The euro-dollar pair today resumed the downward movement and for the first time since 2017 tested the eighth figure. And although on Friday, the EUR/USD bulls were able to win a few dozen points from the bears, corrective growth did not continue today. Political events in the US continue to support the dollar, which is temporarily used by the market as a defensive tool. The European currency is also going through "troubled times" - in anticipation of the release of data on inflation growth in the eurozone, rather weak figures of German inflation were published today. This is a very "wake-up call", which portends the further easing of monetary policy by the ECB.

Such a "black and white" fundamental background opens the way for the EUR/USD bears to the area of the eighth figure, and to be more precise, to the level of 1.0820 (the lower line of the Bollinger Bands indicator on the monthly chart). And although this is the lower limit of the new price range (after the bears overcome the support level of 1.0950), sellers can achieve it in the medium term, especially if fundamental factors resonate in one direction, that is, against the euro and in favor of the dollar.

The immediate reason for today's downward impulse of the pair was the data on inflation growth in Germany. The annualized general consumer price index continued its downward movement, reaching 1.2% (with a forecast of growth to 1.3%). In monthly terms, the indicator came to zero, adding to the negative picture. The harmonized consumer price index also disappointed. In both monthly and annual terms, the indicator came out in the "red zone", not reaching the forecast values. It is worth recalling that German macroeconomic reports have recently shown extremely weak results. In particular, the September index of business activity in the manufacturing sector in Germany collapsed to a record low - to -41 points. On the whole, in the eurozone, this index also turned out to be lower than forecasted values, recording a slowdown in production. Industrial PMI has been declining for almost the entire year, and since February it has been below the key level of 50 points, indicating a decline in industry. Similar dynamics were recorded in France and Italy. The PMI in the service sector also ended up in the red zone, complementing the overall negative picture.

All this suggests that further easing of the monetary policy parameters of the ECB will continue to be on the agenda. Despite a certain split in the camp of the European Central Bank, most traders are confident that the regulator will not be limited to the measures adopted in September. If tomorrow's release on the growth of pan-European inflation also comes out worse than expected, then the pressure on the euro will grow due to the increased likelihood of further steps by the ECB. By the way, today in the Financial Times publication an interview was published by Mario Draghi, who, among other things, specified that the European Central Bank "still has an arsenal that the regulator can use." At the same time, he clarified that we are talking about the size of the interest rate and the volume of QE. Add fuel to the fire and ECB chief economist Philip Lane. He stated that the European Central Bank has not yet approached the limit for reducing the deposit rate, that is, this indicator has not reached the level that would be harmful to lending. Lane said that in some other countries there are "lower negative rates" (apparently, he meant Switzerland), so the ECB has not yet reached the technical limit in this context.

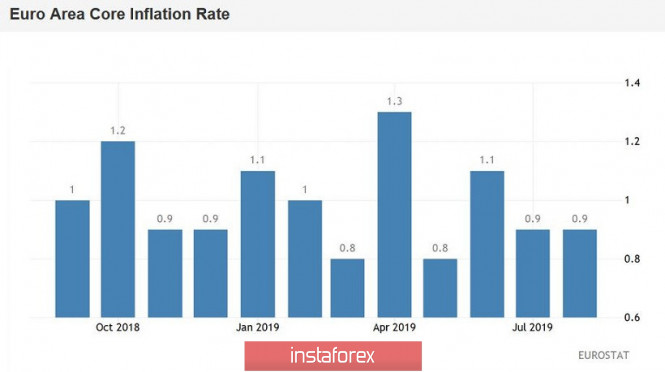

Such "dovish revelations" of the representatives of the European Central Bank's senior management put pressure on the euro as a whole, and on the EUR/USD pair in particular. Today's macroeconomic data only increased pressure on the single currency, especially on the eve of the publication of a common European CPI. According to preliminary forecasts, the overall index will remain at the level of the previous month, that is, at around one percent. Core inflation should show minimal growth, rising from 0.9% to 1%. If the real numbers fall below the predicted values, the EUR/USD bears will again have a chance to gain a foothold in the eighth figure.

From a technical point of view, the situation is as follows. On all, without exception, higher timeframes (from H4 and above), the pair is on the lower line of the Bollinger Bands indicator under all lines of the Ichimoku indicator, which generated a strong bearish "Parade of Lines" signal. This indicates a clear advantage of the downward movement. The bearish momentum is so strong that it's too early to talk about a price correction: only if the data on the growth of European inflation comes out much better than expected tomorrow, the bulls of the pair can count on a price pullback. Otherwise, priority will remain downwards. The main target of the downward movement is located on the lower line of the Bollinger Bands indicator on the monthly chart, that is, at around 1.0820.

The material has been provided by InstaForex Company - www.instaforex.com