Forecast for October 7:

Analytical review of currency pairs in scale H1:

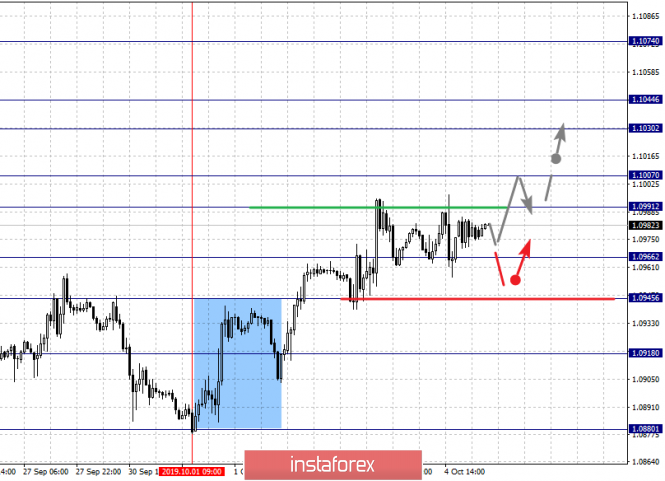

For the euro / dollar pair, the key levels on the H1 scale are: 1.1074, 1.1044, 1.1030, 1.1007, 1.0991, 1.0966, 1.0945 and 1.0918. Here, we continue to monitor the development of the ascending structure of October 1. Short-term upward movement is expected in the range 1.0991 - 1.1007. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.1030. Price consolidation is in the range of 1.1030 - 1.1044. We consider the level 1.1074 to be a potential value for the top; upon reaching this value, we expect a rollback to correction.

Short-term downward movement is possibly in the range 1.0966 - 1.0945. Hence, the high probability of a reversal to the top. A breakdown of the level of 1.0945 will lead to the development of a protracted corrective movement. Here, the target is 1.0918.

The main trend is the upward structure of October 1.

Trading recommendations:

Buy: 1.1007 Take profit: 1.1030

Buy 1.1045 Take profit: 1.1074

Sell: 1.0966 Take profit: 1.0947

Sell: 1.0943 Take profit: 1.0920

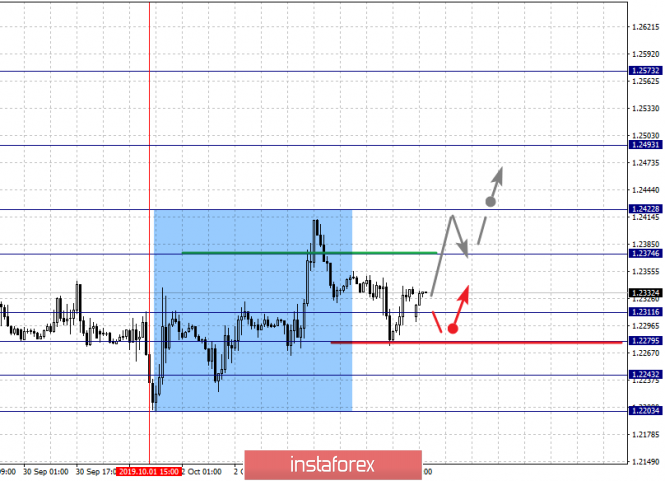

For the pound / dollar pair, the key levels on the H1 scale are: 1.2573, 1.2493, 1.2422, 1.2374, 1.2311, 1.2279, 1.2243 and 1.2203. Here, the price forms the medium-term initial conditions for the upward movement of October 1 and is currently in the correction zone for this structure. The continuation of the movement to the top is expected after the breakdown of the level of 1.2374. In this case, the target is 1.2422. The breakdown of which should be accompanied by a pronounced upward movement. Here, the goal is 1.2493. Price consolidation is near this level. For the potential value for the top, we consider the level of 1.2573. Upon reaching which, we expect a pullback to the bottom.

Short-term downward movement is expected in the range 1.2311 - 1.2279. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2243. This level is a key support for the top.

The main trend is the formation of a medium-term upward structure from October 1.

Trading recommendations:

Buy: 1.2375 Take profit: 1.2420

Buy: 1.2424 Take profit: 1.2490

Sell: 1.2310 Take profit: 1.2280

Sell: 1.2277 Take profit: 1.2245

For the dollar / franc pair, the key levels on the H1 scale are: 1.0027, 0.9999, 0.9974, 0.9957, 0.9921, 0.9892, 0.9872 and 0.9845. Here, we are following the formation of the downward potential of October 3. The continuation of the development of the downward trend is expected after the breakdown of the level of 0.9921. In this case, the target is 0.9892. Price consolidation is in the range of 0.9892 - 0.9872 . For the potential value for the bottom, we consider the level of 0.9845. Upon reaching which, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 0.9957 - 0.9974. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9999. This level is a key support for the downward structure. Its breakdown will lead to the development of the upward movement. Here, the potential target is 1.0027.

The main trend is the formation of potential for the bottom of October 3.

Trading recommendations:

Buy : 0.9976 Take profit: 0.9999

Buy : 1.0003 Take profit: 1.0027

Sell: 0.9920 Take profit: 0.9892

Sell: 0.9870 Take profit: 0.9845

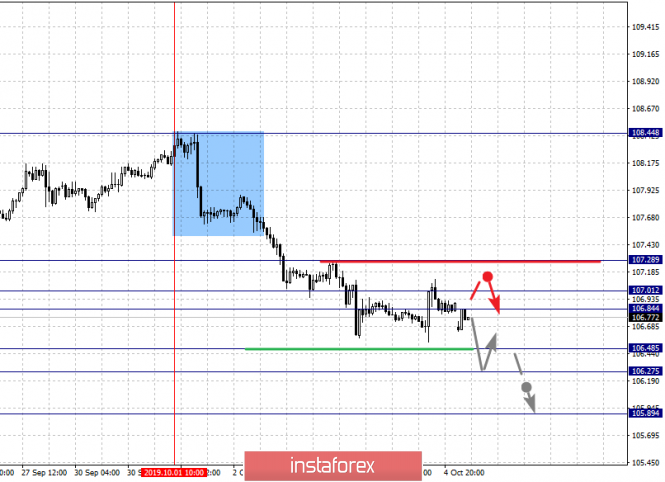

For the dollar / yen pair, the key levels on the scale are : 107.28, 107.01, 106.84, 106.48, 106.27 and 105.89. Here, we follow the development of the downward cycle of October 1. Short-term downward movement is expected in the range of 106.48 - 106.27. The breakdown of the last value will lead to movement to a potential target - 105.89. After reaching which, we expect a pullback to the top.

Short-term upward movement is expected in the range of 106.84 - 107.01. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 107.28. This level is a key support for the downward structure.

The main trend: the downward cycle of October 1.

Trading recommendations:

Buy: 106.84 Take profit: 107.00

Buy : 107.03 Take profit: 107.26

Sell: 106.48 Take profit: 106.28

Sell: 106.25 Take profit: 105.90

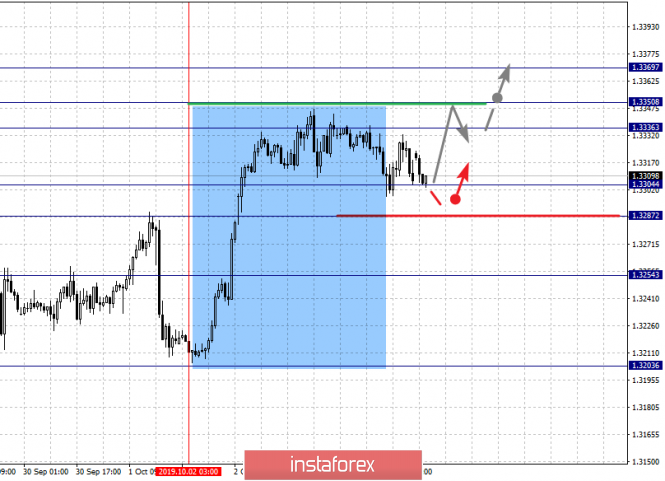

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3369, 1.3350, 1.3336, 1.3304, 1.3287 and 1.3254. Here, the price forms the medium-term initial conditions for the top of October 2. Short-term upward movement is possibly in the range 1.3336 - 1.3350. From here, we expect a key reversal in the correction. For the potential value for the top, we consider the level of 1.3369.

Short-term downward movement is possibly in the range of 1.3304 - 1.3287. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3254. This level is a key support for the top.

The main trend is the formation of medium-term initial conditions of October 2.

Trading recommendations:

Buy: 1.3336 Take profit: 1.3350

Buy : 1.3352 Take profit: 1.3369

Sell: 1.3304 Take profit: 1.3390

Sell: 1.3285 Take profit: 1.3260

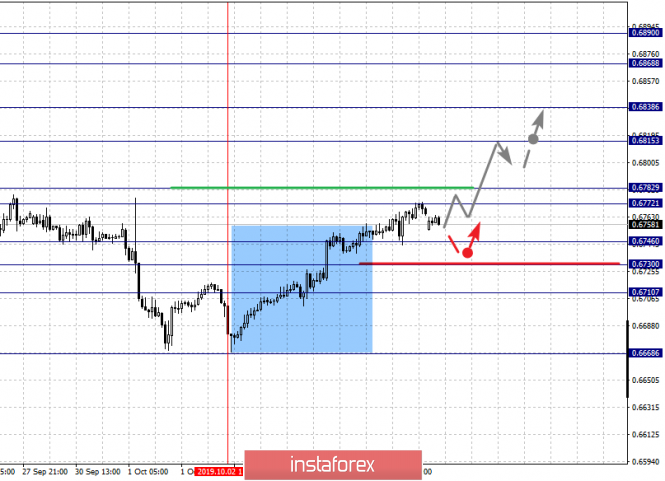

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6868, 0.6838, 0.6815, 0.6782, 0.6772, 0.6746, 0.6730 and 0.6710. Here, we follow the development of the ascending structure of October 2. The continuation of the upward movement is expected after the price passes the noise range 0.6772 - 0.6782. In this case, the target is 0.6815. Short-term upward movement, as well as consolidation is in the range of 0.6815 - 0.6838. For the potential value for the top, we consider the level of 0.6868. The movement to which, is expected after the breakdown of the level of 0.6840.

Short-term downward movement is possibly in the range of 0.6746 - 0.6730. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6710. This level is a key support for the upward structure.

The main trend is the upward structure of October 2.

Trading recommendations:

Buy: 0.6782 Take profit: 0.6815

Buy: 0.6817 Take profit: 0.6836

Sell : 0.6746 Take profit : 0.6732

Sell: 0.6729 Take profit: 0.6710

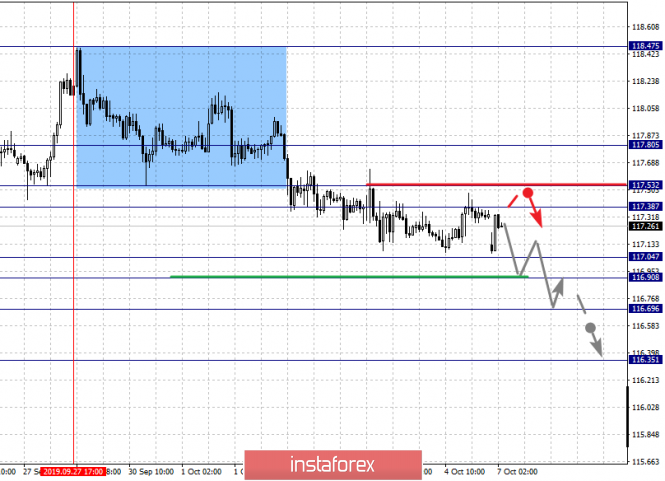

For the euro / yen pair, the key levels on the H1 scale are: 117.80, 117.53, 117.38, 117.04, 116.90, 116.69 and 116.35. Here, we continue to monitor the development of the downward cycle of September 27. Short-term downward movement is expected in the range 117.04 - 116.90. The breakdown of the last value will lead to a movement to the level of 116.96. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 116.35. The movement to which is expected after the breakdown of the level of 116.65.

Short-term upward movement is possibly in the range 117.38 - 117.53. The breakdown of the latter value will lead to in-depth movement. Here, the goal is 117.80. This level is a key support for the downward structure.

The main trend is the local descending structure of September 27.

Trading recommendations:

Buy: 117.38 Take profit: 117.52

Buy: 117.55 Take profit: 117.80

Sell: 117.04 Take profit: 116.90

Sell: 116.88 Take profit: 116.70

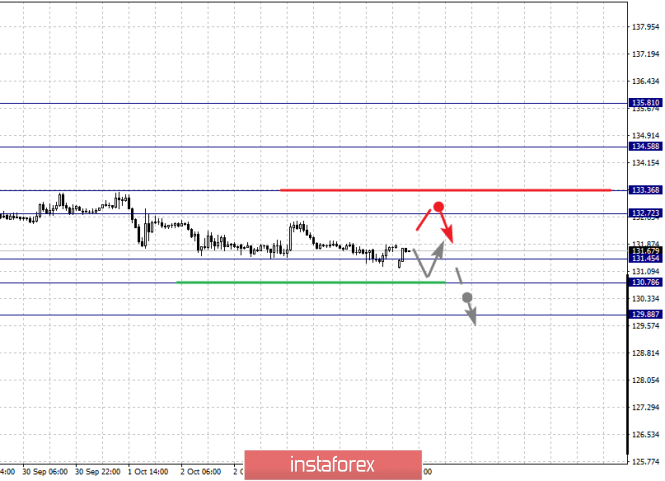

For the pound / yen pair, the key levels on the H1 scale are : 134.58, 133.36, 132.72, 131.45, 130.78 and 129.88. Here, we follow the development of the descending structure of September 20. Short-term movement to the bottom is expected in the range 131.45 - 130.78. The breakdown of the latter value will lead to movement to a potential target - 129.88, when this level is reached, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 132.72 - 133.36. The breakdown of the last value will lead to a long correction. Here, the target is 134.58. We also expect the formation of expressed initial conditions for the upward cycle to this level.

The main trend is the descending structure of September 20.

Trading recommendations:

Buy: 132.72 Take profit: 133.30

Buy: 133.40 Take profit: 134.55

Sell: 131.43 Take profit: 130.80

Sell: 130.74 Take profit: 129.90

The material has been provided by InstaForex Company - www.instaforex.com