Apparently, investors are not impressed by what is happening around Iran, but are still seriously preparing for today's release of the report of the United States Department of Labor. The fact that the likelihood of an escalation of military confrontation between the United States and Iran has faded away has allowed everyone to breathe and relax, which of course has calmed the markets. In turn, this allowed investors to pay close attention to macroeconomic data, as well as to forecasts for the US labor market, and to begin to think over a line of behavior. Only this can explain the complete lack of market reaction to data on applications for unemployment benefits.

Nevertheless, the data turned out to be extremely interesting, and makes us seriously think. The number of initial applications for unemployment benefits fell by 9 thousand, instead of the forecasted 4 thousand. This is certainly not bad, and even good, however, the number of repeated applications for unemployment benefits, which should have been reduced by 31 thousand, unexpectedly increased by 75 thousand. This is a lot. Which naturally inspires concern, and clearly drove many investors into a stupor.

Number of repeated applications for unemployment benefits (United States):

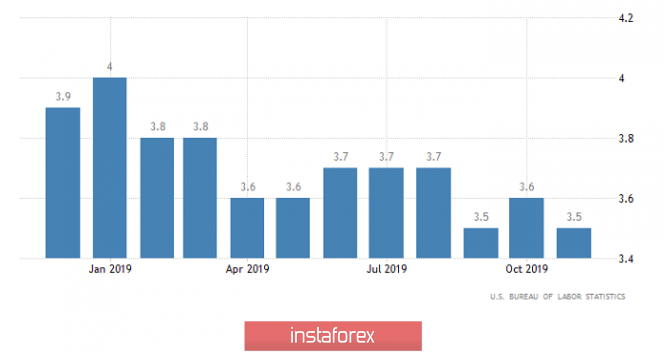

At the same time, it is the incredibly poor data on repeated applications for unemployment benefits that suggest that the content of the report of the United States Department of Labor will be negative. True, it is worth noting that the forecasts for it do not sparkle with optimism. So, 165 thousand new jobs should be created outside agriculture, against 266 thousand in the previous month. Also, the unemployment rate could rise from 3.5% to 3.6%. Although this should happen due to an increase in the share of labor in the total population, from 63.2% to 63.3%. But no one will initially pay attention to this, since the very fact of rising unemployment will plunge investors into gloom. But the most interesting is that no one has revised these forecasts, after yesterday's data on the number of applications for unemployment benefits. So there is a chance that the data will be even worse.

Unemployment rate (United States):

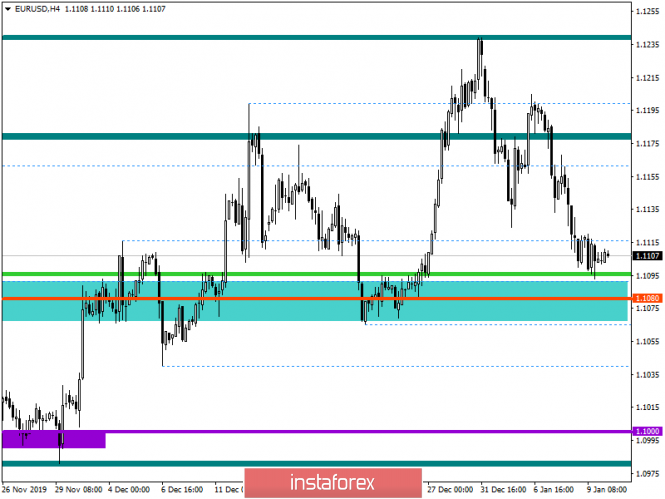

From the point of view of technical analysis, we see a kind of restraint, expressed in local stagnation, along the value of 1.1100. In fact, this is the first stop from the beginning of the week, and an intense downward move behind it, in the structure of which there was no pullback, or correction.

In terms of a general review of the trading chart, we see that the main support is still lower and reflects the level of 1.1080, which in turn changed its status and became a range level, which confirms the current boundaries of the slowdown.

It is likely to assume that the quotation will continue to fluctuate within 1.1090/1.1120, but this will not last long, where the most optimal tactic would be to work on the breakdown of time boundaries.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of price consolidation higher than 1.1125.

- Short positions, we consider in case of price consolidation lower than 1.1080.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments still maintain a downward mood, although the current slowdown has already affected smaller time sections.