Economic calendar (Universal time)

The main attention of today's economic calendar is focused on statistics from the UK and the publication of which is expected at 9:30 UTC+00.

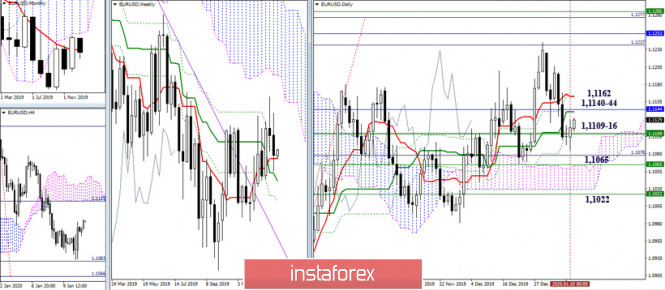

EUR / USD

On Friday, the pair failed to stop under important weekly support. As a result, braking was developed and there was a formation of rebound from the levels of the weekly cross. With the opening of the week of support, they regrouped a bit and their location is now as follows: the current center of gravity and key ongoing support are located at 1.1109-16 (weekly Tenkan + weekly Fibo Kijun + daily Fibo Kijun), if they are broken through, the following lowering tasks will be associated with the breakdown of the daily cloud and the elimination of the weekly dead cross 1.1065 - 22 (daily cloud + weekly Kijun + weekly Fibo Kijun). At the same time, resistances and the nearest reference points for completing the current increase today are 1.1140-44 (daily Kijun + monthly Tenkan) and 1.1162 (daily Tenkan + Fibo Kijun).

On H1, the key resistance is currently located at 1.1138 (weekly long-term trend + R1). A breakdown of the level will change the current balance of forces in the lower halves. The following upward milestones will be 1.1155 (R2) - 1.1180 (R3) within the day. Meanwhile, the nearest support now is the central Pivot level (1.1111). Consolidating below which can return full bearish activity. Other intraday supports are the classic Pivot levels S1 (1.1092) - S2 (1.1067) - S3 (1.1048).

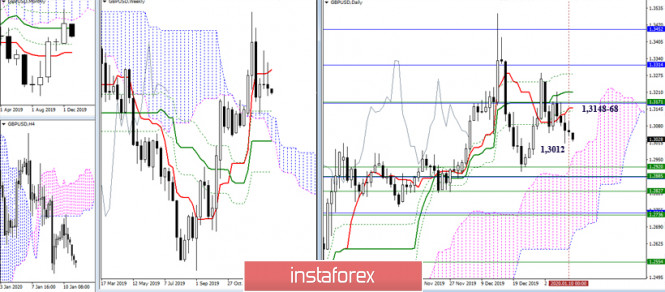

GBP / USD

Last week, the promotion players were unable to oppose anything to the opponent. Nevertheless, it must be taken into account that the players on the downside also failed to achieve any result. Thus, uncertainty and meditation continue to dominate. As of now, bears are trying to push the situation by updating and breaking the minimum of the last week (1.302) in order to regain the prospects for continued decline (daily + weekly cloud + other support levels 1.2957 - 1.2920 - 1.2885 - 1.2827 - 1.2736). However, another failure in this direction will lead the pair to the struggle for the daily advantage (daily cross 1.3148 - 1.3209 - 1.3281) again, strengthened by the weekly short-term (1.3168) and monthly medium-term (1.3167) trends.

At the moment, the initiative and the main advantages belong to the players on the downside in the lower halves. The only weakening factor is being in the correction zone, updating the minimum (1.3012) will completely restore the downward trend and the advantages of the players to decline. On the other hand, the following intraday supports are located at 1.3201 (S2) and 1.2978 (S3). In turn, overcoming the key references will change the current balance of forces. This situation can be noted at 1.3065 (central Pivot-level of the day) and 1.3101 (weekly long-term trend). Consolidation above will open up new perspectives and require a new assessment.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com