While FOMC members ponder when to put an end to the process of easing monetary policy for preventive purposes, investors are wondering what to expect from the next round of U-China trade talks.

The US currency reacted quite calmly to the publication of the minutes of the September meeting of the Federal Reserve. The regulator lowered the federal funds rate to 2%, since, according to his estimates, the risks of a slowdown in the US economy have increased since the July FOMC meeting. The Fed calls trade tensions and uncertainty about economic development the main factors that weigh on exports, industrial production and business investment. At the same time, some officials believe that the central bank should give specific signals about the cessation of the reduction in interest rates for preventive purposes.

It should be recognized that at present there is a serious discrepancy between FOMC point forecasts and market expectations regarding the weakening of the monetary policy of the Federal Reserve.

Minutes of the Fed showed that 7 out of 17 FOMC members expect a federal funds rate between 1.5% and 1.75% by the end of the year, 5 believe that it should remain unchanged (at 1.75% –2.00 %), another 5 do not exclude a higher level of interest (2.00% –2.25%).

The derivatives market estimates the chances that the Fed will lower the interest rate once by 25 basis points, by 92%, by the end of the year. The probability of two reductions of 50 basis points is at 52%.

The minutes of the September meeting of the FOMC also confirmed on Tuesday a statement made by Fed Chairman Jerome Powell that the central bank would resume the purchase of assets. This step will expand the balance of the regulator.

According to Alan Ruskin of Deutsche Bank, if market expectations remain overestimated, then the US dollar as a reaction to the reduction in the federal funds rate will become cheaper by no more than 1% at the end of October.

"The final communique of the October meeting of the Fed is likely to be less dovish than the September instruction. This will not be an additional incentive to sell the US currency," the expert says.

"The USD rate will continue to grow until the end of the year, and even the daily injections of liquidity into the repo market from the Fed will not stop it," UBS strategists say.

According to them, the Fed's actions are more like a technical "twist" of the repo market than a full-fledged asset purchase program (QE).

"The foreign exchange market has not yet responded to the infusion of liquidity by the US regulator, and therefore investors do not consider these measures as a new direction of monetary policy. We believe that only new cuts in Fed rates and some improvement in the prospects for the global economy will be able to curb the growth of the dollar. In addition, in the past, there was no direct and stable correlation between the dynamics of the Fed balance and the USD exchange rate. In general, the greenback tended to get cheaper during three QE rounds in 2009-2013, but there were a lot of exceptions to this rule," UBS noted.

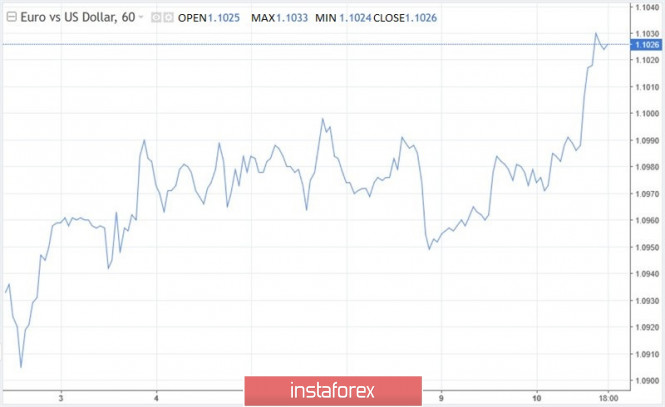

Amid growing positive sentiment regarding US-Chinese trade negotiations to resume in Washington today, the EUR/USD pair finally managed to overcome key resistance at 1.10, as a result of which it jumped to two-week highs.

According to Bloomberg, this time the parties will try to conclude a partial agreement on currency regulation. In addition, the New York Times reported that the White House plans to ease restrictions for US companies on the ban on the sale of its products to the telecommunications giant Huawei, as well as to refrain from introducing a new package of duties on Chinese imports next week. In turn, Beijing promised to increase the volume of purchases of agricultural products from the United States.

Counting on something more is not necessary now. Contradictions remain between the parties on other issues; moreover, they continue to exchange unfriendly statements. Apparently, even the cessation of the mutual increase in tariffs and the desire of both parties to meet again can be considered progress.

Optimists believe: the owner of the White House is beginning to realize that duties harm the US economy and, in order to prevent its serious slowdown on the eve of the 2020 presidential election, he will make concessions. Pessimists believe that the United States does not intend to abandon the idea of raising tariffs, because, according to the US Secretary of Commerce Wilbur Ross, it works: duties forced China to pay attention to US problems.

Thus, a serious breakthrough in trade relations between Washington and Beijing is not worth the wait.

The EUR/USD pair managed to break through the upper limit of the short-term consolidation range of 1.096–1.10, however, it can be attacked by "bears" if it is near 1.1045–1.1065.

The euro is gaining points amid a weakening greenback, which faced sales due to the possible conclusion of a trade agreement between the US and China, but from a fundamental point of view, the single European currency has no long-term drivers for growth.

The eurozone economy continues to slow down, which justifies the ECB's decision to soften monetary policy and keep interest rates low for a longer period. In addition, the United States can still impose duties on European imports, and the Brexit issue has not yet been resolved, which makes the EU's more bleak economic prospects even more pessimistic. All this is fraught with bearish sentiments regarding the euro.

The material has been provided by InstaForex Company - www.instaforex.com