The Bank of Canada's final meeting for this year will take place exactly two weeks from now on December 4. But already now, disputes regarding the further actions of the Canadian regulator are not ceasing among experts. The contradictory fundamental picture does not allow any unambiguous conclusions to be drawn: there are arguments both in favor of maintaining a wait-and-see attitude and in favor of easing monetary policy. Today's data on the growth of Canadian inflation did not help resolve this rebus, as a result of which the USD/CAD pair showed increased volatility, continuing the trend of recent days. After the release, the price initially fell to daily lows, and then jumped to 1.3320, updating the monthly high. After a short pause, the bulls of the pair continued to test this resistance level, which corresponds to the upper line of the Bollinger Bands indicator on the daily chart.

Thus, the reaction of USD/CAD traders to today's release turned out to be quite fleeting. In fact, the market reacted in a fleeting manner to the published figures (all the more so since they reached the forecast level), after which the loonie returned to more pressing problems. The Canadian dollar is getting cheaper for the second day in a row, and even relatively good data on inflation growth could not significantly affect the situation. The market is primarily concerned with external risks, especially in light of the previous rhetoric of Bank of Canada representatives. Stephen Poloz focused on the continuing uncertainty in the light of the ongoing trade conflict at the last meeting of the Canadian central bank

The regulator also downward revised its forecasts for Canada's GDP growth next year (from 1.9% to 1.7%). Poloz expressed concern about the level of consumer spending, declining business investment and export volumes. The latest release on Canada's GDP growth came out in the red zone, not justifying the forecasts of most analysts: on an annualized basis, the indicator was at zero level (with a weak forecast of growth to 0.1%), while in annual terms it dropped to 1. 3% (with a forecast of growth to 1.4%). The labor market data was also disappointing: for the first time since July, the employment growth rate was in the negative area - the number of jobs decreased by almost two thousand. And this despite the fact that for two months, experts marked a record increase in the indicator (in August it grew by 80 thousand, and in September - almost 54 thousand). Despite the October forecast of growth of 14 thousand jobs, the indicator showed a negative trend.

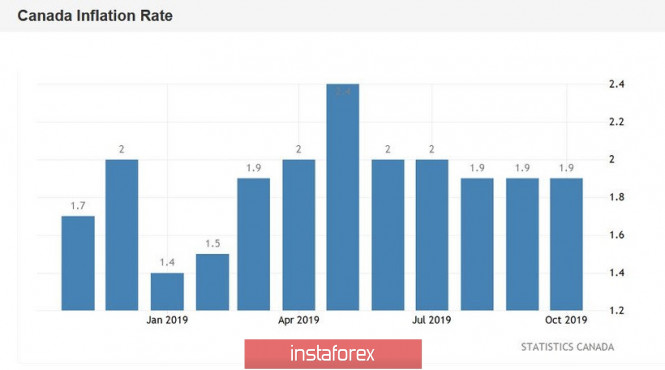

Today's inflation growth data could offset investors' concerns about monetary policy prospects. The core consumer price index continues to stay close to target levels, and this fact could allow the Canadian regulator to continue to pause. But the possible escalation of the trade war has mixed up all the cards: the market is seriously concerned that Washington and Beijing will resume hostilities in the near future, raising the degree of tension in the financial world.

Trade negotiations between the countries stalled last week, when the parties refused to make mutual concessions: the Chinese refused to agree to a fixed volume of purchases of American agricultural products, the White House, in turn, refused to cancel the September duties and (planned) December duties.

The situation was significantly aggravated today when the Congress Senate unanimously voted for the Hong Kong Human Rights and Democracy Act. It is noteworthy that all senators, both Republicans and Democrats, voted for this document. This suggests that it will be difficult for Trump to argue his refusal to sign it. Now the bill has been sent to the House of Representatives, and from there (if approved) it will fall into the Oval Office. If the bill becomes law, it will impose certain sanctions on the Hong Kong administration, and will also oblige the US Secretary of State to confirm at least once a year that Hong Kong maintains a sufficient level of autonomy. If the answer is yes, the United States may grant "special trade status" to Hongkongers. China's reaction to the bill was predictable: they protested and warned that Beijing would retaliate "if the bill becomes law." According to China, Washington is interfering in the internal affairs of China, thereby violating the fundamental formula of the relationship "one country, two systems."

Such a political background suggests that no friendly steps can be expected from China or the United States in the context of trade negotiations. Markets are gradually preparing for a possible escalation of the global trade conflict, and the Canadian dollar is reacting most sharply to recent events. Bank of Canada representatives have repeatedly warned investors that they could resort to preventive measures if trade uncertainty increases. In the light of such prospects, the Canadian dollar has lost its foothold - and judging by the reaction to today's release, internal statistics are not able to regain the loonie's self-confidence.

All this suggests that the USD/CAD pair retains the potential for its growth to the main resistance level of 1.3400 - at this price point, the upper line of the Bollinger Bands indicator coincides with the upper boundary of the Kumo cloud on the weekly chart.

The material has been provided by InstaForex Company - www.instaforex.com