Market participants quite calmly reacted to preliminary data on inflation in Europe, which showed its deceleration from 1.0% to 0.9%. This is largely due to the fact that after unexpectedly poor preliminary data on inflation in Germany, a similar result was quite predictable. In addition, there was reason for joy in the form of final data on the index of business activity in the manufacturing sector in Europe, which fell from 47.0 not to 45.6, but to 45.7. It's certainly terrible that the index continues to fall below 50.0 points, but still, not at the pace as expected. No less important is the fact that a similar picture is taking shape in Europe's largest economy. In Germany in particular, the index of business activity in the manufacturing sector fell from 43.5 to 41.7, and not to 41.4. But in France the picture is somewhat worse, but only at first glance. The index of business activity in the manufacturing sector fell from 51.1 to 50.1, while they expected a decrease to 50.3. However, it is still above 50.0 points, which is significantly better than in Germany.

The market also reacted quite casually to the final Markit data on the index of business activity in the United States, which showed growth from 50.3 to 51.1. This turned out to be slightly better than forecasts, which showed growth to 51.0. But a little later, the market became somewhat feverish, and the reason was that the ISM data on the index of business activity in the manufacturing sector showed a decrease from 49.1 to 47.8, instead of growth to 50.1, became the reason. Market participants seized on this data, as yet another evidence of the imminent approaching recession. However, it most likely worked that the dollar was slightly overbought, and ahead of the Friday publication of the report of the United States Department of Labor, these imbalances should be addressed. Also, the fact that the two indices moved in completely different directions had an impact.

Markit Manufacturing PMI (US):

But everything went back to square one pretty quickly. This time, Mario Draghi became a troublemaker, who, in the course of his speech, almost directly stated that the European Central Bank would soon reduce the refinancing rate. The truth is not entirely clear, will this happen even under Mario Draghi, or under Christine Lagarde?

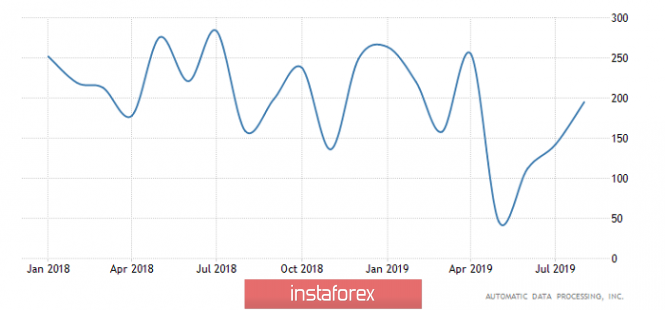

Investors of all stripes are now keeping in mind the upcoming Friday publication of the United States Department of Labor report, so any labor market data will drive the market participants into a frenzy. So today's ADP employment data is incredibly important to the market. And these same data can show employment growth of 140 thousand, against 195 thousand in the previous month. Obviously, this will be perceived as a signal that the contents of the report of the Ministry of Labor may turn out to be somewhat disappointing, which will negatively affect the dollar.

Employment Change from ADP (US)

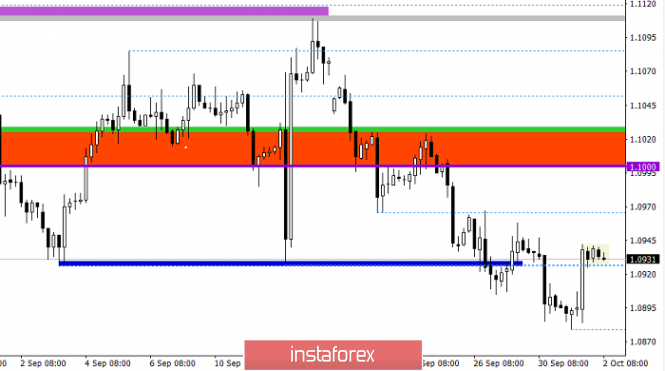

The EUR/USD pair still failed to stay at the levels of May 2017 and as a result, there was a pullback to the previously passed pivot point of 1.0930. The movement of the past day itself is similar to a V-shaped oscillation, in the tact of a downward trend. Considering what is happening in general terms, we see that the pulse cycle in the trend structure lasts as long as 12 trading days, where, in principle, there was no proper stop in the form of a pullback/stagnation. Thus, local overheating of short positions in this market phase does not take place.

It is likely to assume that the current stop at 1.0925/1.0942 will not last very long, where in general terms a further pullback towards 1.0980-1.1000 is considered. Regarding the current stagnation [1,0925/1,0942] it would be advisable not to take hasty actions, since the analysis of consolidation points can give the most accurate, local forecast.

Concretizing all of the above into trading signals:

• Long positions, we consider in case of price consolidation higher than 1.0960, with the prospect of a move to 1.0980-1.1000.

• Short positions, we consider in case of price consolidation lower than 1.0920, with the prospect of a move to 1.0900-1.0880.

From the point of view of a comprehensive indicator analysis, we see a versatile interest. So the daily period is focused on the main trend, that is, it signals a downward movement. Hourly periods try to work on a pullback, providing a signal about purchases. Minute intervals hovered on existing stagnation, giving out neutral interest.