Forecast for January 3:

Analytical review of currency pairs on the scale of H1:

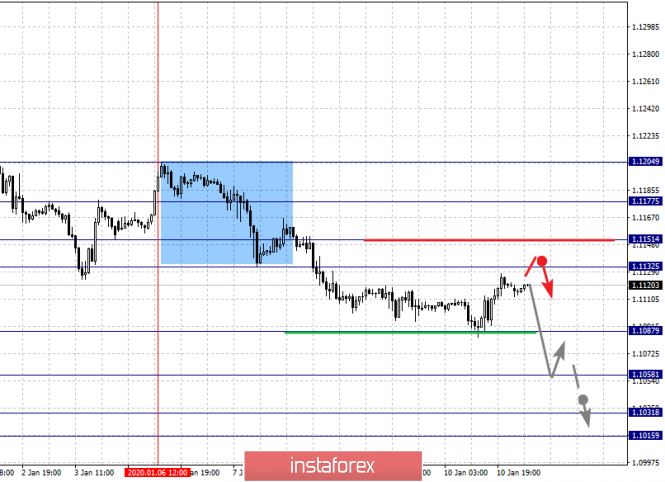

For the euro / dollar pair, the key levels on the H1 scale are: 1.1177, 1.1151, 1.1132, 1.1087, 1.1058, 1.1031 and 1.1015. Here, we continue to monitor the local descending structure of January 6. The continuation of the downward movement is expected after the breakdown of the level of 1.1087. In this case, the target is 1.1058. Price consolidation is near this level. The breakdown of the level of 1.1056 will lead to movement to a potential target - 1.1015. In turn, price consolidation is in the range of 1.1015 - 1.1031 and from here, we expect a rollback to the top.

Short-term upward movement is possible in the range of 1.1132 - 1.1151. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 1.1177. This level is a key support for the downward structure.

The main trend is the local descending structure of January 6

Trading recommendations:

Buy: 1.1132 Take profit: 1.1150

Buy: 1.1153 Take profit: 1.1175

Sell: 1.1085 Take profit: 1.1060

Sell: 1.1056 Take profit: 1.1034

For the pound / dollar pair, the key levels on the H1 scale are: 1.3178, 1.3113, 1.3073, 1.3006, 1.2937, 1.2874 and 1.2838. Here, we consider the descending cycle of December 31 as the main structure. We expect further downward movement after a breakdown of the level of 1.3006. In this case, the target is 1.2937. Price consolidation is near this level. Its breakdown will lead to a movement to a potential target - 1.2838. Price consolidation is in the range of 1.2838 - 1.2874 and from here, we expect a correction.

Short-term upward movement is possible in the range of 1.3073 - 1.3113. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3178. This level is a key support for the descending structure of December 31.

The main trend is the descending structure of December 31

Trading recommendations:

Buy: 1.3073 Take profit: 1.3111

Buy: 1.3120 Take profit: 1.3175

Sell: 1.3005 Take profit: 1.2940

Sell: 1.2935 Take profit: 1.2875

For the dollar / franc pair, the key levels on the H1 scale are: 0.9832, 0.9810, 0.9778, 0.9751, 0.9706, 0.9685 and 0.9664. Here, we determine the next goals from the local ascending structure on January 8. The continuation of the movement to the top is expected after the breakdown of the level of 0.9751. In this case, the target is 0.9778. Price consolidation is near this level. The breakdown of the level of 0.9780 will lead to a pronounced movement. Here, the target is 0.9810. For the potential value for the top, we consider the level of 0.9832, upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.9706 - 0.9685. There is a high probability of a reversal to the top from this range. The breakdown of the level of 0.9685 will lead to the development of a downward structure. Here, the first potential target is 0.9664.

The main trend is the local ascending structure of January 8

Trading recommendations:

Buy : 0.9751 Take profit: 0.9775

Buy : 0.9780 Take profit: 0.9810

Sell: 0.9705 Take profit: 0.9688

Sell: 0.9683 Take profit: 0.9664

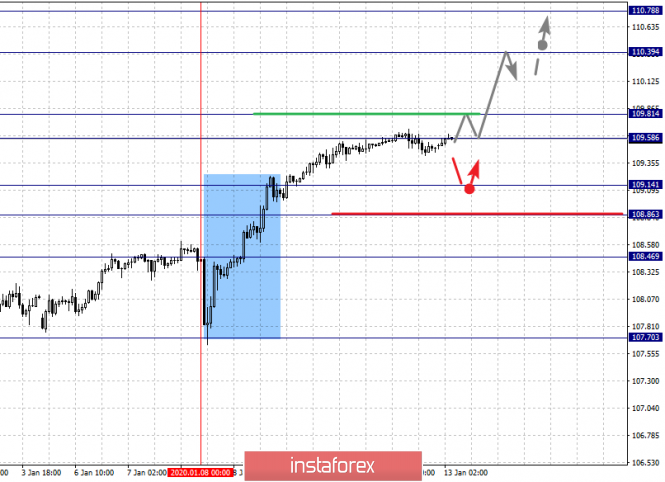

For the dollar / yen pair, the key levels on the scale are : 110.78, 110.39, 109.81, 109.58, 109.14, 108.86 and 108.46. Here, we are following the formation of a pronounced ascending structure of January 8. Short-term upward movement is expected in the range of 109.58 - 109.81. The breakdown of the last value should be accompanied by an impulsive movement to the level of 110.39. Price consolidation is near this level. For the potential value for the top, we consider the level of 110.78, from which we expect a pullback to the bottom.

Short-term downward movement is possible in the range 109.14 - 108.86. The breakdown of the last value will lead to an in-depth correction. Here, the target is 108.46. This level is a key support for the top.

The main trend: building potential for the top of January 8.

Trading recommendations:

Buy: 109.58 Take profit: 109.80

Buy : 109.83 Take profit: 110.30

Sell: 109.14 Take profit: 108.88

Sell: 108.82 Take profit: 108.50

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3157, 1.3126, 1.3112, 1.3090, 1.3062, 1.3040 and 1.3015. Here, we are following the development of the upward cycle of January 7. We expect further upward movement after the breakdown of the level of 1.3090. In this case, the target is 1.3112. Price consolidation is in the range of 1.3112 - 1.3126. We consider the level of 1.3157 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the range of 1.3062 - 1.3040. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3015. This level is a key support for the top.

The main trend is the upward cycle of January 7

Trading recommendations:

Buy: 1.3090 Take profit: 1.3112

Buy : 1.3126 Take profit: 1.3155

Sell: 1.3062 Take profit: 1.3042

Sell: 1.3038 Take profit: 1.3015

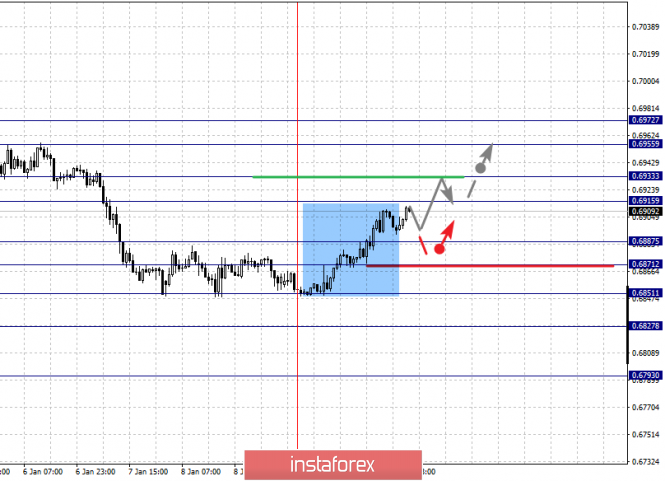

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6972, 0.6955, 0.6933, 0.6915, 0.6887, 0.6871, 0.6851, 0.6827 and 0.6793. Here, the price forms the potential for the upward movement of January 9 in the correction of the downward cycle of December 31. Short-term movement to the top is expected in the range of 0.6915 - 0.6933. The breakdown of the last value will lead to a pronounced movement. Here, the target is 0.6955. For the potential value for the top, we consider the level of 0.6972, upon reaching this value we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is expected in the range 0.6887 - 0.6871. The breakdown of the last value will have the subsequent development of the downward structure. Here, the first goal is 0.6851. As a potential value for the bottom, we consider the level of 0.6793. The movement to which is expected after the breakdown of the level of 0.6825.

The main trend is the descending structure of December 31, the formation of potential for the top of January 9

Trading recommendations:

Buy: 0.6915 Take profit: 0.6930

Buy: 0.6935 Take profit: 0.6955

Sell : 0.6887 Take profit : 0.6873

Sell: 0.6870 Take profit: 0.6852

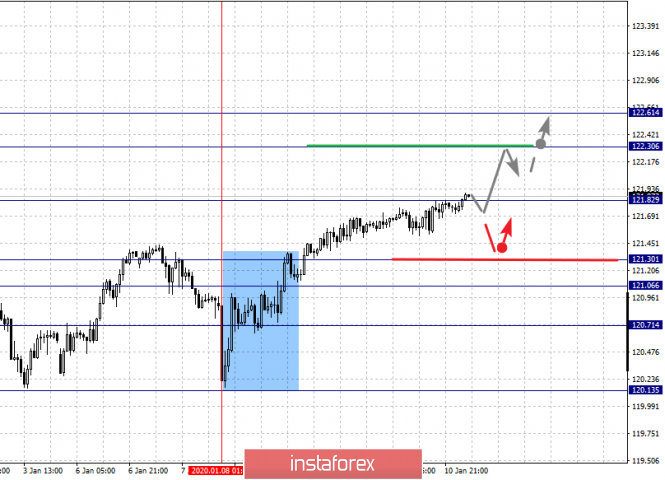

For the euro / yen pair, the key levels on the H1 scale are: 122.61, 122.30, 121.82, 121.30, 121.06 and 120.71. Here, we are following the formation of the initial conditions for the upward cycle of January 8. We expect the continuation of the upward movement after the breakdown of the level of 121.82. In this case, the target is 122.30. For now, we consider the level of 122.61 to be a potential value for the upward trend; upon reaching this level, we expect consolidation.

Short-term downward movement is possible in the range of 121.30 - 121.06. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 120.71. This level is a key support for the upward structure.

The main trend is the formation of initial conditions for the top of January 8

Trading recommendations:

Buy: 121.82 Take profit: 122.26

Buy: 121.32 Take profit: 122.60

Sell: 121.30 Take profit: 121.08

Sell: 121.04 Take profit: 120.76

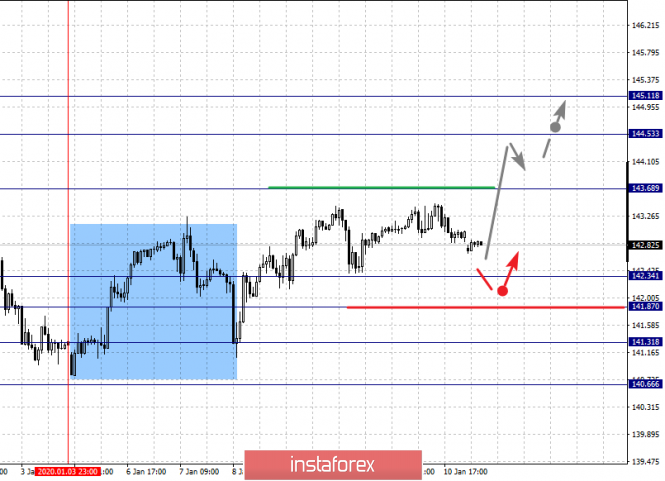

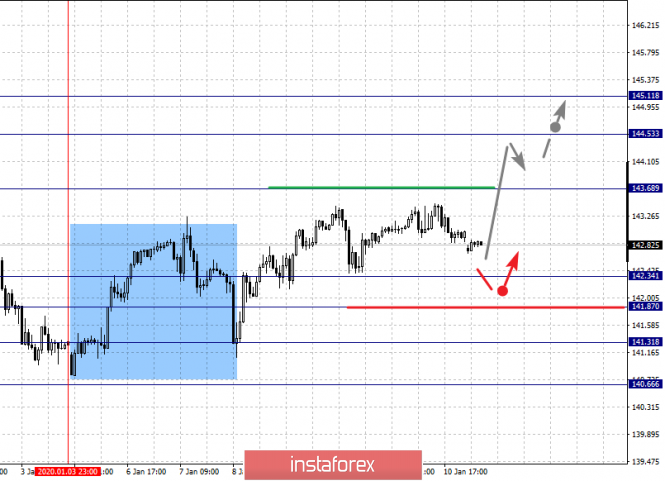

For the pound / yen pair, the key levels on the H1 scale are : 145.11, 144.53, 143.68, 142.34, 141.87, 141.31 and 140.66. Here, we are following the development of the upward structure of January 3, after the abolition of the downward trend. We expect further upward movement after the passage at the price level of 143.70. In this case, the target is 144.53. Price consolidation is near this value. For the potential level for the top, we consider level 145.11, from which we expect a pullback to the bottom.

Short-term downward movement is possible in the range of 142.34 - 141.87. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 141.31. This level is a key support for the upward structure.

The main trend is the upward structure of January 3

Trading recommendations:

Buy: 143.70 Take profit: 144.50

Buy: 144.55 Take profit: 145.10

Sell: 142.34 Take profit: 141.90

Sell: 141.85 Take profit: 141.35

The material has been provided by InstaForex Company - www.instaforex.com