EUR/USD

Euro is delayed at the resistance of the price channel line on the third day. The price only pierced the support of the balance line and returned to the Fibonacci level of 123.6%. The signal line of the Marlin oscillator is becoming more and more neutral. And if formally the probability of the euro moving in any direction is the same, then the ripening upward trend is intensifying.

Price taking above the peak on November 18 (1.1090) will also mean automatic consolidation above the line of the price channel, and this can lead to an increase in the euro to the Fibonacci level of 110.0% at the price of 1.1155. The goal of the bears is also preserved - 1.1012 - support for the MACD line. There is a slight nuance in favor of the bears - the balance line approached the Fibonacci level of 123.6%, which makes the euro a little easier to consolidate under both of these lines on the second attempt.

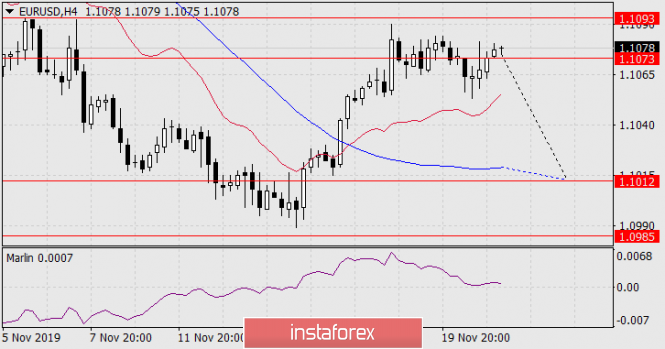

On the four-hour chart, the situation has not changed since yesterday - the price is developing above the lines of balance and MACD and the Marlin oscillator almost touches the boundary with the negative zone - the territory of the downward trend. The target level of 1.1012 with a price fall is expected to coincide with the MACD line. Support will increase, from it corrective growth is possible.

The material has been provided by InstaForex Company - www.instaforex.com