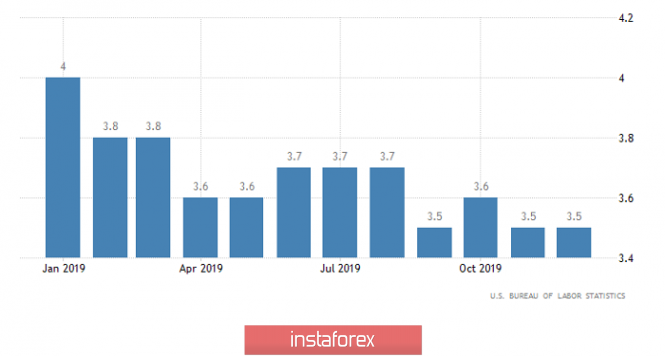

The market quite calmly accepted the contents of the report of the United States Department of Labor, as it turned out to be completely different than expected. Of course, the pace of creating new jobs outside of agriculture has slowed, and more significantly than expected. They were created 145 thousand, while 165 thousand were forecasted. At the same time, 256 thousand were created in the previous month. And although this is an extremely negative factor, it still did not lead to a weakening dollar, as the unemployment rate, unexpectedly, remained unchanged . This is precisely the reason why there was no reaction to the publication of the report, because investors look at these two indicators. However, in fact, the content of the report was extremely poor. Thus, the unemployment rate remained unchanged due to the fact that the share of the able-bodied in the total population did not change, although they expected its growth from 63.2% to 63.3%. In addition, the growth rate of the average hourly wage did not remain unchanged, but slowed down from 3.1% to 2.9%. Moreover, the average working week, in fact, decreased to 34.3 hours. True, statistics indicate that the duration of the working week remained unchanged, as previous data was revised downward. So it is clear that the content of the report of the Ministry of Labor is clearly negative, and directly indicates a high probability of a decrease in consumer activity. Not now, but in the near future.

Unemployment Rate (United States):

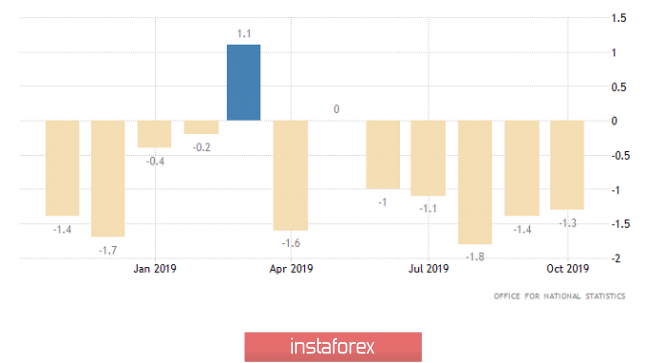

Today, all the attention is paid to the UK, where industrial production data is published. No more interesting statistics are published today. At the same time, the pound will most likely be forced to give up its positions, as British industry, which is currently declining by 1.3%, can accelerate its decline to 1.4%. This will mean that the decline in industrial production has been going on for the eighth consecutive month.

Industrial Production (UK):

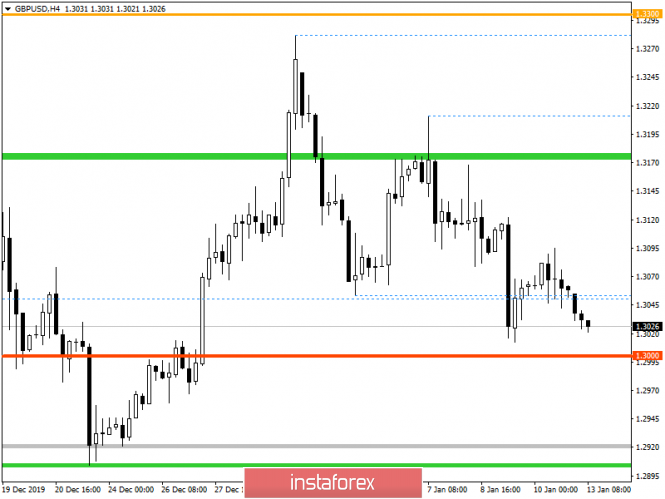

In terms of technical analysis, we see that after a slight pullback, the GBP/USD pair again went to the psychological level of 1.3000, while showing little activity. In fact, the quote sequentially forms a downward move, where it was set in the first days of the new year.

Considering the trading chart in general terms, we continue to monitor the extremely high pound sterling, where the quote displays similar behavior, as it did at the beginning of last year.

It is likely to assume that sellers will nevertheless be able to closely approximate the quotation to the psychological level of 1.3000, where it is worthwhile to carefully monitor the price taking points, since depending on the consolidations it will be clear which trading method we will use - Breakout/Bounce.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of deceleration within the level of 1.3000, followed by a rebound.

- Short positions, we look towards the level of 1.3000, we expect a deeper decline after a clear consolidation of the price below 1.2980/1.2990.

From the point of view of a comprehensive indicator analysis, we see that indicators invariably signal a decline, which is confirmed by the general interest of the market.