By the end of the last trading week, the pound / dollar currency pair showed volatility close to the daily average of 86 points, locally slowing down the quotation in the region of 1.2150. From the point of view of technical analysis, we see that the quote has returned to the level of 1.2150 again, where it slowed down without any diligence, forming as a fact an accumulation. Whether this level of 1.2150 is strong in the market, there is no way, but because of the impending uncertainty regarding the divorce process, they are trying to grab hold of everything in order to take a break at least for a while.

As discussed in the previous review, speculative traders are working on the decline, where the focus of attention was concentrated just at the level of 1.2150, in terms of its breakdown. Did everyone went into short positions, as soon as we began to pierce the level, at the end of Friday, I'm not sure, because the move was already very sluggish. However, I do not exclude that a considerable part of speculators nevertheless entered, and perhaps, this is not a failed step, since the downward mood has not gone away. Conservative traders are in no hurry with actions, but they also monitor the level of 1.2150, because, perhaps, it will give an acceleration in terms of going to the psychological level of 1.2000. Considering the trading chart in general terms (the daily period), we see that half of the recent correction has already been won back, and this is a good sign in terms of restoring the downward trend and forming the Impulse tact.The main conversation and the continuation of the formation of the global downward trend will go after the breakdown of the psychological level of 1.2000.

Meanwhile, Friday's news background did not have complete statistics for Britain and the United States, but it was needed when all traders and investors were immersed in the information background, in particular the "divorce process". Thus, the decision of the new prime minister to temporarily leave the country without parliament raised a considerable wave of negativity. Last weekend, thousands of protesters took to the streets of London, Manchester, Leeds, York and Belfast, blaming not only Boris Johnson, but also the queen who gave permission for this. The British deputies did not stand aside and announced their intention to present on Tuesday a plan to prevent the United Kingdom from leaving the European Union without an agreement. The opposition is confident that the Prime Minister is suspending the work of the parliament precisely for this. In turn, Boris Johnson decided to threaten politicians,

Naturally, against such a "positive" background, investors can only flee Britain or temporarily take the ostrich's position until at least a little explanation appears.

Today, in terms of the economic calendar, we have only the manufacturing activity index in the manufacturing sector (PMI) for August in the UK, where there is a slight increase of 48.0 ---> 48.4. In the United States, today is a day off. Labor Day is celebrated, thereby trading volumes can be reduced. In your work, it is worth taking into account such a moment that the pound and its participants react exclusively to the information background, thereby even though we do not have solid statistics and Americans on the market, but we have not gone away from the background, we should carefully monitor the entire information flow.

Further development

Analyzing the current trading chart, we see that the fluctuation within the 1.2150 level continues in the market, where the quote is trying to go below it. In turn, speculative traders continue to analyze the behavior of prices near the level where some market participants already have short positions.

It is likely to assume that the fluctuation within the 1.2150 level will continue for some time, but the pressure on the British currency only intensifies with the onset of autumn, in the medium term we see only a decrease. Thus, selling positions are priority, where it is worthwhile to understand whether the quotation will be able to break the level of 1.2150 in a downward direction.

Based on the above information, we derive trading recommendations:

- Buying positions are considered in the case of price fixing higher than 1.2180-1.2200.

- Sell positions, if we still do not have, are considered if we look at how the price will show itself now and whether it can go lower than the 1.2138 puncture. The prospect of progress in this case is to 1.2100 ---- 1.2000 (+/- 30 points).

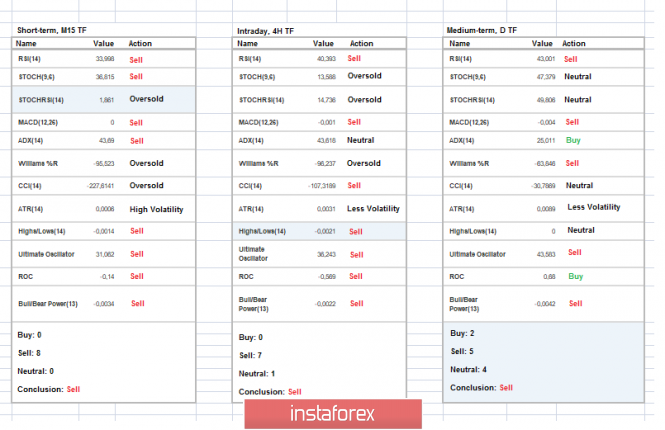

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that indicators on all the main time intervals signal a further decrease, which in general terms, confirms the background in the English currency.

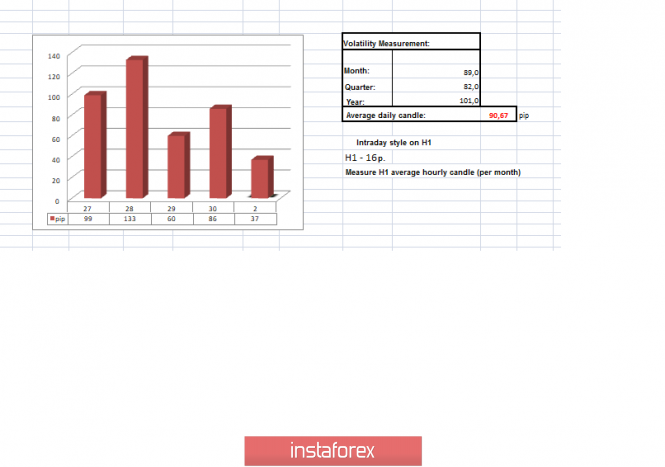

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(September 2 was built taking into account the time of publication of the article)

The current time volatility is 37 points. It is likely to assume that in the case of maintaining the inertial course and the breakdown level of 1.2150, volatility may begin to grow, and the information background will help us in this.

Key levels

Resistance zones: 1.2150 **; 1.2350 **; 1.2430; 1.2500; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 *; 1,3000 **; 1.3180 *; 1.3300

Support areas: 1.2150 **; 1,2000; 1.1700; 1.1475 **

* Periodic level

** Range Level

*** The article is built on the principle of conducting a transaction, with daily adjustment

The material has been provided by InstaForex Company - www.instaforex.com