There is the concept of seasonality in any market, including foreign exchange. Some markets, such as the energy market, are more prone to this, while other markets, such as the currency market, are less susceptible, but absolutely all financial markets are subject to seasonal changes. Many of you have heard of the pre-Christmas stock market rally, usually taking place on New Year's Eve, but few have wondered how the end of the year affects exchange rates. Let's try to figure this out.

First of all, we must understand that financial markets are connected with economic cycles and time periods, just as the quotes in our InstaForex terminals are subject to session changes. If you did not know this, then I inform you that the worst time to open positions is the period one and a half hours before the opening of the US session and half an hour after the opening. At the current moment, this corresponds to the period from 12 to 14 London time. It was at this time, before and immediately after the beginning of the US trading session, that the market generated a lot of false signals that mislead traders, but let's return to seasonality.

The generally accepted economic periods are the quarter, the end of the half year and the end of the year. Moreover, the end of the year, coinciding with the end of the fourth quarter, is the most important period that coincides with the Christmas holidays, which are widely celebrated in the US and Western Europe. As you close the year, you get such a bonus. Close the year with a loss, you will declare a loss in the statements, close the year with a profit - you will receive a premium.

That is why the closure of numerous financial contracts in December is of such great importance. In addition, the Christmas holidays do not allow traders and investors to quickly respond to possible threats, and in this regard, part of the open position is reduced. In other words, liquidity is leaving the market, and the market is becoming thin. This is fraught with significant price spikes and increased volatility, which occurs in the absence of a counterparty to transactions. This is especially dangerous in low liquid currency pairs and cross rates, as well as other assets that are not very popular, but liquid assets, such as EURUSD, are also subject to stress at this time.

Significant increases in swaps and spreads are also possible during this period, which is fraught with unplanned losses for traders. In turn, the increase in liquidity begins immediately after the New Year and by the second half of January, liquidity in the markets is usually restored.

This Friday, December 6, the last option contract of the current year will be closed in the futures currency markets, and, as you understood from the narration above, how it is closed will largely determine whether option sellers will profit in the current quarter. They no longer have time to correct a mistake and withdraw positions from losses.

Let me remind the reader of the mathematically proven truth: 75% of options burn out without money, and rare exceptions only confirm this rule. However, we have the opportunity, falling out only once a year, to test this theory in practice. Let's see how the optional barriers were located in the course of the European currency a week ago, November 26 (Fig. 1).

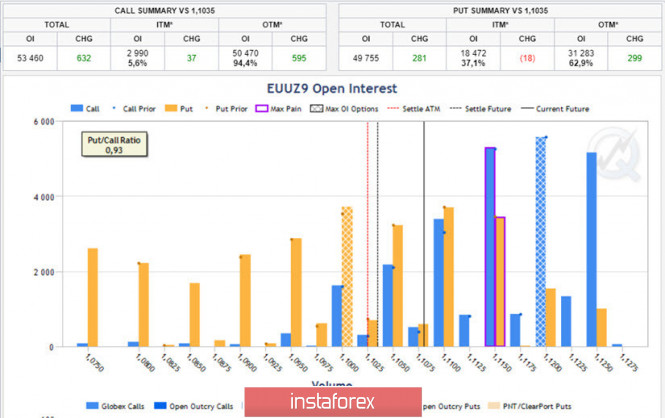

Fig. 1: Optional barriers (strikes) as of November 26

As you can see from the diagram below, the largest barrier of Put options was located at 1.10. At the same time, the largest option barrier of Call options was located at around 1.12. The point of maximum pain for option buyers - Max Pain was located at 1.1150. The number of Call options in the money was 5.6%. The number of Put options in the money was 37.1%. The EURUSD rate closed at 1.1020 on November 26.

On Friday, November 29, using the thin market triggered by Thanksgiving in the USA, EURUSD updated its low, took off stops below 1.0985, after which on Monday, November 30, it sharply grew and ended the session at 1.1080, i.e. actually achieved goals at the end of this week. Let's see how the optional barriers have changed since November 26? (fig. 2)

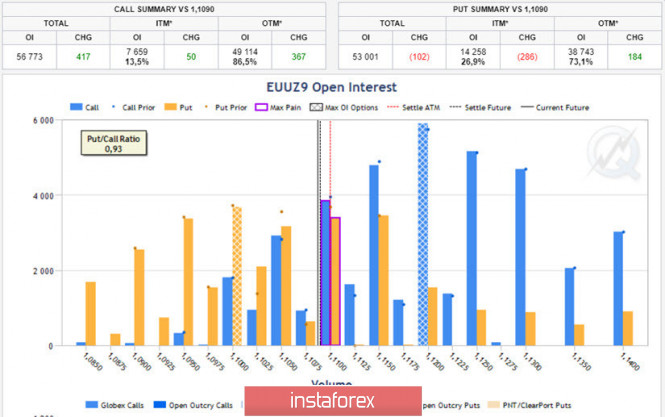

First of all, it should be noted that by December 3, the MP point has shifted from the level of 1.1150, to the value of 1.11. At the same time, the number of Call options in money increased to 13.5%, and the number of Put options in money decreased to 26.9%. The price of the EURUSD cash rate has almost matched the futures contract and is now actually at the point of Max Pain for option buyers, which was to be proved. An accident? I don't think so.

Fig. 2: Optional barriers (strikes) as of December 3

What conclusion can we draw from these facts? First of all, it can be assumed that, with a high degree of probability, before the closing of the option contract EUUZ9, the EURUSD rate will be in the zone of 1.11. Then a period of low liquidity will come, which will intensify even more after December 16, when the December futures contract for the ECZ19 euro will be closed.

It will not be superfluous to note that the European Central Bank meeting will be held on December 12, and a decision by the US Federal Reserve will be announced on December 18. These meetings will serve as additional uncertainties for the entire foreign exchange market and, in particular, for the euro. Considering the fact that unemployment data in the US will be published this Friday, December 6, the picture of the forthcoming movement of the euro exchange rate by the end of December becomes completely uncertain. However, let's see how option barriers are located in the next January option contract. Perhaps there, we will receive answers to our questions.

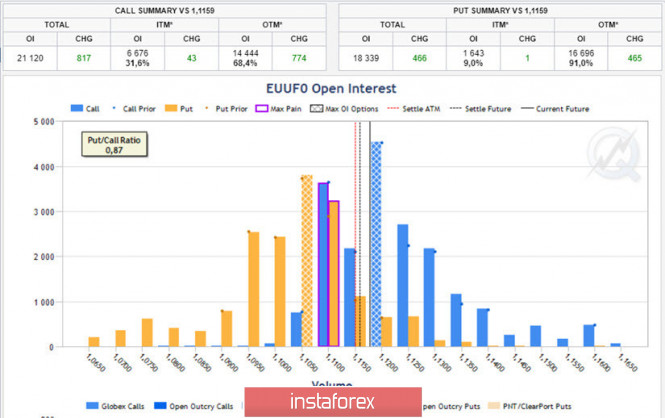

Fig. 3: Optional barriers (strikes), January EUUFO option contract

The January option contract, with the closure on January 3, 2020, although it has good liquidity, still does not have such key significance as the December contract. However, if you look at the current status of this EUUFO contract, you can see that the maximum open interest of Put options is on strike 1.1050, and the maximum open interest of Call options is on strike 1.12. In turn, the MP point of the January contract coincides with the MP point of the December contract and is at a value of 1.11. This is a very narrow range, so during December it is impossible to exclude a change in the parameters of open interest at the optional levels in this contract, and therefore the shift of the MP point.

Traders, when opening positions for buying, should be guided by the level of 1.12, and when opening positions for sale as a price reference, by the end of the current year, the level of 1.1050 should be considered, at least until new data allow another informed decision . In conclusion, I would especially like to note that the main thing in trading financial instruments is not determining the direction, but following the rules of money management.

The material has been provided by InstaForex Company - www.instaforex.com