The British pound continues to hit highs after news that the Conservative Party could get a majority in Parliament in the December 12 general election. Such a scenario will allow incumbent Prime Minister Boris Johnson to secede from the EU and bring into play the agreed Brexit plan.

In the morning, I noticed that according to the Kantar report, the ruling Conservative Party of Great Britain increased its margin from the Labour Party to 12 points, which supports the pound, as it changes investors' attitude to risk for the better. But do not forget that the closer we get to the election date, the more attention investors will pay to the survey results.

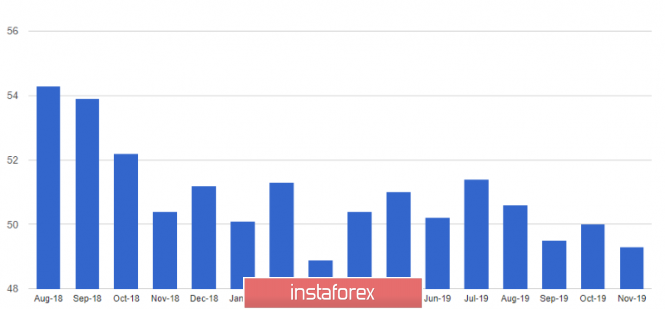

The pound buyers' optimism was also filled with enthusiasm by the UK services activity report, which was revised upward after preliminary data. Despite the fact that the index is below the mark of 50 points, it showed a slight increase in November from a preliminary estimate. According to the IHS Markit report, the index of procurement managers for the UK services sector was 49.3 points in November against a preliminary estimate of 48.6 points. However, one growth to the level of 50 points is clearly not enough, as the British economy continues to feel insecure. IHS Markit economists still expect a quarterly decline in GDP of about 0.1%.

As for the technical picture of the GBPUSD pair, the breakthrough of the large resistance of 1.3010, to which I paid attention in the morning, led to a powerful upward momentum. Now the bulls are focused on a new high in the area of 1.3125, the breakout of which will provide a direct path to a resistance of 1.3170. The downward correction will be limited to the first support level of 1.3055, and there is no need to talk about the trading instrument's return to a low of 1.3010.

EURUSD

Buyers of the European currency were not so optimistic after the data on the service sector, which indicated the persistence of problems in the eurozone economy. However, they turned out to be enough to prevent the bears from breaking below yesterday's lows, which preserves the upward potential in the pair.

According to IHS Markit, PMI for the Italian services sector in November was at 50.4 points versus 52.2 points in October. Given that economists had forecast a decline to 51.4 points, this did not add any particular problems to the market. But the PMI for the French services sector remained above 52 points and amounted to 52.2 points in November compared to 52.9 points in October. An indicator above 50 points indicates an increase in activity.

In Germany, there was a surge in service activity, where the PMI reached 51.7 points in November against 51.6 points in October this year, with a forecast of decline to 51.3 points.

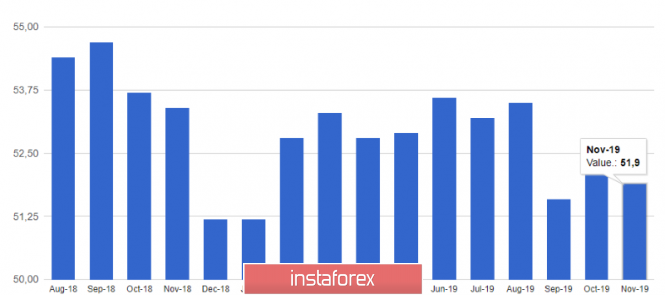

In the eurozone as a whole, the service sector has slightly decreased, but this did not upset traders. According to the report, PMI for the eurozone services sector fell to 51.9 points in November. Economists predicted that the figure would drop to 51.5 points.

But the composite index, which already includes the manufacturing sector and the services sector, still indicates a weak economic growth in the eurozone in the fourth quarter of this year.

According to IHS Markit, eurozone PMI Composite was finalized at 50.6 points compared to 50.3 points in October and the preliminary value of the same 50.3 points. All this once again suggests that the economic growth of the eurozone will remain weak in early 2020, however, the actions of the European Central Bank will help maintain growth. The fears that the problems of the manufacturing sector extend to the service sector are decreasing with each report.

Nothing has changed in EURUSD from a technical point of view. Bulls ran into a resistance of 1.1095 and cannot get above this range. Only its breakthrough will provide risky assets with a new impetus, which will lead to the renewal of highs in the areas of 1.1131 and 1.1180. If pressure on the euro returns, and for this, sellers of risky assets only need to push the trading instrument below the support of 1.1060, we can expect EURUSD to fall to the lows of 1.1030 and 1.1000.

The material has been provided by InstaForex Company - www.instaforex.com