EUR/USD

Yesterday, the euro stayed on the blue downward price channel all day, awaiting today's ECB meeting, which is the last for Mario Draghi. We believe that the meeting will be neutral, as all the preparatory work for Mario's successor has already been completed. The general mood of the markets in this regard is positive. October European PMIs will be published earlier in the day. The forecast is optimistic for them: business activity in the manufacturing sector is expected to grow from 45.7 to 46.1, in the services sector, the index is expected to grow from 51.6 to 51.9. In the US, on the contrary, economic indicators are expected to deteriorate: orders for durable goods in September are projected to be -0.5% versus 0.2% in August, sales of new homes in September are expected to decrease from 713 thousand to 710 thousand. US Manufacturing October PMI may drop from 51.1 to 50.7. Services PMI may grow, but not significantly: forecast 51.0 versus 50.9 earlier.

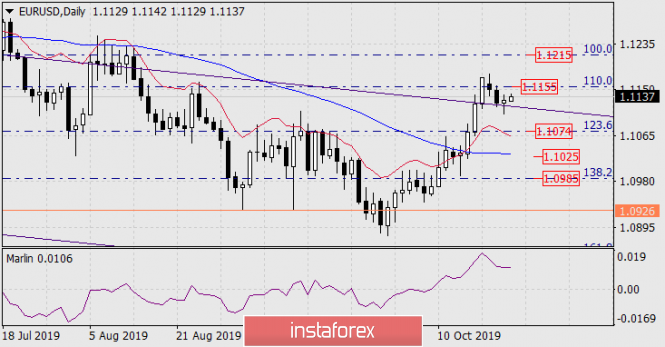

The immediate goal on the daily chart for the euro is the Fibonacci level of 110.0% at the price of 1.1155, consolidation above the level may extend the growth to the level of 100.0% at the price of 1.1215. Consolidating yesterday's low with negative macroeconomic indicators will open the immediate target of 1.1073, after which the euro will gather strength to attack 1.1025 (MACD line).

On the four-hour chart yesterday's low (1.1106) corresponds to the support of the MACD indicator line. Consolidation under it will raise the downward pressure in the role of a new trend. The 1.1106/55 range is the consolidation zone for the euro in the current situation.

The material has been provided by InstaForex Company - www.instaforex.com