4-hour time frame

Amplitude of the last 5 days (high-low): 118p - 89p - 111p - 55p - 79p.

Average volatility over the past 5 days: 86p (average).

The British pound sterling tried to resume the downward movement at the European trading session on Wednesday, January 15. However, the bearish mood of the traders ended very quickly and the pair has now returned to the Kijun-sen critical line, and the Bollinger bands are narrowing and turning sideways again. Thus, the further downward movement is still in question, as traders are clearly not willing to sell the pound again and even ignore quite important macroeconomic statistics from the UK. Today's inflation report showed that the consumer price index fell to 1.3% y / y by December, while traders expected inflation to remain unchanged at 1.5%. Thus, this is another slowdown in inflation in Britain. In monthly terms, the consumer price index was 0.0%, although market participants were expecting + 0.2%. In general, we can state that the data from the Foggy Albion failed once again. Formally, traders reacted to these statistics, since the pound still declined by 40 points early in the morning. However, we believe that this is too little for yet another confirmation of the weakness of the UK economy. This week, a retail sales report will be published in the UK, which will not save the situation for the British pound in any case.

The most important thing in the current situation is to find out why the British pound has stopped declining. Maybe the reasons lie not in the pound, but in the dollar? However, there have been no pessimistic events recently in the States. The signing of a trade deal in the first phase between Beijing and Washington with all the desire could not cause a sell-off of the American currency. Thus, we are now inclined to believe that traders again consider the current level of the pound / dollar pair unattractive for new sales.

Not so long ago, we listed a list of reasons why the pound will continue to fall in price in 2020. The main reason, of course, was Brexit, and this reason brings with it a number of other reasons. For example, we said that London could have serious problems with Scotland, which wants to remain in the European Union, with Ireland, where clashes between various separatist and nationalist movements may begin, with Gibraltar, which Spain claims, and so on. Of course, the most pressing issue remains the issue with Scotland, whose Prime Minister Nicola Sturgeon has repeatedly stated her intention to initiate a second referendum on independence. Yesterday, January 14, Boris Johnson sent an official letter to Mrs. Sturgeon which refused to allow her to hold an independence referendum. Boris Johnson recalled the results of the previous referendum in 2014, when most Scots decided to stay in the United Kingdom. He also recalled that Nicola Sturgeon and her predecessor, Alex Salmond, promised last 2014 that the referendum would be the last "in a generation." In principle, Johnson's failure was predicted by everyone. Why would the Prime Minister endorse the possible loss of an entire country in such difficult times for Britain? Moreover, there is really an iron argument in the form of the 2014 referendum. However, the problem is that Scotland is unlikely to give up so easily. It's good (for London) if the Scottish National Party simply continued to act "by law", requiring official permission from London. But then this process will simply drag on for many years and will not have any serious consequences. However, it can be assumed that Edinburgh may not follow a completely legal path given the truly serious attitude of Nicola Sturgeon, for example, to hold a referendum not agreed with London. Potentially, this could be a source of global conflict between England and Scotland. After all, Scotland remains under the jurisdiction of London and is obliged to obey. However, Nicola Sturgeon has repeatedly stated that her country does not want to be under the leadership of Boris Johnson. In general, Brexit will only begin on January 31, 2020, and the UK has already faced so many problems: financial losses and a political crisis that it becomes scary at the expense of the near future of the country. Thus, the future of the pound is no less vague and we continue to expect a decline in the British currency in the medium and long term.

Trading recommendations:

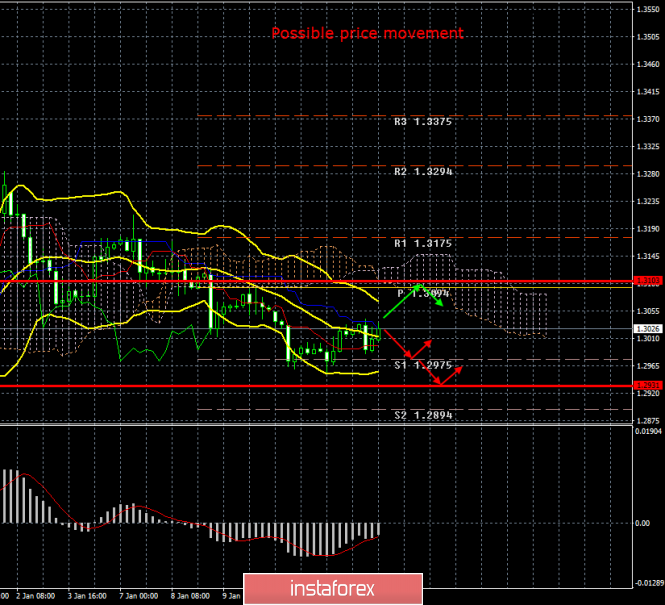

GBP / USD remains downside. Thus, traders are advised to stay on the pound / dollar pair with targets at 1.2975, 1.2931 and 1.2894 as long as the pair is below the critical line. It is recommended that purchases of British currency be returned no earlier than the price fixing above the Kijun-sen and Senkou Span B lines with the first target of 1.3175.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com