The media once again broke the picture of the day, and forced the market to go against the wind. Despite the fact that preliminary data on business activity indexes in the UK turned out to be significantly better than forecasts, which already predicted the growth of indexes, the pound fell. The reason lies in reports that appeared in a number of media that the Bank of England may well lower the refinancing rate, already at the end of the next meeting. Although more recently, all forecasts have been revised, and even interest rate futures indicate that this will happen no earlier than mid-summer of this year. Nevertheless, given that the information was distributed by quite influential media, investors were seriously worried, and contrary to common sense, they began to actively get rid of the pound.

At the same time, there were no reasons to weaken the pound, at least before the US session begins. After all, preliminary data on business activity indices, as mentioned above, turned out to be much better than the most daring forecasts. Thus, the index of business activity in the service sector grew from 50.0 to 52.9, with a forecast of 51.0. The index of business activity in the manufacturing sector, which was supposed to grow from 47.5 to 48.9, increased to 49.8. As a result, the composite business activity index grew from 49.3, not to 50.6, but to 52.4. So the pound, at least before the publication of similar data in the United States, was supposed to grow. Well, or at least not to decline. However, another panic organized by the media confused all the cards.

Composite Business Activity Index (UK):

If we talk about preliminary indices of business activity in the United States, then they are not so unambiguous, although they are more likely to be positive. The index of business activity in the manufacturing sector, which was supposed to grow from 52.4 to 52.5, unexpectedly dropped to 51.7. But the index of business activity in the service sector, which has a much greater weight, rose to 53.2 instead of falling from 52.8 to 52.7. This is what made it possible for the composite business activity index to grow from 52.7 to 53.1. Initially, it was expected to decrease to 52.5. So for good, the pound should slightly grow, and then go back. But everything turned out somewhat differently due to external factors.

Composite Business Activity Index (United States):

Today, we can even see the continuation of the Friday scenario, although the pound will support the fact of a rather serious and sudden oversold. The assumption that the pound may continue to decline is based on data on approved mortgages, the number of which may decrease from 43.7 thousand to 42.5 thousand. Given the extremely high importance of the condition of the real estate market for the UK's investment attractiveness, at least reasons for growth, the pound simply will not.

Mortgages Approved (UK):

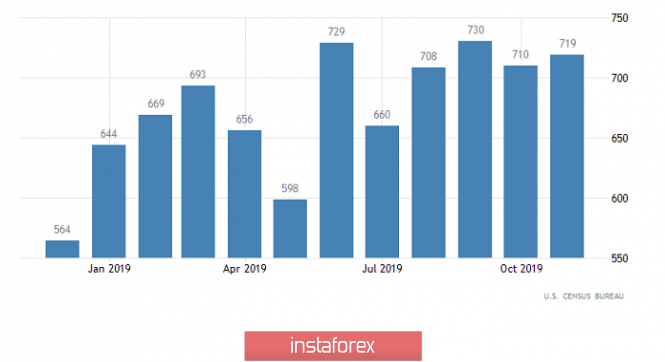

Another factor that will work against the pound is the expected 0.8% increase in new home sales in the United States. The number of sales should be 725 thousand, against 719 thousand a month earlier.

New Home Sales (United States):

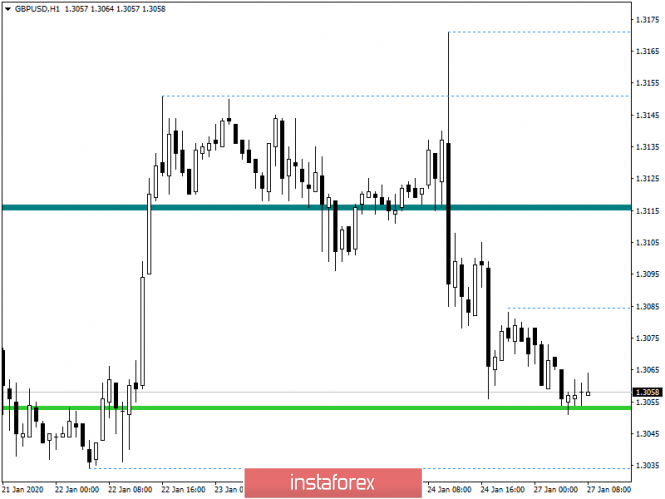

In terms of technical analysis, we see that alternating stagnation gave way to a sharp rally, where the quote showed volatility exceeding that of the previous day in just a few hours. In fact, the quote again took a downward position, as a result of which it fell to the area of 1.3055, where it all started.

Considering the trading chart in general terms, we see a characteristic amplitude fluctuation [daily chart], where each subsequent measure is less than the previous one, which signals stagnation.

It is likely to assume that the variable support point of 1.3055 will try to temporarily restrain the ardor of sellers, where, against the background of local oversold, stagnation of 1.3040/1.3065 may form. The best tactic is a wait-and-see attitude regarding price consolidation points.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of price consolidation higher than 1.3065.

- Short positions, we consider in case of price consolidation lower than 1.3035-1.3040.

From the point of view of a comprehensive indicator analysis, we see a continuing downward interest due to the recent impulsive move. In fact, hourly and daily periods signal selling, but minute intervals reflect a slowdown, having a variable signal.