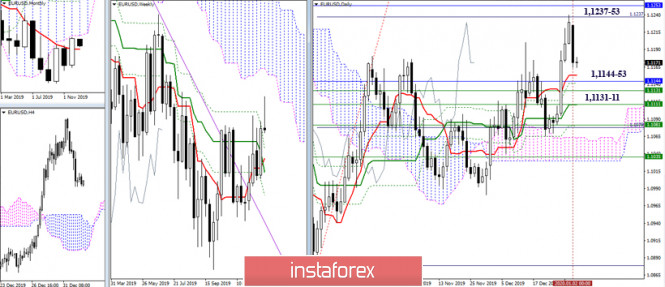

EUR / USD

The players took a break for an increase, which was immediately actively used by the opponent after the optimism which we managed to consolidate in the results of the story. Thus far, a downward correction has brought the pair closer to the supports, forming a fairly wide area. The first one on the direction is the daily short-term trend (1.1153), then the levels of different halves are located at 1.1144 - 1.1131 - 1.1111. Now, it is important for promotion players to find support in the designated support area to maintain their capabilities and advantages. The consolidation below will require clarification of the situation, as it may change current plans and priorities.

In the lower halves, the pair has so far performed a correction to support the weekly long-term trend (1.1164). Today, the following intraday support can be noted at 1.1148 (S1) - 1.1126 (S2) - 1.1087 (S3). At the same time, the nearest resistance, which may affect the current balance of power, is now located at 1.1187 (central pivot-level of the day).

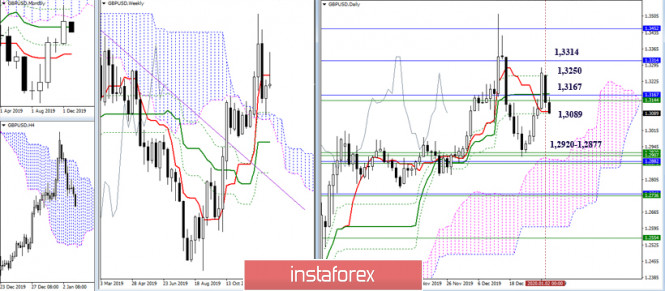

GBP / USD

The rebound from which the resistance met 1.3250 - 1.3167 - 1.3089 (daily cross + monthly medium-term trend + weekly short-term trend), which are still attracting and restraining the decline, will lead to the continuation of the decline and new testing of the strengthened support zone in the area 1.2920 - 1.2877 (weekly cloud + monthly Fibo Kijun + upper border of the daily cloud).

On the other hand, a correctional decline in the lower halves led the players to lower to the union of supports for the weekly long-term trend (1.3095) and S1 of the classic Pivot levels (1.3084), as a result, braking is possible in the near future. Overcoming levels will open the way to 1.3032 (S2) - 1.2949 (S3). Now, resistance and benchmark. Consolidation above which will confirm the rebound from the support they met and will allow us to consider further plans to restore the positions of players to increase to the level of 1.3167 (central Pivot-level of the day) today.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com