Economic calendar (Universal time)

The economic calendar for the current day is quite filled with statistics of varying degrees of importance. Among the most significant are data from the USA. Today, you need to pay attention to the publication of the following indicators:

13:30 basic orders for durable goods;

13:30 GDP;

15:00 index of incomplete sales in the real estate market;

15:30 crude oil reserves.

EUR / USD

Over the past day, the movement had a narrow range as inhibition and reflection persist. The growth prospects of the players, in turn, still depend on the passage of the resistance zone 1.1030 (weekly short-term trend) - 1.1055 (daily cloud) - 1.1082 (daily Kijun + weekly Fibo Kijun). At the same time, the direction is open for players to decline, and new prospects will appear after passing the supports, which are formed by the minimum extreme of 1.0989 and 1.0879.

At the moment, the players on the downside take advantage as they are supported by all the analyzed technical indicators. The classic pivot levels S1 (1.1010) - S2 (1.0999) - S3 (1.0991) can be intraday support. Moreover, consolidation above the central Pivot level (1.1018) will form the prerequisites for the development of an upward correction again, the key reference point of which will be the weekly long-term trend which is currently located at 1.1041. Breaking through this and its reversal will change the current balance of forces and require a new assessment of the situation.

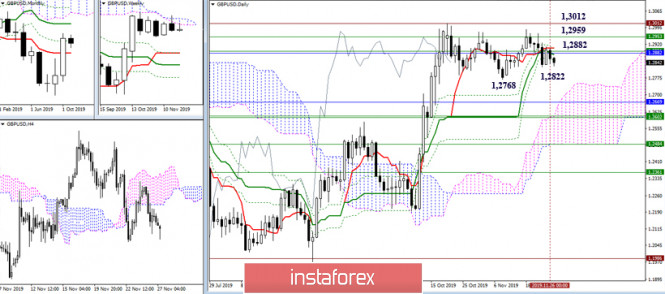

GBP / USD

The pair cannot leave the zone of attraction and remains tied to the accumulation of levels in the region of 1.2882. Here (area of 1.2882), quite several strong levels have joined forces now - the daily cross, the lower border of the weekly cloud, the monthly Fibo Kijun. At the same time, consolidation above can not only delay the development of the situation and maintain uncertainty, but, given the current situation, serve as a good basis and the beginning for a new strengthening of bullish sentiments and positions. The following resistances are located at 1.2959 (weekly cloud) - 1.3012 (maximum extremum). Updating the lows of last week (1.2822) and the area of prevailing uncertainty (1.2768) is now the main task of players to decline.

It can be analyzed that technical indicators currently support players for a decline. Thus, we are seeing continued decline. The pair is close to updating last week's low (1.2822), strengthened today by S1 (1.2828). Now, updating 1.2822 and consolidating below is the main task for today for players to decline. The following support for classic Pivot levels are located today at 1.2796 (S2) - 1.2759 (S3). The development of correction and the subjugation of the key resistance of the lower halves of 1.2865-87 will significantly change the current balance of forces, since the key resistance of the lower halves now coincides with the most important area of attraction and resistance of the higher time intervals (1.2882).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com