The development of events yesterday was a complete surprise, because the dollar did not decline, but strengthened contrary to all forecasts. The reason for such behavior lies in American macroeconomic statistics, which turned out to be much better than forecasts. Moreover, it is surprising that the dollar strengthened only slightly, as the statistics turned out to be so good that it would be worth waiting for a much more significant increase.

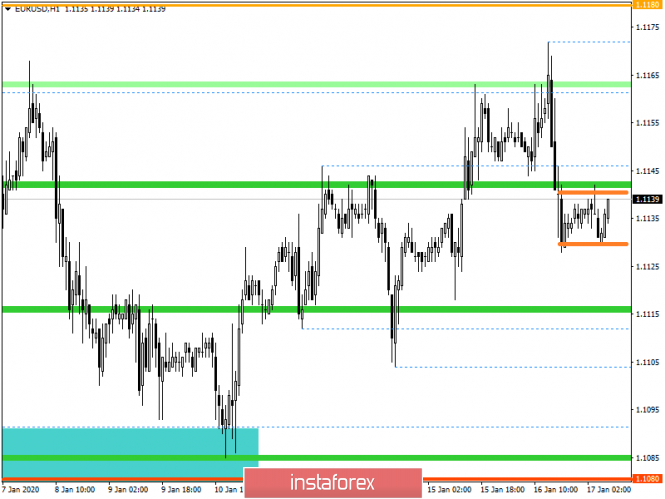

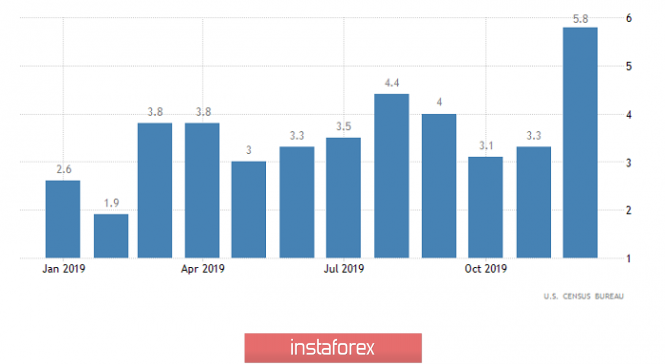

So, the total number of applications for unemployment benefits declined by 46 thousand, while the expected reduction was only 6 thousand. In particular, the number of repeated applications for unemployment benefits decreased by 36 thousand instead of 11 thousand. However, the number of initial applications for benefits unemployment, which declined by 10 thousand, was supposed to increase by 5 thousand. But what is much more important is retail sales, whose growth rates did not slow down from 3.3% to 2.9%, but accelerated to 5.8% . Combined with the recent rise in inflation, such an impressive increase in consumer activity is simply an incredibly positive factor. Therefore, it really seems that the dollar is somehow modest.

Retail Sales (United States):

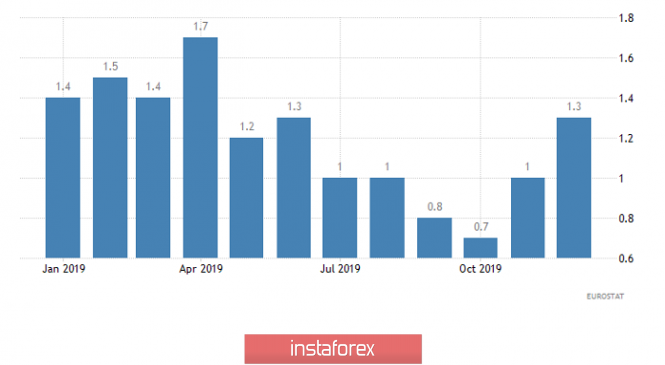

The most important news of the day will probably be the data on inflation in Europe, where it should accelerate from 1.0% to 1.3%. This in itself is a positive factor. However, there is every reason to believe that the data will turn out to be even better, and this is indicated by recent inflation data in the largest countries of the euro area. And if this is so, then the European Central Bank will have no reason to search for new ways to mitigate monetary policy parameters. In other words, the single European currency has all the prerequisites for strong growth.

Inflation (Europe):

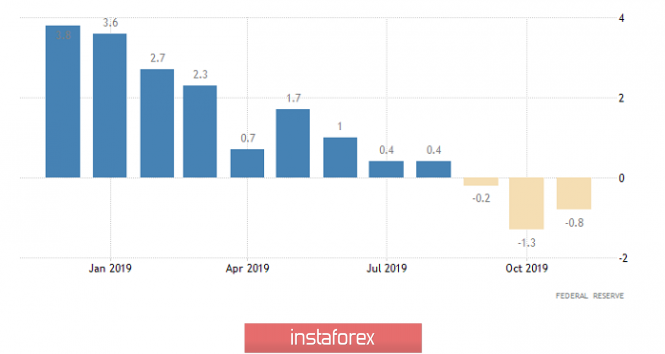

At the same time, the dollar will most likely lose its positions throughout the day, since it will have nothing to oppose European inflation. Its own statistics are not encouraging. Thus, the volume of new construction projects may be reduced by 2.6%, but the worst thing is that the number of issued permits for new construction should be reduced by 1.6%. Consequently, the current reduction in construction will continue in the near future. In addition, it is expected to deepen the pace of decline in industrial production, from -0.8% to -1.2%. Due tot this, the only thing that can save the dollar is that the statistics will turn out to be completely different than expected. However, in all respects, the probability that there will be growth instead of a decrease is almost zero.

Industrial Production (United States):

From the point of view of technical analysis, we saw an unusual attempt to break through the periodic level of 1.1165, but as a result, we got punctures with shadows, without a clear point of price fixing. The subsequent actions were in terms of a reverse stroke, based on impulse candles and a price return to the 1.1135 area. In fact, we got a local change in trading interest, where a stagnation of 1.1130 / 1.1140 formed when emotions faded.

In terms of a general review of the trading chart, we see that the correction phase from the range level of 1.1080 is still preserved in the market, where there are not many points left to key levels.

It is likely to assume that the existing stagnation of 1.1130 / 1.1140 may serve as a kind of platform for the continuation of long positions, where attractive positions will open in the direction of 1.1165 in case of price fixing higher than 1.1145. At the same time, subsequent actions are considered in case of a clear fixation of the price higher than 1.1165, where the finishing move is located in the area of 1.1180 / 1.1200.

From the point of view of a comprehensive indicator analysis, we see that indicators have changed from rising interest to neutra due to the recent chatter. Thus, it is worth considering that the indicators of technical instruments will return to their original course in case of price fixing higher than 1.1145.