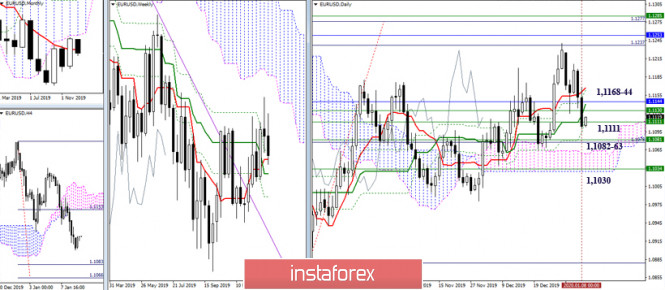

EUR / USD

Players on the downside continue to struggle with the support zone they met, which is located within 1.1168-44 (daily and monthly Tenkan) - 1.1130-11 (weekly Fibo Kijun + Tenkan + daily Kijun). Nevertheless, weekly closure under the support zone will help them achieve further success. After that, we will consider the support located at 1.1082-63 (weekly Kijun + upper border of the daily cloud + target for breakdown of the H4 cloud) and 1.1030 (lower border of the daily cloud + final level of the weekly golden cross) to continue the decline. The breaking of the met supports, and even more so the formation of a rebound, can delay the development of the situation and save uncertainty.

The main advantage of the lower halves now belongs to the players on the decline. The reference points within the day when the decline continues will be the support of the classic Pivot levels 1.1081 (S1) - 1.1057 (S2) - 1.1014 (S3). The expansion of the capabilities of the current upward correction may provoke consolidation above the central Pivot level of the day (1.1124). In this case, the interests of the players to increase will shift to the conquest of the key resistance at H1 - the weekly long-term trend (1.1161).

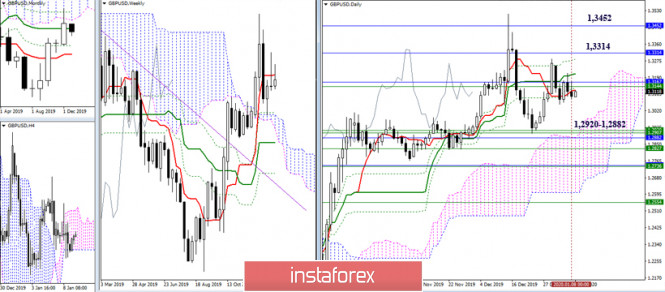

GBP / USD

The pair continues to close the working day under the attraction zone 1.3121-96, which has combined many important and strong levels of high halves, but it is impossible to go beyond it, so there is no change in the situation, and the conclusions and possible options for the development of events voiced earlier retain their relevance. At the same time, a separation from the zone of attraction will lead to the strengthening of bears, whose interests will be directed to 1.2920 - 1.2882 (weekly cloud + monthly Fibo Kijun + upper border of the daily cloud). Now, consolidating above 1.3121-96 may contribute to the further restoration of the bullish positions, with the goal of conquering the nearest monthly resistance (1.3314 - 1.3452).

Yesterday, players on the upside failed when trying to break down key resistance on H1, while the pair remained in the zone of attraction of the levels and could not develop directional movement. At the moment, certainty and clear advantage are lacking again. The pound is testing key resistance levels again, combining the central Pivot of the day (1.3114) and the weekly long-term trend (1.3126), and continues to remain in their zone of attraction, with a slight advantage in favor of the bears, as the pair is now working under key levels. Today's intraday supports are 1.3059 (S1) - 1.3025 (S2) - 1.2970 (S3), while the resistances of the classic Pivot levels are located at 1.3148 (R1) - 1.3203 (R2) - 1.3237 (R3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com