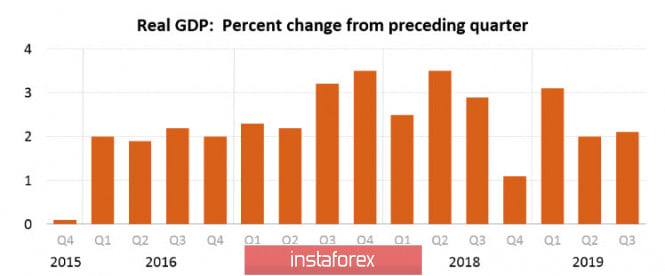

US GDP grew by 2.1% in the 3rd quarter. The first preliminary estimate is revised upwards. Meanwhile, the growth is higher than in the 2nd quarter, which was a surprise for the markets, however, the growth rate of consumer spending slowed down to 2.5% against 4.6% in the 2nd quarter.

The report leaves a mixed impression. Despite stronger-than-forecast GDP growth, there are clear signs of a slowdown in the main driving force of the US economy - consumer spending, which in turn supports inflation and ultimately determines the monetary policy of the Fed.

At the same time, it is no coincidence that the yield on 5-year TIPS bonds, which reflects real business inflation forecasts, continues to be in the area of November lows and didn't react at all to GDP and PCE data. The United States, in turn, reflects the dynamics of global demand with a big lead, and if consumer spending in the United States begins to slow down, then such a signal will inevitably be perceived as negative in the rest of the world.

Mizuho Bank, analyzing the positions of the leaders of the world's largest central banks, concludes that they are forced to follow the Bank of Japan in the war of attrition, having the only tool in their luggage - ultra-low interest rates. The Fed, in many ways, is preparing to implement a plan to limit the yield curve, similar to the one that has been guided by the Bank of Japan for more than 5 years. This means continued growth in the Fed's balance sheet, an aggressive purchase of public debt and a constant infusion of new liquidity, which creates the illusion of stock market growth.

However, optimism in the markets is unstable and is based on two pillars - the resumption of growth in the Fed's balance sheet and expectations for the successful completion of trade negotiations between the US and China, which can give impulse to all world trade. A significant blow was dealt to the second point yesterday - Trump signed two bills on Hong Kong, which the Chinese side can only regard as an attempt to intervene in the country's internal affairs. The chances of successful negotiations are reduced, and at the same time, the demand for risk will also go down. This morning, the Nikkei and the Shanghai Composite are trading in the red zone. There is an increase in demand for bonds, the probability of a negative opening for Europe is high, and the Japanese yen and gold may begin to increase.

EUR/USD

On Thursday, a report on consumer inflation in Germany in November and a number of structural indices from the European Commission, reflecting the state of the business climate in the eurozone is of importance. Minimum growth is expected relative to October and the release of data in line with expectations is unlikely to support the euro.

Moreover, the euro cannot get out of the range, volatility is low, repeated testing of support 1.0988 is technically possible, but players see no fundamental reasons for the decline. Resistance is 1.1060 / 80, which is also unlikely to be broken through.

GBP/USD

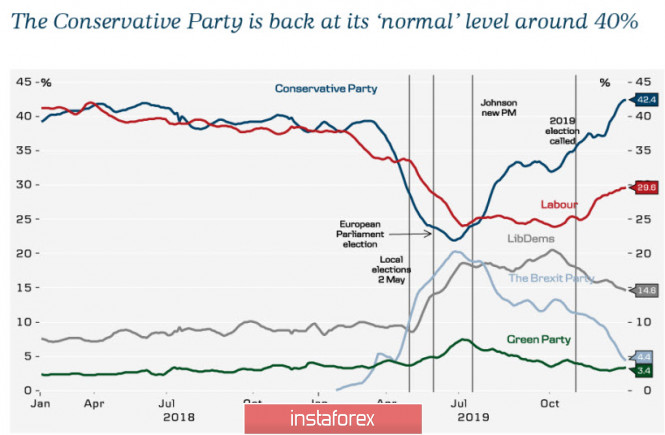

Politics controls the British pound, taking advantage of the complete lack of significant macroeconomic news. The chances of conservatives gaining more than 326 seats in parliament and forming the necessary majority are growing steadily. Thus, this reduces uncertainty.

Johnson repeatedly said that he would not extend the transition period, which should end by December 31, 2020, which increases the risk of a no-deal Brexit.

In turn, the pound is holding around a 6-month high; the chances of a continued growth look strong. On the other hand, demand is supported by the assumption that the Tory victory in the elections will increase demand for the pound due to a change in the direction of the cash flow.

Technically, the pound is neutral with a small bullish margin, support is 1.2820 / 30, and resistance zone is 1.2980 / 3010. Today, it can be tested according to the results of the publication of the YouGov MRP poll, which predicts 359 seats for conservatives on Thursday morning, which is more than enough for a complete victory.

The material has been provided by InstaForex Company - www.instaforex.com