The euro-dollar pair consolidated within the 11th figure for the first time since the end of August, demonstrating a fairly large-scale correctional growth. Such a price dynamic is due, first of all, to Brexit: Brussels and London unexpectedly for many agreed on a draft deal, completing a many-month-long negotiating epic. Now, Johnson will have to agree with the MPs of his own Parliament - but, according to some experts, the issue of "hard" Brexit is in any case removed from the agenda. The prime minister will either convince MPs to support his version of the deal, or he will nevertheless ask Europe for a respite in order to re-elect the House of Commons and agree already with the new composition of the Parliament.

In other words, the pressure on the EUR/USD pair has somewhat eased, although the European currency has enough problems - new US duties on the EU, weak inflation in the eurozone and the dovish rhetoric of the ECB representatives - all these factors do not allow the euro to "spread its wings" ". Nevertheless, the pair has been growing for the fourth day in a row, updating all new price highs. This growth is due, firstly, to Brexit, and secondly, to the weakness of the US currency. The second factor will play an increasingly significant role in the context of the prospects for the EUR/USD pair - especially on the eve of the next Fed meeting, the results of which we will learn on October 30.

The next round of trade talks between the US and China did not become a springboard for the dollar for a large-scale rally: the greenback showed formal growth, but overall remained at the same positions as before the negotiations. The parties did not conclude a deal, having concluded only an interim deal, essentially a "non-aggression pact", until the second stage of the negotiation process. It is at it that the most complex and fundamental issues will be discussed, which became a stumbling block in previous negotiations - at the beginning of this year and at the end of the past. Therefore, the restrained optimism of traders is quite justified, given the backstory of the US-Chinese dialogue.

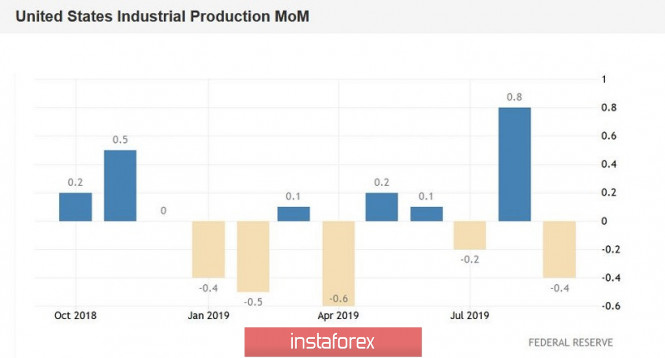

However, dollar bulls are also worried about more pressing issues. Amid the long-running negotiation process, barrage trade barriers continue to operate, adversely affecting both China's economy and the US economy. Therefore, it is not surprising that the latest releases in the field of US industrial production come out in the red zone, provoking panic among bulls for the dollar. Moreover, various indicators signal pending problems, which add puzzles into one picture of a negative nature.

For example, according to the latest Nonfarm, the number of jobs in the manufacturing sector decreased by two thousand - for the first time since April this year. At the same time, the ISM production index has been consistently decreasing for the past six months, plunging in September to around 47.8 points. The last time the indicator was at such lows was no less around ten years ago. A significant decline in the US producer price index was also recorded. On a monthly basis, this indicator, which, among other things, is an early signal of changes in inflationary trends, unexpectedly fell into the negative area (for the first time since January of this year), reaching -0.3%. This is the weakest result since the fall of 2015. In annual terms, the indicator also did not significantly reach forecasts, falling to 1.4% instead of the expected growth to 1.8%. The utilization of industrial capacities in the US decreased to 77.5% in September (from the August level of 77.9%). The indicator also turned out to be lower than analysts' forecasts, who expected it to be at the level of 77.7%, and 2.3 percentage points less than the long-term average.

Yesterday's release only added to the negative fundamental picture: the volume of industrial production, which includes manufacturing, mining and utilities, fell in September by 0.4% (on a monthly basis). For the first time since April this year, this indicator fell into the negative area. Although the August indicator was revised up (+ 0.8% instead of 0.6%), the overall impression remained depressing: the published report, together with other releases, indicates a decrease in activity in this sector, and this is not good news for the dollar bulls.

According to the latest Fed minutes, regulator members are still concerned about the trade conflict between the US and China, and more precisely, the consequences of this conflict. They stated that business investment and industrial production have recently continued to weaken amid unrest over the prospects for trade relations between the two superpowers. Jerome Powell has repeatedly spoken about this fact during his speeches. The above releases only confirm the validity of the announced position of the Fed.

Thus, the dollar is under the yoke of the latest macroeconomic reports, which again reminded traders of the intentions of some members of the Federal Reserve to reduce the interest rate by 25 basis points by the end of this year. Weak dynamics of industrial production may strengthen the position of the dove wing of the Fed at the October meeting. Against the background of such prospects, the dollar index fell over the past 10 days from 98.822 to the current value of 97.347 points. Speaking directly about the EUR/USD pair, here the price broke through the upper boundary of the Kumo cloud on the daily chart and approached the midline of the Bollinger Bands indicator on the weekly chart (1.1155). If the pair consolidates above this target, then on the daily chart the Ichimoku indicator will generate a bullish "Parade of Lines" signal , and on the weekly chart - the "Golden Cross" signal. This combination will allow the bulls of the EUR/USD pair to expect further price growth, up to the lower boundary of the Kumo cloud weekly chart, which corresponds to the price of 1.1305. If the Brexit issue fails in the British Parliament (which is likely), a price pullback will follow - right up to the bottom of the 10th figure.

The material has been provided by InstaForex Company - www.instaforex.com