As you know, cross-rates are an excellent tool for hedging positions in "majors", such as the most popular of them - the EUR/USD pair.

I recommend for each position in major - to have a position in the "right" cross, and you will appreciate this tactic of distributing profits between instruments.

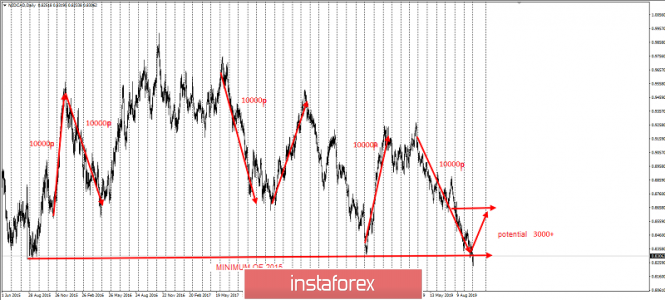

Let's pay attention to the very oversold NZD/CAD cross-instrument, which has passed 10,000 p for 5 figures almost without a pullback since March 2019. However, several people know that this cross has an average rollback passage of exactly 10 points. And right now, after updating the minimum of 2015, it makes sense to buy it with a potential of at least 3,000 p at 5 figures.

It is easier to do this by collecting a grid of orders in longs on pullback movements. In fact, you will work out a false breakdown on an annual scale, or rather - for 4 years. This does not happen every day. Therefore, it is necessary to take advantage of this unique opportunity.

The material has been provided by InstaForex Company - www.instaforex.com