movement, as well as consolidation is in the range of 0.9985 - 1.0007. We consider the level of 1.0037 to be a potential value for the top. Upon reaching which, we expect consolidated movement in the range of 1.0037 - 1.0054.

Short-term downward movement is possibly in the range of 0.9908 - 0.9883. The breakdown of the latter value will lead to the cancellation of the upward structure. Here, we expect movement to a potential target - 0.9843.

The main trend is the initial conditions for the top of September 24.

Trading recommendations:

Buy : 0.9935 Take profit: 0.9952

Buy : 0.9955 Take profit: 0.9985

Sell: 0.9906 Take profit: 0.9888

Sell: 0.9880 Take profit: 0.9845

For the dollar / yen pair, the key levels on the scale are : 108.84, 108.59, 108.24, 108.07, 107.79, 107.65 and 107.41. Here, we are following the development of the ascending structure of September 24. Short-term upward movement is expected in the range 108.07 - 108.24. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 108.59. Price consolidation is near this level. For the potential value for the top, we consider the level of 108.84. Upon reaching this value, we expect a pullback to the bottom.

Short-term downward movement is expected after the breakdown of the last value in the range of 107.79 - 107.65, which will lead to an in-depth correction. Here, the goal is 107.41. This level is a key support for the top.

The main trend: the rising structure of September 24.

Trading recommendations:

Buy: 108.08 Take profit: 108.24

Buy : 108.26 Take profit: 108.57

Sell: 107.79 Take profit: 107.66

Sell: 107.63 Take profit: 107.44

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3304, 1.3286, 1.3262, 1.3247, 1.3203, 1.3174, 1.3157 and 1.3131. Here, we are following the development of the descending structure of September 23. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3203. In this case, the target is 1.3174. Price consolidation is in the range of 1.3174 - 1.3157. For the potential value for the bottom, we consider the level of 1.3131. Upon reaching this level, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 1.3247 - 1.3262. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3286. This level is a key support for the top. Its breakdown will lead to the development of an upward structure. In this case, the potential target is 1.3304.

The main trend is the descending structure of September 23.

Trading recommendations:

Buy: 1.3247 Take profit: 1.3260

Buy : 1.3264 Take profit: 1.3286

Sell: 1.3203 Take profit: 1.3175

Sell: 1.3173 Take profit: 1.3158

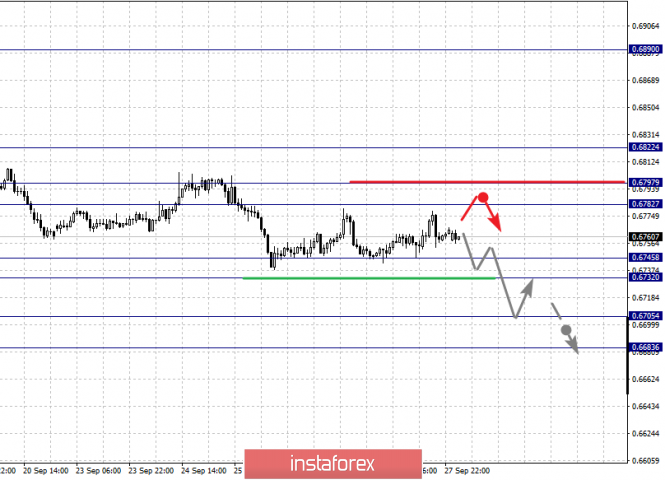

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6822, 0.6797, 0.6782, 0.6745, 0.6732, 0.6705 and 0.6683. Here, we are following the development of the downward cycle of September 13. Short-term downward movement is possibly in the range 0.6745 - 0.6732. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the target is 0.6705. Price consolidation is near this value. For the potential value for the bottom, we consider the level of 0.6683. Upon reaching which, we expect a departure in the correction.

Short-term upward movement is possibly in the range of 0.6782 - 0.6797. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6822. This level is a key support for the downward structure.

The main trend is the downward cycle of September 13.

Trading recommendations:

Buy: 0.6782 Take profit: 0.6795

Buy: 0.6797 Take profit: 0.6820

Sell : 0.6745 Take profit : 0.6734

Sell: 0.6730 Take profit: 0.6707

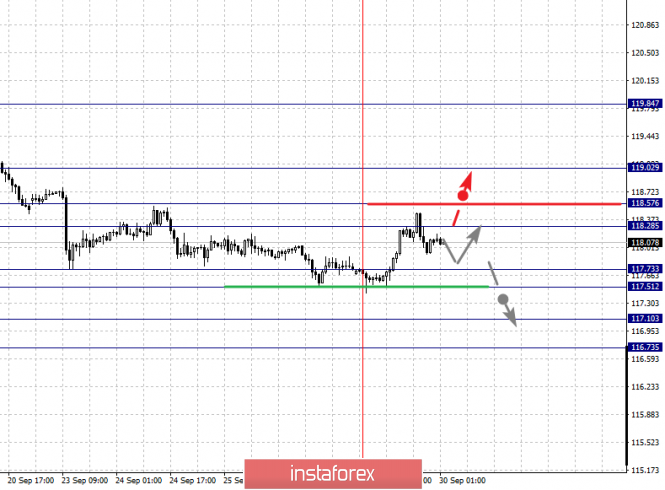

For the euro / yen pair, the key levels on the H1 scale are: 119.02, 118.57, 118.28, 117.73, 117.51, 117.10 and 116.73. Here, the price is in correction from the upward trend of September 18 and forms a small potential for the top of September 27. The continuation of the movement to the bottom is expected after the price passes the noise range 117.73 - 117.51. In this case, the target is 117.10. For the potential value for the bottom, we consider the level of 116.73. Upon reaching this value, we expect a rollback to the top.

Short-term upward movement is possibly in the range 118.28 - 118.57. The breakdown of the latter value will lead to in-depth movement. Here, the goal is 119.02. This level is a key support for the downward structure.

The main trend is the descending structure of September 18, the correction stage.

Trading recommendations:

Buy: 118.28 Take profit: 118.55

Buy: 118.60 Take profit: 119.00

Sell: 117.50 Take profit: 117.10

Sell: 117.08 Take profit: 116.73

For the pound / yen pair, the key levels on the H1 scale are : 135.81, 134.58, 134.03, 133.06, 132.42, 131.45, 130.78 and 129.88. Here, we are following the development of the descending structure of September 20. Short-term movement to the bottom is expected in the range 133.06 - 132.42. The breakdown of the latter value should be accompanied by a pronounced downward movement. In this case, the target is 131.45. Price consolidation is in the range of 131.45 - 130.78. We consider the level of 129.88 to be a potential value for the downward movement. Upon reaching this level, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 134.03 - 134.58. The breakdown of the latter value will lead to the formation of an upward structure. In this case, the potential target is 135.81.

The main trend is the formation of the downward structure of September 20.

Trading recommendations:

Buy: 134.03 Take profit: 134.55

Buy: 134.60 Take profit: 135.80

Sell: 132.40 Take profit: 131.45

Sell: 131.43 Take profit: 130.80

The material has been provided by InstaForex Company - www.instaforex.com