In fact, the single European currency stood still yesterday. Fluctuations in quotations were so insignificant that it was just right to examine them under a microscope. Even fairly weak data from the United States did not affect the market. This is largely due to the fact that the data was published quite late, and for many European traders, the hand was already reaching for the button to turn off the trading terminal. They were clearly not going to think and do something there at such a late hour. The data is not so crucial. Just one of the components of the real estate market.

However, new home sales in the United States were down 0.4%. From 697 thousand to 694 thousand. At the same time, the previous data was also revised downward, from 719 thousand. So, in general, the picture is rather sad. Nevertheless, these data are still not as significant as housing sales in the secondary market, where the bill goes not to hundreds of thousands of objects, but to millions. Moreover, just the secondary market is growing.

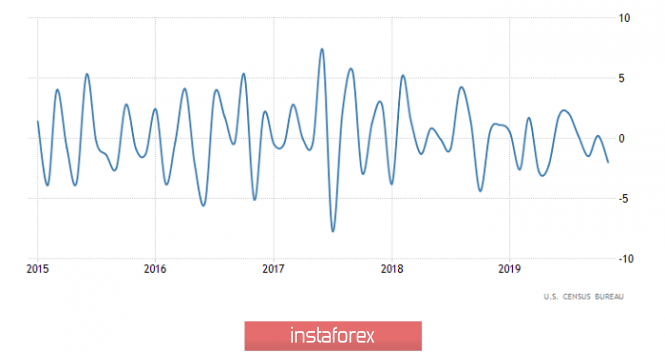

New Home Sales (United States):

Today, again, only US statistics will interest investors. Unlike yesterday, as the data themselves are somewhat more interesting, they are also published much earlier, so that all traders will still be in their places. The greatest interest is caused by orders for durable goods, the volume of which, after a decrease of 2.0%, should increase by 0.6%. Such growth makes it possible for us to argue that the recession in industry will be short-term, and soon we will see its growth. Also, this indicates that there are no prerequisites for a significant decrease in consumer activity. In addition, S&P/ CaseShiller data on housing prices should compensate for the negative nature of yesterday's data on sales of new homes. The fact is that the growth rate of real estate prices can accelerate from 2.2% to 2.6%. So it's worth waiting for a positive reaction to US data. However, the reaction will still be moderate, since no one intends to take any risks before the meeting of the Federal Open Market Committee.

Durable Goods Orders (United States):

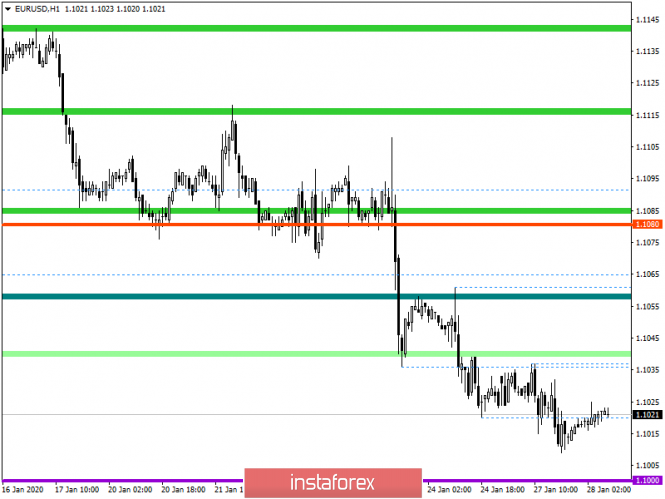

From the point of view of technical analysis, we see a narrow amplitude fluctuation within the psychological level of 1.1000. In fact, the control level puts pressure on the quote, where due to patterns waiting for a rebound. It is worth considering that at the current beat, the inertial component set by the market at the beginning of the year is preserved.

In terms of a general review of the trading chart, we see quotes recovering by more than half relative to an oblong correction, which is a good signal for sellers.

It is likely to assume that the pressure from the psychological level of 1.1000 will still remain on the market, which will lead to a temporary fluctuation within 1.0990/1.1040, where trading tactics are selected by the method of breaking specified boundaries. It is worth considering that in the case of considering the lower limit, we need not just to puncture the set value, but consolidated below, while maintaining the inertial course.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of price consolidation higher than 1.1045, local transactions.

- Short positions, we consider in case of price consolidation lower than 1.0990, not a puncture in the shadow of a candle.

From the point of view of a comprehensive indicator analysis, we see that the downward interest in the hourly and daily periods remains, which cannot be said about the minute intervals, which occupy a neutral position.