4-hour timeframe

Amplitude of the last 5 days (high-low): 138p - 139p - 80p - 161p - 59p.

Average volatility over the past 5 days: 115p (high).

Monday, October 28, for the GBP/USD pair also takes place in quiet trading with low volatility. Even the news that the EU officially gave the go-ahead for the transfer of Brexit for another three months did not affect the currency pair's movement. Indeed, why should traders get nervous? Everything went to the next Brexit date postponement in recent weeks, despite the fact that Boris Johnson and the EU leaders have agreed on a deal. We have repeatedly said that, in fact, there is no sense in Johnson's agreements with the European Union until they are approved by the British Parliament. In practice, it was the House of Commons that once again stood in the way of the "divorce" of London and Brussels. And the deal of Boris Johnson, in fact, is not much different from Theresa May's deal, which the deputies blocked three times. Thus, today traders had nothing to react to.

But Boris Johnson has no choice but to push through the idea of re-election to the Parliament and hope that the electorate will vote for as many Conservatives as possible in order to allow Johnson to make decisions individually. One way or another, now everything will depend not on Johnson, Corbyn, political parties, but on the population of Great Britain. Will there be a second referendum or will parliamentary re-elections take place, it is the people who will decide the fate of the country, as well as the question "Do British citizens want to renew Brexit every three months or leave the EU without any deals?" If the majority of voters still want to leave the EU according to any scenario, then they should vote for the Conservatives, but if they want to stay in the European Union or try to get out according to the mildest scenario, then they should vote for the Labour Party. The problem is that the distribution of votes can again be ambiguous, as in the 2016 referendum itself, when it is impossible to say unequivocally that most citizens support one opinion or another, one or another party. The British prime minister is going to agitate the population in such a situation. But not for themselves, but against the Parliament, against the House of Commons, which blocked Brexit for the fourth time. Accordingly, Johnson received an additional trump card. Now he can, speaking to the people, declare that the Parliament rejected both an exit without a deal and an exit with a deal. If this works, then the Conservatives will win the parliamentary elections. But will there be an election? Labour and opposition cannot help but realize that elections can give Johnson the necessary edge. And if this advantage is obtained, Johnson will not be interested in the opinion of the opposition. He and the opinion of the whole Parliament were not very interested, since initially he was going to single-handedly withdraw the country from the European Union by means of the propaganda of the work of the MPs. Thus, it does not make sense for the opposition to approve the re-election. Fortunately, their implementation requires the approval of at least 434 MPs, that is 2/3. There are still so many votes in favor that need to be collected. Voting for the December 12 parliamentary elections will take place tonight, so tomorrow we will know for sure whether Boris Johnson will get the chance of his first victory at the helm of the UK or not.

As for macroeconomic statistics, nothing interesting has been published either in the United States or in the UK today. In the UK, no macroeconomic indicators have been published for more than a week, so the drop in volatility is also partly due to this factor. We again do not expect any economic data from Great Britain tomorrow, and only a couple of minor reports will be published in the United States. From a technical point of view, the pair is being traded inside the Ichimoku cloud, so the "dead cross" is weak and the sales of the pound are mixed. The upward trend may well resume if the bulls manage to return the pair above the Kijun-sen critical line, which could happen with the help of the Fed's actions on Wednesday. But Brexit should not be overlooked. It should be remembered how the 800-pound upward movement began. From the banal news that Leo Varadkar and Boris Johnson announced the possible (!!!) achievement of a deal on Brexit with the European Union, which at the moment does not make much sense.

Trading recommendations:

GBP/USD within the downward correction has consolidated below the critical line. Thus, formally, sales of the British currency are currently relevant with a target of 1.2743, which, if opened, is only done in small lots. It is recommended to return to buying if the pair is re-secured above the Kijun-sen line, but also in small lots, since the foundation does not yet suggest strong growth of the pair.

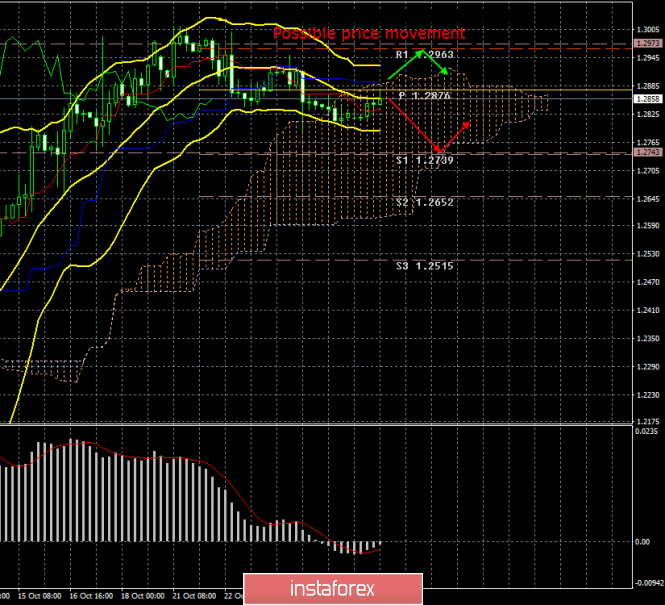

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com