The decision of the US Federal Reserve is likely to lead only to a slight strengthening of the US dollar against a number of world currencies, however, provided that the committee leaves interest rates unchanged within the current range of 1.5% -1.75%. More attention will be focused on the Fed statement, from which we can draw conclusions about the future prospects of the economy and interest rates. It is also expected that quarterly long-term forecasts will be given at the meeting.

Much will depend on how inflation shows itself today. If the report is better than economists' forecasts, it is likely that the Fed will take a break in the cycle of lowering interest rates. If prices remain at the same levels or even worse, they fall below economists' forecasts, then the central bank will continue to lower rates in the coming months.

An additional bonus is November data on US employment, which could make some Fed leaders skeptical about rates change their minds. Let me remind you that just recently, during his speech, Fed Chairman Jerome Powell announced a series of interest rate cuts this year as a mid-cycle correction. This suggests that after the stabilization of the situation, the Fed could begin to raise rates to the target value, or higher.

A number of negative forecasts given by global economic agencies in the event that the United States and China fail to come to an agreement negatively affect risky assets. Even if trade conflicts are resolved, in 2020 US GDP growth will still slow to 2.1% from the projected 2.4% this year. However, global economic growth may accelerate to 3.4% in 2020, from 3.0% in 2019.

Considering that no important fundamental data were released today in the morning, nothing has technically changed in the EURUSD pair. The bulls did not even try to break above the resistance of 1.1100, which was quite expected before the Fed's decision on interest rates. The whole calculation will be on inflation in the US and on the Fed's decision on interest rates. The return of the trading instrument to support 1.1075 may increase the pressure on the pair, which will lead to its decline in the area of lows 1.1050 and 1.1030.

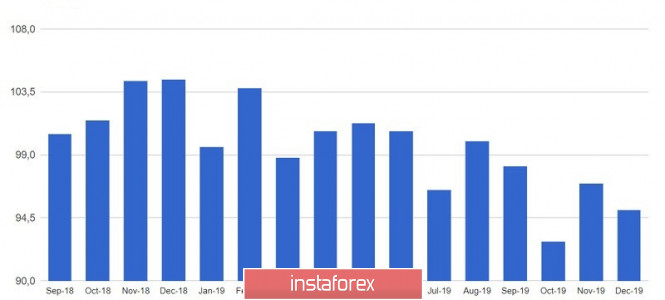

The latest report on consumer sentiment in Australia showed a deterioration in December this year. The consumer sentiment index fell to 95.1 points in December from 97.0 points in November, which casts doubt on the effect of lowering interest rates. The RBA said that the index is consistent with data indicating weak consumer demand.

The material has been provided by InstaForex Company - www.instaforex.com