The bears of the EUR/USD pair could not overcome the support level of 0.0980, which corresponds to the lower line of the Bollinger Bands indicator, which coincides with the lower boundary of the Kumo cloud on the daily chart. Buyers won the 10th figure, although the price growth is limited.

Macroeconomic reports helped the European currency: traders saw the first signs of a recovery in the German economy. Pan-European GDP growth data also came out better than expected, complementing the fundamental picture of the day. In turn, the dollar feels insecure, despite Jerome Powell's encouraging rhetoric. The rise in US inflation and the producer price index did not impress dollar bulls: China, or rather, US-Chinese trade negotiations, remains in the spotlight. The failure of the negotiation process could lead to a decrease in the Federal Reserve interest rate at the beginning of next year. Perhaps this is the only factor that can force members of the Fedto return to this issue again. That is why the dollar index retreated from its local highs, reflecting the devaluation of the currency throughout the market.

In other words, the EUR/USD pair continues to trade flat, within the wide-range price range of 1.0980-1.1090. Having reached the bottom of this range, the pair jumped and headed towards the middle of the 10th figure. The formal reason for the correctional growth, as mentioned above, was the European macroeconomic reports. It is worth noting that the European currency reacted rather weakly to German data, which turned out to be much better than forecasts. In annual terms, German GDP grew immediately by 1% (the best result for the last year), although experts expected a decrease of 0.1%. The German economy avoided the recession, and this fact may serve as a signal for the restoration of the European economy. By the way, the pan-European level of GDP also showed positive dynamics. In annual terms, the indicator remained at 1.2%, while the market expected a decline to 1.1%. On a quarterly basis, the indicator also remained at the level of the second quarter: + 0.2%.

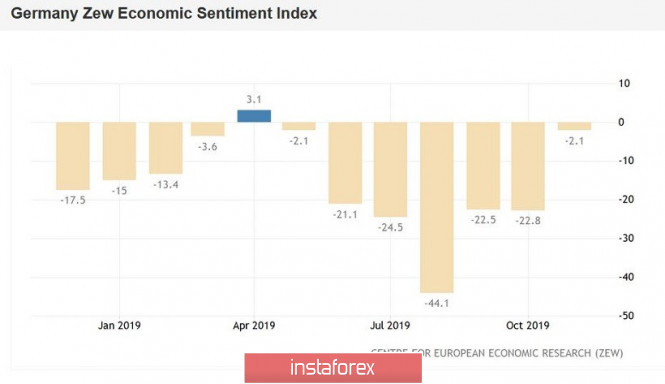

It is also worth recalling the latest reports from the ZEW Institute. The current situation index remained deep in the negative area, but still moved away from 9-year lows reached in October. But the index of expectations (moods) in the business environment has shown significant growth. This indicator reached the level of -22.8 points in October, while it recovered to -2.1 this month - this is the best result since April of this year. A similar pan-European indicator showed a similar trend: -1 point in November after a decline to -23.5 in October.

According to experts from the ZEW Institute, these figures reflect the optimism of European investors regarding the prospects of Brexit and the conclusion of a trade deal between the United States and China. Big business has also expressed confidence that Donald Trump will not impose duties on European cars and auto parts.

Whether such optimism is premature or not is an open question. And while Brexit's prospects depend on the outcome of early Parliament elections to the House of Commons, the prospects for a deal between the United States and China depend on a wider range of factors. Once again, the parties cannot find a common denominator on key issues. Donald Trump made it clear that he was not ready to satisfy the ultimatum of Beijing (the abolition of September duties and the refusal of December). In turn, China said it was not going to commit itself to the annual acquisition of US $50 billion worth of agricultural products. At this stage, the parties could not find a compromise, after which the negotiations actually stopped. Beijing officials say that a deal without specifying the exact amount will provide them with some flexibility in subsequent decisions — for example, if the Americans backtrack. Another escalation of violence in Hong Kong may also jeopardize the negotiation process - according to some representatives of China, Hong Kong protesters secretly support or even finance Washington.

Such a news flow puts pressure on the dollar, especially after a wave of optimism about the prospects for US-China negotiations. The US currency retreats, allowing EUR/USD bulls to go for a correction. But the buyers are not in a hurry to seize the opportunity. Traders are not sure about the euro, even after good data from Germany. The German economy escaped a technical recession, but the industrial recession continued in the country, and this fact is alarming.

In other words, EUR/USD buyers need more signals confirming the recovery of the European economy. Until then, the pair will be forced to trade in the flat, within the framework of a price fork of 1.0980-1.1090: these marks correspond to the lower line of the Bollinger Bands indicator, which coincides with the lower boundary of the Kumo cloud on the daily chart and the middle line of this indicator, which coincides with the Kijun line -sen on the same timeframe.

The material has been provided by InstaForex Company - www.instaforex.com