Predicting the movement of assets before the publication of such news as the decision of the US Federal Open Market Committee is a futile task. It is much easier to do this when the solution has already been published, and then you can very thoroughly explain why it happened this way and not otherwise. But I still take the risk and try to propose the most likely scenario for the development of events, all the more subsequently it will be interesting to see if I turned out to be right or not.

Actually, the question that I want to answer in this article is whether the Fed's decision and Jerome Powell's speech can turn the dollar back, or at least to provoke it to a correction. If the upward trend in the US currency has already been going on for a year and a half, and Trump is very dissatisfied with this. The answer to this question will help me make the EURUSD rate, especially since the dollar index consists of almost 60 percent of the euro. In addition, EURUSD is the most popular and complex currency pair, so I think it will be interesting to everyone to understand what is happening in the European currency.

To analyze the situation, I will not draw graphs, patterns and clutter up the article with an abundance of indicators. I hope that my fundamental approach based on the analysis of the futures market will help someone create their own strategy for assessing the situation. I will use the data of the futures market provided by the CME exchange on option positions of traders, and I will proceed from the hypothesis that the sellers of options are big players, and most of the options bought burn up without being in the money. Alas, this is so, buying options is a game with a negative mathematical expectation, which, however, does not make strategies with their application automatically unprofitable.

So what do we know at the moment? We will use the CME exchange data for weekly and monthly option positions, which determine the dynamics of the asset for an hour and four hour time. At the same time, we will take into account the fact that now the difference between the cash contract that we see in the terminal and the December futures, the so-called forward point, is 72 points.

EU3U9 weekly option, basic contract 6EZ9

This EU3U9 option contract closes on Friday, September 20, and gives the right or obligation to buy or sell the December futures euro contract 6EZ9 at a pre-agreed price. Since there is still a lot of time before the futures close (expiration), the contact is not of great value, especially in the conditions of the expected strong volatility inherent in the decisions of the US Federal Reserve. However, the EU3U9 option contract implies a disposition equivalent to an hour time in InstaForex terminals (Fig. 1), which makes it a valuable analysis tool for traders working in that time.

First of all, pay attention to the ratio of the number of put options and Put/Call Ratio calls equal to 1.10, which means a slight excess of the number of put options over call options, and suggests that the futures rate is slightly easier to move up than down.

Fig. 1: Positioning of the EU3U9 option contract. Source - CME Exchange

Chart 1 attracts two large levels of put options located at 1.10 and 1.1025, which for a cash contract will correspond to levels 1.0925 and 1.0950. This is the so-called lower limit of the market. On the right is the level of 1.1150, which corresponds to the value of 1.1075, in the InstaForex terminal and this is the upper boundary of the market. In the center is the so-called Max Pain point, level 1.1125, where option buyers will incur maximum losses. Sellers, in turn, want the price to be as close to this level as possible when closing the contract on Friday.

In a calm market, one could make the assumption that the price in InstaForex terminals on Friday, September 20, will close there, near the level of 1.1050 (remember the forward point 72 points between the cash and the futures contract), but today is a special case, and we it is necessary to make an amendment to the publication of the decision of the US Federal Reserve.

EUUV9 monthly option, basic contract 6EZ9

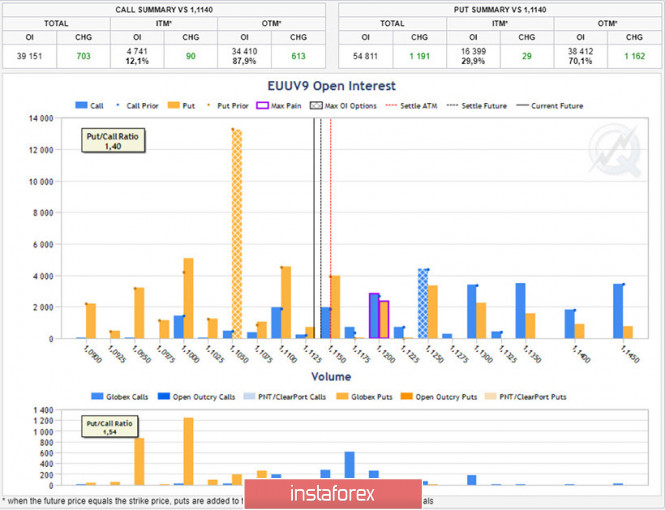

This EUUV9 option contract closes on October 4 and gives the right or obligation to buy or sell the December euro futures at a pre-agreed price. This option contact is more valuable than the EU3U9 weekly contract, especially amid expected strong volatility inherent in the decisions of the US Federal Reserve. The EUUV9 option contract assumes a disposition equivalent to a four-hour half-time in InstaForex terminals (Fig. 2).

Fig. 2: Positioning of the EUUV9 option contract. Source - CME Exchange

As can be seen from chart 2, the open interest in this monthly option contract is about ten times higher than the EU3U9 weekly contract. The ratio of put and call options is 1.40, i.e., the number of puts is much higher than the number of open calls, which makes it difficult for the price to move down and facilitates the growth of the rate.

The MP point is at a value of 1.12, which corresponds to the level of 1.1125 in InstaForex terminals. The lower boundary of the market is at the level of 1.1050 or 1.0975 for the cash contract. The upper boundary of the market is located at 1.1250 or 1.1175 for a cash contract.

Based on the current disposition corresponding to the four-hour time, it can be assumed that in the future, until October 4, the euro exchange rate in the terminals will tend to the zone of 1.1125 and may try to rise slightly higher and gain a foothold at the level of 1.12.

Summing up the results of this analysis, we can conclude that by October 4, with a probability of 68%, the EURUSD rate at InstaForex terminals will be in the range of 1.0925 –1.1200. Higher levels are not yet available for EURUSD, since they are limited by significant option barriers in the futures market. From below, the course will support levels 1.0925 - 1.0950.

The situation in the EURUSD course, in the long term from one to four weeks, can be described as a range for the breakthrough of which a significant news background is needed. Thus, it is likely that the decision on the rate will really be able to reverse the euro. However, this will be very difficult to do, and with a high probability the formation of a wide range of 1.0950 - 1.1250 will continue until the Fed meeting in December.

The material has been provided by InstaForex Company - www.instaforex.com