Volatility increased, the euro locally lost its previously occupied positions, but the sideways boundaries still hold the quote when it is worth waiting for a breakout

The quotation is confidently moving within the set boundaries, without touching the control points that would lead to the opening of trading positions, although local price spikes were recorded. So yesterday the minutes of the October meeting of the European Central Bank were published, which was the final one for Mario Draghi. The former head of the ECB urged all participants in the meeting not to abandon efforts to accelerate inflation, Draghi appealed to the heads of the central banks of the EU, asking him not to criticize the actions of the ECB, but to maintain unity. In particular, the text of the minutes had a discussion about the rate of inflation, which will slow down, which delays the process of achieving the target level of the ECB.

In terms of statistics, we have applications for unemployment benefits in the United States, which instead of a decrease of 4 thousand has increased by 3 thousand. At the same time, data were published on sales in the secondary housing market in the US, for October, where there is an increase of 1, 9%, with a forecast of 1.4%.

Today, attention is on the new head of the European Central Bank, Christina Lagarde. The presentation will be extremely interesting, for the reason that she has been in office for three weeks now and the monetary policy has not yet been mentioned. Thus, market participants will carefully monitor the rhetoric of the new chapter, as this can provoke movement/jumps in the market.

In terms of statistical reporting, today we have data on German GDP, which should remain at the same level of 0.5%. At the same time, the composite index of business activity in the manufacturing sector from Markit for the EU is published, where a slight change of 50.6 -> 50.9 is expected.

EU 7:30 London time. - Speech by ECB President Christine Lagarde

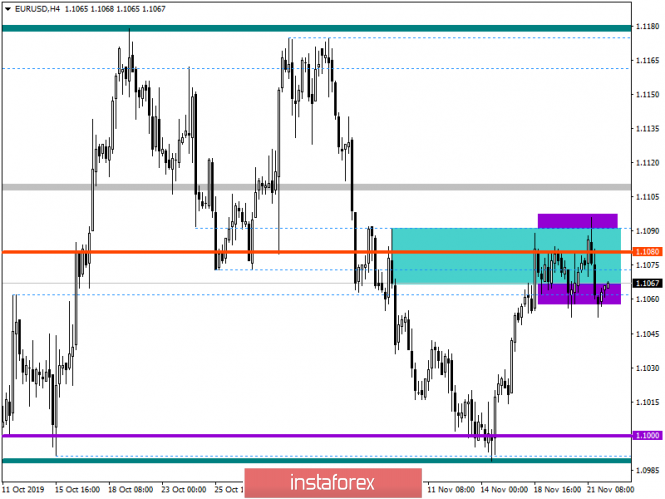

In terms of technical analysis, the EUR/USD currency pair once again proceeded to the lower boundary of our flat formation, where the control points 1.1055/1.1100 were not touched, thereby trading operations continued to be in standby mode. In fact, lateral movement along the range of 1.1080 has been going on for the fourth consecutive day, focusing more and more attention on itself, which in theory should lead to accelerated volatility and as a fact a breakout of one of the control points.

In terms of a general review of the trading chart, we see a kind of versatile stop, which is confirmed by candles at higher time intervals. At the same time, an attempt to restore movement, on the part of sellers, continues to maintain a portion of short positions, which just do not allow the price to go above the control value.

It is likely to assume that the lateral movement will still persist in the market, where the trading tactics remain the same, work on the breakout of control values. I remind you that the longer we see a characteristic restraint, the stronger the acceleration.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of price consolidation higher than 1.1100, not a puncture shadow.

- Short positions, we consider at a clear phase of the passage of the mark 1.1055, not a puncture shadow.

From the point of view of a comprehensive indicator analysis, we see that due to yesterday's downward jump, the indicators have mixed up again. So the intraday prospects took the downside, and the medium-term outlook changed the upward interest to neutral. The short-term interval is currently working on a rebound from the lower boundary, signaling purchases.