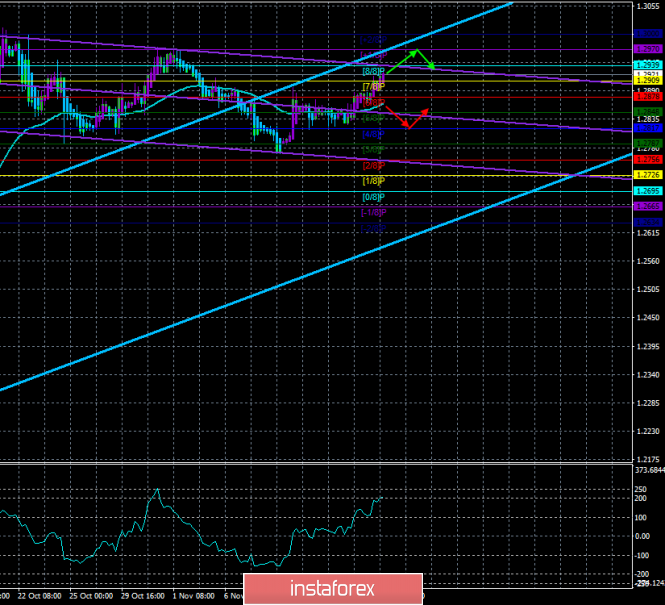

4-hour timeframe

Technical data:

The upper channel of linear regression: direction – up.

The lower channel of linear regression: direction – down.

The moving average (20; smoothed) – up.

CCI: 203.3535

The British pound paired with the US dollar continues a weak upward movement based on all those expectations of traders in the successful outcome of Brexit at the end of January. But macroeconomic statistics from the UK, which was supposed to lower the pound last week by 150-200 points down, continue to be ignored. At the moment, the pound/dollar pair continues to move confidently, albeit slowly, to the Murray level of "+ 1/8" - 1.2970, which is the last local peak. If traders manage to overcome this level, then at least there are no fundamental factors supporting the British currency now, but there will be technical grounds for a new upward trend. Thus, the future of the GBP/USD currency pair for the next few days will depend on the behavior of traders around the level of 1.2970.

From macroeconomic statistics, nothing interesting will happen today. The calendar of events is empty, which in principle often happens on Mondays. Although what difference is published macroeconomic data or not if market participants still do not pay attention to them?

But in the UK, another scandal is brewing, which is very similar to the scandal with Donald Trump in the United States. In general, the two leaders of the UK and the US are very similar to each other. According to the latest information, the topic of participation of the Russian Federation in the UK parliamentary elections has been raised in the UK. According to unverified information, several Russian oligarchs regularly donate large sums to the Conservative Party, thus providing it with serious financial support, with which it is certainly much easier to win elections. The opposition and opponents of Boris Johnson's policy demanded that the Prime Minister publish the report of the intelligence and Security Committee on allegations against Russia in attempts to influence the UK economy. However, the Prime Minister refused to do this until December 12, actually, before the election date. Boris Johnson's view is: "there is no evidence of Russian interference in British politics, and I think we should be very careful — we should not just blame all people from a particular country just because of their nationality." It is assumed that the document contains evidence of Russian interference in the political life of the UK, but the publication of the report was blocked, and the whole story is similar to the one that is now taking place in the US, with the impeachment of Donald Trump. It is clear that the conservatives have opponents, the opposition, and these oppositionists benefit as much as possible to cast a shadow on the figure of Boris Johnson before the parliamentary elections. Just like in the USA, cast a shadow on Donald Trump before the presidential election. We can only observe what is happening and analyze how these events affect the ratings of the Conservative Party, which only show the general mood of the electorate, but do not give reason to assume with high probability the outcome of the parliamentary elections.

The technical picture of the currency pair now reflects an upward trend, so it is quite possible to expect a continuation of the upward movement, but very restrained. We remind traders once again that from a fundamental point of view, the fall of the pound is now much more preferable and it is possible that sooner or later, the bulls will lose their nerve and they will release the British pound, which can then collapse downwards.

Nearest support levels:

S1 – 1.2909

S2 – 1.2878

S3 – 1.2848

Nearest resistance levels:

R1 – 1.2939

R2 – 1.2970

R3 – 1.3000

Trading recommendations:

The GBP/USD pair continues to trade near the moving average line, so any positions on the pair now are still associated with increased risks. Given that traders are practically not responding to fundamental data, the flat may resume. Formally, now we can consider long positions with targets of 1.2970 and 1.3000, however, a downward turn is possible near these levels.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue line of the unidirectional movement.

The lower channel of linear regression – the purple line of the unidirectional movement.

CCI – the blue line in the regression window of the indicator.

The moving average (20; smoothed) – the blue line on the price chart.

Support and resistance – the red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com