US stock exchanges closed in positive territory after the release of employment data for October, the dollar made an attempt to win back some of the losses after the meeting of the US Federal Reserve, and the mixed Asian exchanges are trading on Monday morning. Meanwhile, the Chinese Shanghai Composite is gaining more than 0.5%, while the Nikkei is in the red zone, which indicates an increase in positiveness, a slight decrease in tension and, in general, a decrease in demand for defensive assets.

Moreover, the labor market report ended up better than expected. 128 thousand new jobs were created with a forecast of 89 thousand. The unemployment rate did not change, but the growth rate of the average wage was still slightly below expectations - 0.2% mom, which corresponds to 3% yoy. In general, the report did not give any guidance as to whether the Fed will reduce the rate in December.

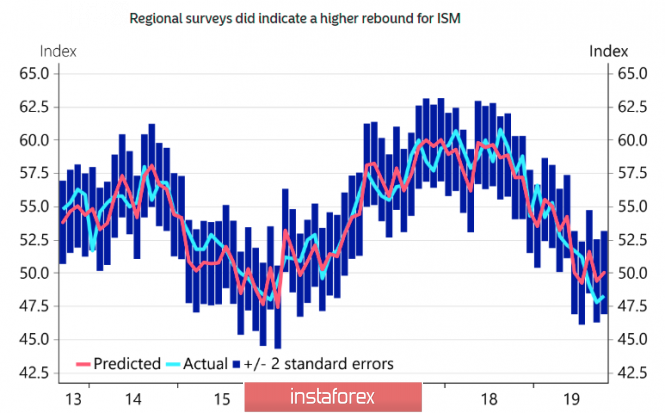

As for the production ISM, the expected rollback, after the failure in September, did not happen. On the other hand, the index rose from 47.8p to 48.3p, remaining below 50p, which indicates the continuation of decline, and there is no reason to expect changes in the coming months.

The ISM dynamics indicate that the Trump administration needs to conclude a trade agreement with China more than China, which has long been preparing to reduce global demand. A thorough and hassle-free restructuring of the economy with an emphasis on domestic demand is bearing fruit - the PMI Caixin / Markit index in production rose to 51.7p, which is the highest since February 2017, while the new orders subindex reached a maximum since January 2013, taking into account the growth rate exports remain not the highest, the conclusion is inevitable that domestic demand in China is growing steadily, which means that the Chinese market for US companies is more valuable than the declining US market for China.

Today, a report on production orders in September will be published, an inevitable decline. On Tuesday, the main event is the ISM report on the services sector, only strong growth can support the dollar.

USD/CAD

The results of the October labor market report may be higher than expected since the October 21 elections required the involvement of nearly 300,000 workers across the country, and some of them will be included in the statistics. Since this effect is expected, the high data on employment in Canada, which will be published on Friday November 8, is unlikely to lead to an increase in the rate of the loonie.

USD/CAD is static and more prone to consolidation than to pronounced movement. The probability of retesting 1.30 in the short term is not high, while the resistance at 1.3175 and 1.3207, with growth, is more logical to sell, since 1.30 is still more likely to move by the end of the year.

USD/JPY

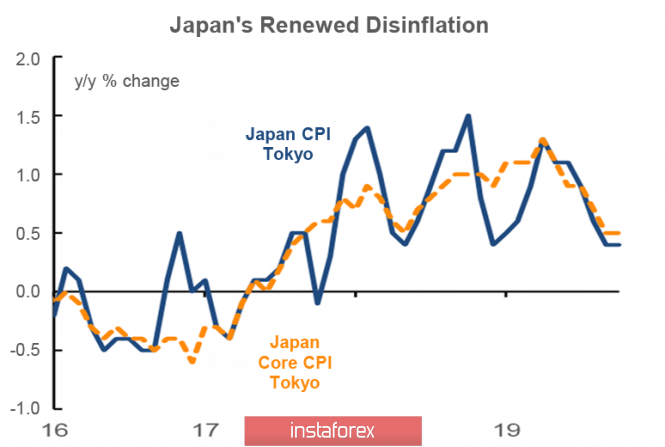

Despite the increase in sales tax from 8% to 10% on October 1, the readings of Japanese inflation show no signs of growth. The October data came out lower, and therefore, the Bank of Japan still faces the challenge of preserving its face and hoping that a tax increase will produce results in the near future.

A similar measure taken 5 years ago, when the sales tax was increased from 5 to 8%, led to a surge in inflation, but at this stage, there is nothing like it.

Forecasts on the main releases of the current week are pessimistic. The manufacturing PMI of Jibun Bank is expected to drop to 50p in October and data on the dynamics of average wages and household expenses will be published on Thursday. The changes will show whether it is worth counting on rising inflation or the idea of raising the sales tax will be unsuccessful.

On Friday, the yen strengthened slightly amid reports that China doubts the possibility of a long-term trade deal with the United States. At the same time, the general trend towards a decrease in tension remains, therefore, support at 107.87 looks stable and growth is more likely. The yen will move to the resistance zone 109.26 / 30 with a target of 111.00 / 50. From a technical point of view, this target is in the middle of the rising channel and cannot be ignored.

The material has been provided by InstaForex Company - www.instaforex.com