On Monday, US stock exchanges lost from 1.5% to 2% due to the threat of the spread of coronavirus, the number of countries where patients are officially recorded, is increasing. On the other hand, the sales wave is expected to spread to the Asia-Pacific countries, the Japanese Nikkei 225 index is losing 0.65% at 6.00 Universal time after a strong decline on Monday, the Australian S & P / ASX 200 1.35%, and the Korean KOSPI all at 3.3%.

At the same time, uncertainty has increased dramatically; the global economic recovery is in danger of ending without ever starting. In the short term, there is no reason to expect a recovery in demand for risky assets, the US dollar, yen, gold and government bonds will remain the favorites. Oil, in turn, has not yet experienced a reduction in demand, but a drop in demand will become inevitable, which will drag prices even lower if the panic persists.

NZD/USD

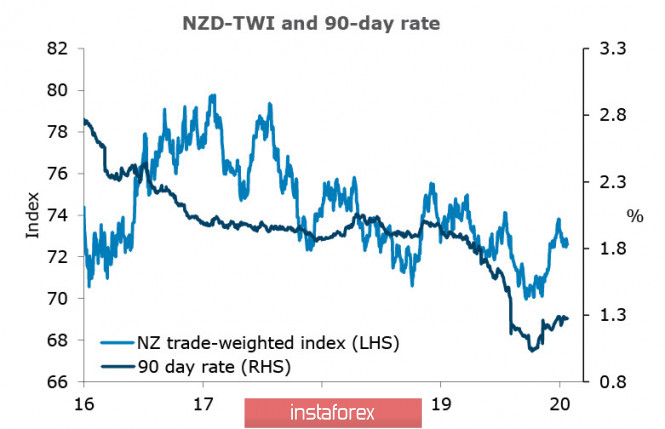

Consumer inflation in the Q4 rose to 1.9% YoY and the result was 0.1% which was better than forecasted and provided grounds for revising prospects for the rate and, as a result, for the kiwi exchange rate.

It was assumed that the rate will decline to 0.5% at the beginning of this year until recently. Now, expectations are changing and RBNZ is likely to take a break. Moreover, ANZ Bank released its next quarterly forecast this morning. ANZ sees New Zealand's economic outlook positively positive - GDP growth in 2021 to 2.6% against 2.3% in the current, unemployment decline from 4.2% to 3.8%, inflation at 2%, and believes that the NZD/USD rate will drop to 0.65 at the same time. Such optimism is based on two assumptions - firstly, an improvement in the global economy, and secondly, faster growth of the United States.

These forecasts do not yet take into account the probability of a global crisis from the threat of the spread of the virus. Thus, they can show a strong discrepancy with reality in the short-term.

In any case, we must proceed from the fact that the assessment of the economic situation in New Zealand has become more positive, and will push the kiwi to increase if panic sales stop. Bearish pressure will remain strong until this happens. Strong support is located in the zone of 0.6470 / 90, and its decline will open the way to 0.6420. This is possible if the panic is not stopped. The momentum is strong at the moment and there is no reason to wait for a reversal.

AUD/USD

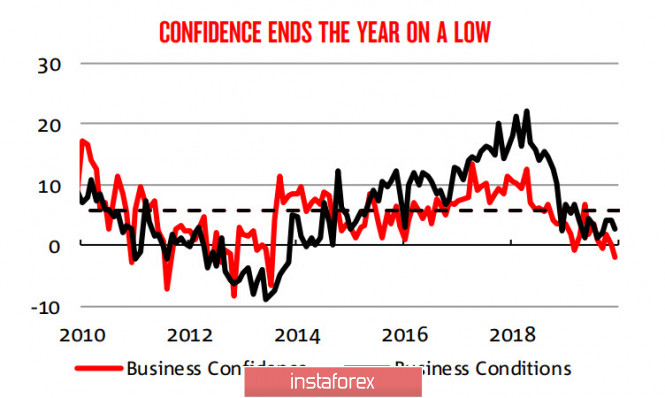

In light of the upcoming RBA meeting, the two releases are of particular importance - the NAB Business Survey for January and tomorrow's December CPI. The first of these was published this morning and was unexpectedly worse than expected. As a result, both components are steadily declining.

Forecast indicators do not suggest a significant improvement in the near future. Capacity utilization is below average, capital expenditures in 2019. decreased, retail and wholesale trade, despite slight growth, are deep in negative territory, and this have not yet been reflected in the research results, despite the fact that large-scale forest fires.

The Australian economy does not look very confident, and monetary stimulus is expected to increase this year, although a strong employment report last week means that a decrease in the RBA rate in February has become less likely. Moreover, ANZ changes its forecast and expects one decline in April, another one in the fall. As a result of which, the RBA rate will drop to an unprecedented level of 0.25%. Alan Oster, chief economist at NAB Group, believes that more incentives will be needed in 2020. In turn, ANZ Bank has a similar assessment.

The weakness of the economy, combined with panic in the financial markets, does not leave Aussie traders the choice of bearish pressure remains strong, despite oversold. Support 0.6753 was reached as a result of a rapid decline. Technically, we can expect a correction to 0.6799 / 6805, but any attempt to grow will be used for new large-scale sales. Thus, Australian currency is targeting 0.6669 - a minimum since 2009.

The material has been provided by InstaForex Company - www.instaforex.com