4-hour timeframe

Amplitude of the last 5 days (high-low): 73p - 42p - 28p - 28p - 36p.

Average volatility over the past 5 days: 42p (average).

The fourth trading day of the week ends with a continuation of a weak upward correction, which began even a few days earlier. There was a rather large amount of important or relatively important macroeconomic information both in Europe and in the US today. Thus, traders again had every chance to behave more actively, however, the pair again beats all the anti-record volatility. The euro/dollar covered a distance of 28 points. Of course, by the end of the day this figure may grow a little and amount, for example, to points 40, which is just the average value for the pair over the past five days. At the same time, the pair worked out the critical line Kijun-sen as part of the correction and intends to overcome it. If this happens, then the downward trend will cancel for a while, and short positions will lose their relevance. Bulls will be able to form an upward trend, especially since for the first time in a long time the macroeconomic background can help them in this. We would also like to note the fact that the pair, once again approaching their two-year lows, could not overcome this area of support and now can again pull back upwards by 100-200 points.

Now we will consider and analyze all the macroeconomic statistics of the day; there were plenty of them on January 30. The day began with the publication of the unemployment rate in Germany, which remained unchanged at 5%. The change in the number of applications for unemployment benefits amounted to -2,000, which is better than forecasts. Then, about an hour later, similar information was published on the European Union. The unemployment rate in December was 7.4%, which is lower than a month earlier. In addition, several secondary indicators were published immediately reflecting the state of the business climate in the EU, as well as the mood in the economy, business optimism and consumer confidence. In general, indicators signaled versatile changes. Some turned out to be slightly better than forecasts, some were slightly worse. In any case, no reaction of market participants to all these data was followed.

Then, a few hours later, again in Germany were published more important data on the consumer price index in January (preliminary values). The main inflation rate accelerated to 1.7% y/y, and in monthly terms fell by 0.6%, which is fully consistent with the forecast values. The harmonized consumer price index was 1.6% y/y and did not reach the forecast value of 0.1%. However, in any case, acceleration of inflation in the locomotive country of the entire European Union is positive news for the euro. Now we can expect that pan-European inflation will accelerate slightly in January. Although, on the other hand, it is unlikely that it will still reach the ECB target levels of about 2.0% y/y.

The most interesting information came from overseas, since we primarily connect the prospects for the euro/dollar currency pair with US macroeconomic statistics. We have already said that we are concerned about indicators of business activity in the manufacturing sector, a drop in industrial production and a decline in GDP. The Fed in the form of Jerome Powell tried to calm the markets, and he managed to do so. Although the US dollar is becoming cheaper at the moment, its fall is negligible. The fourth quarter annual GDP data (preliminary value) amounted to +2.1%. The same value of the main indicator was in the third quarter. Thus, it can hardly be called strong, and the general trend remains bearish. The GDP price index was also published, which characterizes the change in prices for goods and services in the country for the reporting period and is a harbinger for the main inflation indicator. This indicator was forecasted to increase by 1.8%, but in reality it fell to 1.5% in the fourth quarter. The price index for personal consumption expenditures reflects the average amount of consumer spending on durable goods, consumer goods, and services, but does not take into account energy and food expenses. It is also a good indicator for forecasting inflation and also did not reach the forecast value of 1.6%. The last to be published was the index of expenditures on personal consumption, which reflects the average consumer spending on durable goods, consumer goods and services. This indicator decreased compared to the previous period (2.1%) and did not reach the forecast value (1.7%) - 1.3%. Thus, in general, we can say that macroeconomic statistics from across the ocean turned out to be very weak, and most importantly, we can now expect a slowdown in inflation, which has accelerated in recent months to 2.3% y/y. This is bad news for the US dollar, and the euro can finally form a more or less strong upward trend, fundamentally justified.

Trading recommendations:

The EUR/USD pair began to adjust against the downward trend. Thus, it is recommended to sell the euro again with targets of 1.0990, 1.0968, if traders fail to gain a foothold above the Kijun-sen line, that is, a rebound will occur. It will be possible to consider buying the euro/dollar pair no earlier than traders of the Kijun-sen line with small lots with the goal of a volatility level of 1.1051 and the Senkou Span B. line

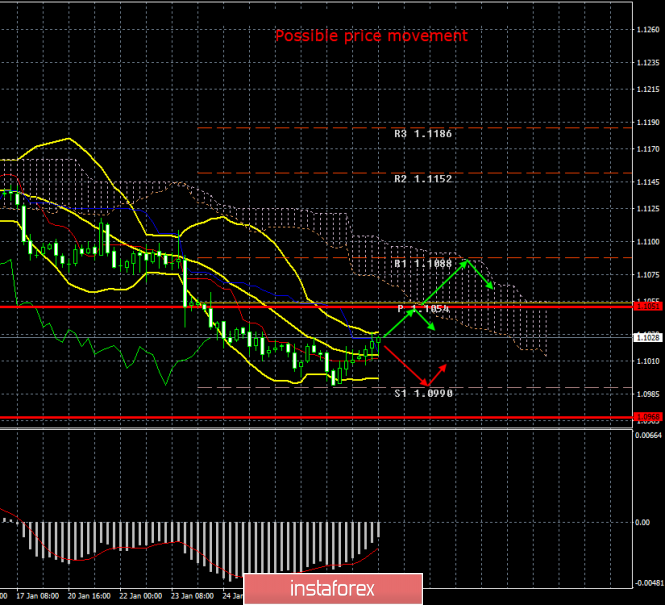

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com