What the market is preparing for us - #USDX, EUR / USD, GBP / USD and USD / JPY (H4) - A comprehensive analysis of the options for the movement of currency instruments from November 06, 2019

____________________

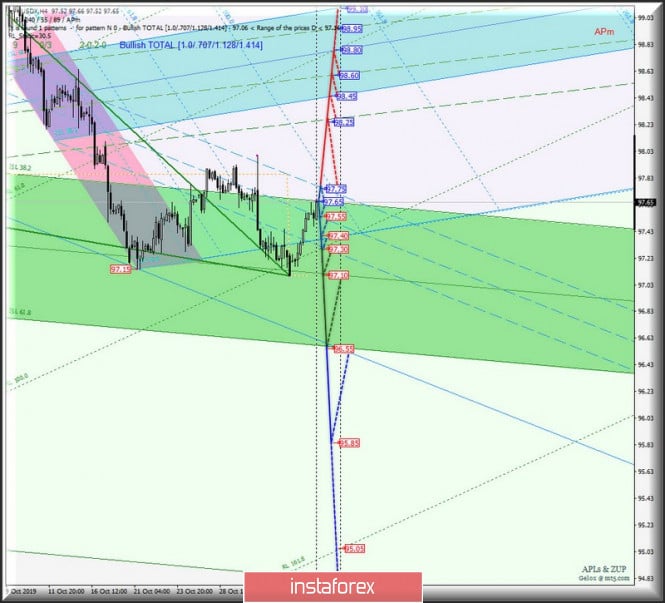

Us dollar index

From November 6, 2019, the development of the #USDX dollar index movement will be determined by working out the boundaries of the 1/2 Median Line channel (97.75 - 97.55 - 97.30) Minuette operational scale forks. The markup for this movement is shown on the chart.

The breakdown of the resistance level of 97.75 at the upper boundary of the 1/2 Median Line Minuette channel will determine the continuation of the development of the upward movement of the dollar index to the boundaries of the 1/2 Median Line channel (98.25 - 98.60 - 98.95) of the Minute operational scale fork and the equilibrium zone (98.45 - 98.80 - 99.10) Minuette operational scale fork.

On the contrary, the breakdown of the support level of 97.30 on the lower boundary of the 1/2 Median Line channel of the Minuette operational scale forks will direct the movement #USDX to the targets - Median Line Minuette (97.10) - the lower border of the ISL61.8 (96.55) equilibrium zone of the Minuette operational scale forks with the prospect of reaching the local minimum 95.85.

The details of the movement #USDX are presented on the chart.

____________________

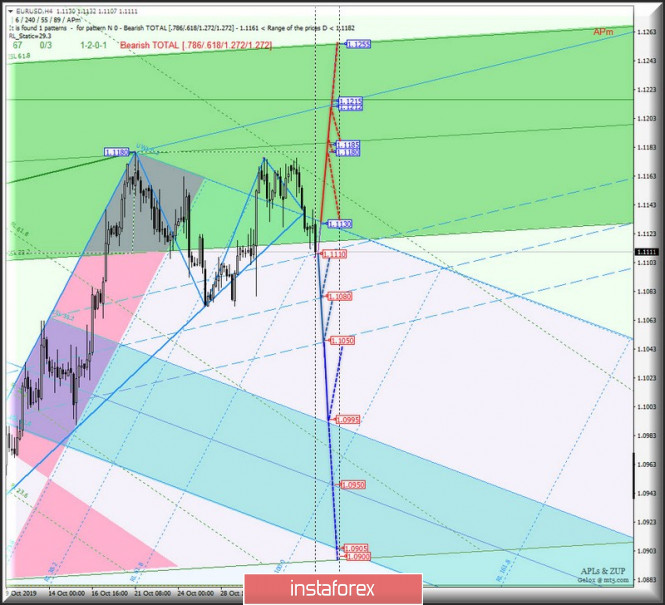

Euro vs US dollar

The trend of the further development of the movement of the single European currency EUR / USD from November 6, 2019 will be determined by the direction of the breakdown of the range :

- resistance level of 1.1130 (the initial SSL line of the Minuette operational scale forks);

- support level of 1.1110 (upper boundary of the 1/2 Median Line Minuette channel).

The breakdown of the support level of 1.1110 - the development of the EUR / USD movement will continue in the 1/2 Median Line Minuette channel (1.1110 - 1.1080 - 1.1050), and in case of breakdown of the lower boundary (1.1050) of this channel, it will be possible for the common European currency to reach the boundaries of the equilibrium zone (1.0995 - 1.0950 - 1.0905) of the Minuette operational scale.

In case of breakdown of the SSL initial line (resistance level of 1.1130) of the Minuette operational scale forks, the EUR / USD movement will develop to the resistance levels :

- 1.1180 (local maximum);

- 1.1185 (control line UTL Minuette);

- 1.1215 (the Median Line of the Minuette operational scale forks).

The details of the EUR / USD movement options are shown on the chart.

____________________

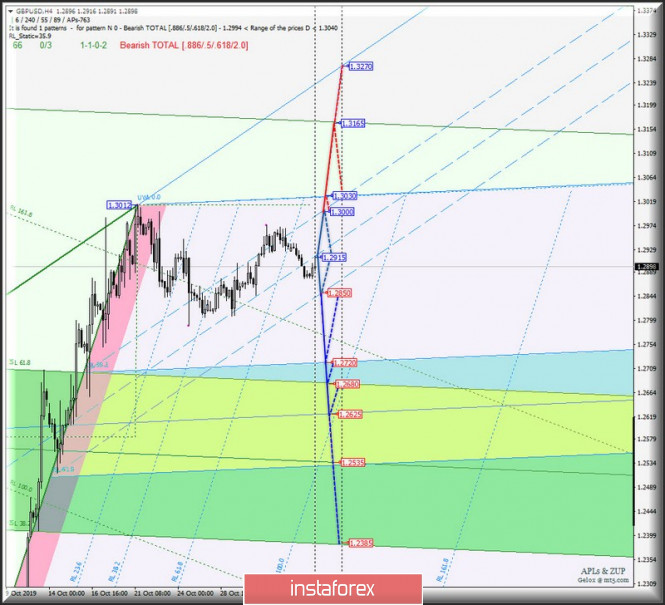

Great Britain pound vs US dollar

From November 6, 2019, the development of Her Majesty's GBP / USD currency movement will depend on the development and direction of the breakdown of the 1/2 Median Line (1.3000 - 1.2915 - 1.2850) of the Minuette operational scale forks. The movement details inside the 1 /2 Median Line channel are presented on the animated chart.

In case of breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 1.2850), the downward movement of GBP / USD can continue to the boundaries of the equilibrium zones of the Minuette operational scale forks (1.2720 - 1.2625 - 1.2535) and Minuette (1.2680 - 1.2535 - 1.2385).

Combined breakdown of resistance levels :

- 1.3000 (upper boundary of the 1/2 Median Line Minuette channel);

- 1.3030 (the initial line of SSL Minuette operational scale forks);

will make the development of Her Majesty's currency upward movement to the final line FSL (1.3165) of the Minuette operational scale relevant with the possibility of reaching the control line UTL Minuette (1.3270).

The details of the GBP / USD movement can be seen on the chart.

____________________

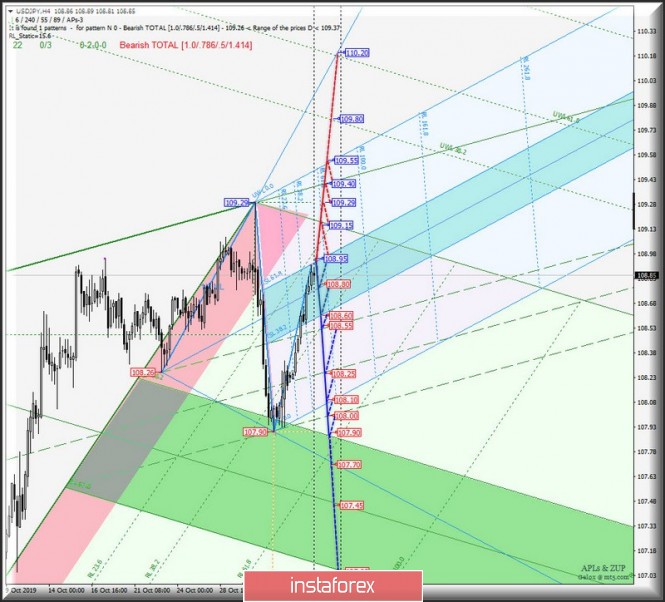

US dollar vs Japanese yen

The development and direction of the breakdown of the boundaries of the equilibrium zone (108.95 - 108.80 - 108.60) of the Minuette operational scale forks will determine the development of the USD / JPY currency movement of the "country of the rising sun" from November 6, 2019. The details of the movement inside the equilibrium zone can be seen on the chart.

The breakdown of the lower boundary of ISL38.2 (support level of 108.60) of the equilibrium zone of the Minuette operational scale forks - the USD / JPY movement will continue to the boundaries of the 1/2 Median Line Minuette channel (108.55 - 108.25 - 108.00) with the prospect of reaching the upper boundary of ISL38.2 (107.90) equilibrium zone of the Minuette operational scale forks.

On the contrary, in the event of a breakdown of the resistance level of 108.95 on the upper boundary of ISL61.8 of the equilibrium zone of the Minuette operational scale forks, it will be possible to continue the development of the upward movement of the currency of the country of the rising sun to the goals - the initial SSL line (109.15) of the Minuette operational scale forks - maximum 109.29 - control line UTL Minuette (109.40) - the final line of the FSL Minuette (109.55).

We look at the details of the USD / JPY movement on the chart.

____________________

The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy").

The formula for calculating the dollar index :

USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036.

where power factors correspond to the weights of the currencies in the basket:

Euro - 57.6% ;

Yen - 13.6% ;

Pound Sterling - 11.9% ;

Canadian dollar - 9.1%;

Swedish Krona - 4.2%;

Swiss franc - 3.6%.

The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other.

The material has been provided by InstaForex Company - www.instaforex.com