Hello, dear colleagues!

That's the end of the first winter month and with it, the year 2019. The year was not easy and was marked by a trade standoff between the United States and China. However, trade disputes between countries with the first and second world economies have been going on for about 17 months, and are unlikely to be resolved immediately, at one point. In this light, it is reasonable to assume that in the coming year, the trade conflict between the United States and China will find its continuation.

As for the US currency, which is the No. 1 in the Forex market, despite the Fed's rate cut, sometimes ambiguous macroeconomic statistics and the same trade war between Washington and Beijing, the US dollar feels no less confident and is trading without any falls or take-offs. Except that the weakening of the "American" in pairs with commodity currencies, but this is not about it.

Since December ended, it makes sense to start the technical part of this review with a review of the monthly chart and see what the prospects for EUR/USD look like on the most senior timeframe.

Monthly

As you can see, by the end of December, the main currency pair has significantly strengthened. As a result of the growth, the Tenkan line of the Ichimoku indicator was broken, as well as the resistance of sellers in the area of 1.1080. It is worth noting here that attempts to break through the indicated resistance were observed during the previous two months, but were in vain.

The December closing price was 1.1228, which is pretty good in itself. However, at 1.1254, the lower boundary of the Ichimoku cloud passes, and at 1.1333, the 50 simple moving average is located. If the growth continues, the lower limit of the cloud and 50 MA may provide serious resistance, but in the meantime, it is possible to adjust the course to its December strengthening.

In general, after the growth in December, the breakdown of resistance near 1.1180 and the closing price above 1.1200, it is likely that the euro-dollar will continue to strengthen, but, as noted above, much will be decided near 1.1250 and 1.1330.

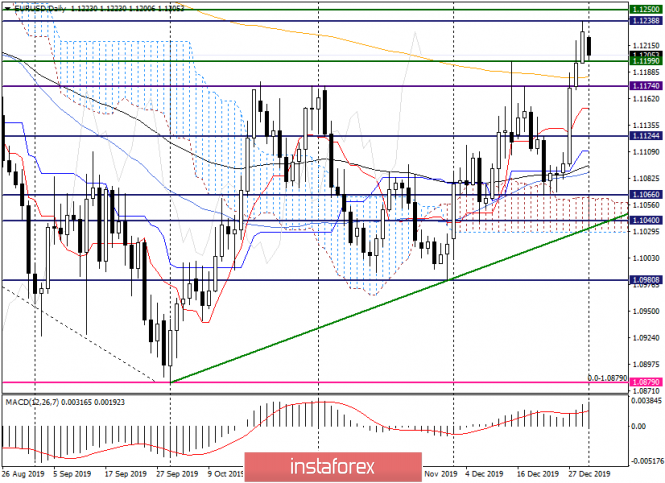

Daily

As expected in the last review of last year, trading on January 2 opened with a gap, and with a bearish one. After such a rapid growth of the last three trading days, this factor looks quite justified. The market needs a correction, after which, most likely, the pair will turn in the chosen north direction.

At the time of writing, trading is conducted near 1.1205. A little lower is the broken resistance level of 1.1190, which now may well support the price. At 1.1183, there is a 233 exponential moving average, which can also support the rate in case of its decline. Thus, the goals of the expected correction can be identified in the area of 1.1200-1.1180, and when the pair falls in this area, we consider the opening of long positions from here. Let's see how things are in smaller time intervals and whether this idea will find confirmation there.

H1

As you can see, trading on January 2 began for EUR/USD extremely negative. Not only did they open with a downward trend, but after that, there was a fairly strong decline. However, at the moment, the pair has found support in the form of 50 MA and began to recover. But how much it will be significant remains a big question. The situation for the euro is complicated by the presence of an obvious bearish divergence of the MACD indicator, but it is necessary to perceive such diversions only as an additional signal.

As for the current recovery and the situation in general. Alternatively, they can go up, close the gap and turn down again. If there is a bearish candle or candles near 1.1225, you can try to sell with the removal of the stop above the highs of 1.1238. Fortunately, the stop is small. The goals are in the area of 1.1200-1.1180, from where it is already worth looking at the purchases and again focus on the signals of the Japanese candlesticks.

Here is a simple plan for the main currency pair. In conclusion, I want to wish everyone a Happy New Year, wish them good health and success!

The material has been provided by InstaForex Company - www.instaforex.com