To open long positions on EURUSD you need:

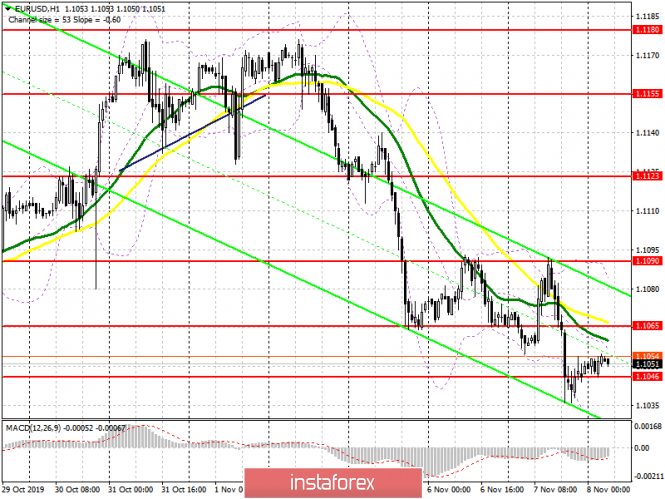

Buyers once again retreated from the market yesterday, losing the support level of 1.1050, which has now transformed into resistance around 1.1065. Weak data on Germany pushed away purchases of the European currency. Today, the bulls only have to rely on a false breakout of intermediate support at 1.1046, however, larger long positions should be postponed until the lows 1.1026 and 1.0994 are updated. The main task of EUR/USD buyers will be a return to the level of 1.1065, from which it will be possible to observe growth to a high of the last two days to the area of 1.1090, where I recommend profit taking.

To open short positions on EURUSD you need:

Sellers will count on the formation of a false breakout in the resistance area of 1.1065, where the moving averages are currently located. However, a breakthrough and consolidation below the support of 1.1046 will be a more important task, which, together with weak data on France, may lead to the continuation of the downward trend in the pair and update of the lows of 1.1026 and 1.0994, where I recommend profit taking. If in the first half of the day active sales will not be observed in the resistance area of 1.1065, I recommend postponing short positions in EUR/USD to test the high of 1.1090.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 moving averages, which indicates a bearish nature of the market.

Bollinger bands

In case of growth, the upper boundary of the indicator in the region of 1.1085 will act as resistance. In the event of a decline, support will be provided by the lower boundary of the indicator in the region of 1.1026.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20