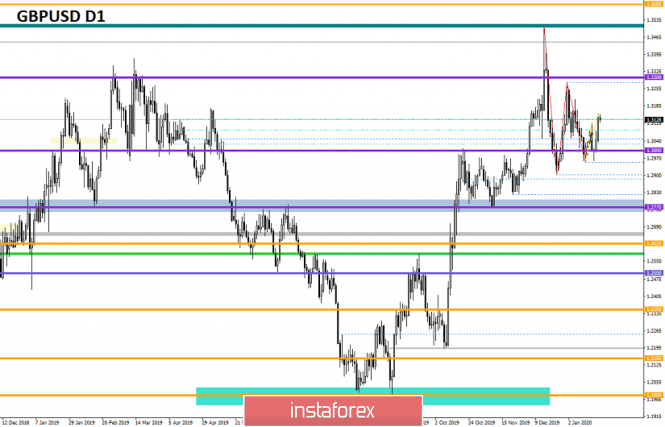

From the point of view of complex analysis, we see a sharp surge in activity, which led to a jump in prices towards 1.3150. In fact, the psychological level of 1.3000 was left behind, and the structure of the Zigzag-shaped model has undergone a significant change. The long-running Zigzag model led to a significant compression of the amplitude, where the psychological level, relative to which the compression phases occurred, became the point of interaction. Yesterday's surge in activity, larger than 110 points, managed to break through the maximum of the third phase of the model [01/17/19 (High) -20.01.20], which led to discussion of the fracture of the Zigzag-shaped model and a sharp surge of long positions. Predictions coincided, traders earned, but in the depths of consciousness lies the thought that this is not the end, but we should expect something more.

What is the doubt? That is, we have two assumptions since the impulse that occurred earlier is insufficient in comparison with the mass of the model. The first suggests that the current impulse is only the beginning of a future move, and the second judgment, on the contrary, casts doubt on the structure of the model and the correctness of the phases. To be more precise, the previous phase [01/17/19/20/01/20] is only a tact, the current phase and the reverse is still possible.

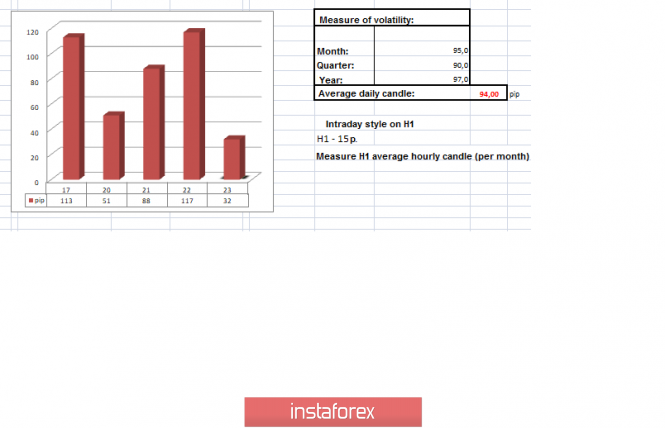

In terms of volatility, we see the highest indicator since the beginning of the trading week, where for the first time we exceeded the average daily indicator by 24%. A characteristic acceleration was observed in the market since Tuesday, where the daily indicator grew to the level of 88 points in comparison with Monday.

Analyzing the past minute by minute, we see that the structure of the move resembles steps, and the impulse move raised us to a new level, where the surge in activity occurred at 10: 00-13:00 [UTC+00 time on the trading terminal]. Subsequent swings were in terms of deceleration, reflecting a range of 1.3115 / 1.3150.

As discussed in the previous review, speculators had long positions even from the value of 1.3201, where the breakdown of the January 17 maximum gave confidence to the actions, which led to the further progress and the achievement of subsequent predicted coordinates.

Considering the trading chart in general terms [the daily period], we see that there are no cardinal changes, the main coordinates are not affected by the price. Thus, the medium-term upward movement is preserved in the structure of the global downward trend.

The news background of the past day contained statistics for the UK, where the volume of borrowing in the public sector fell by 4 billion pounds. At the same time, data were published on the Business Optimism Index [CBI], which rose from -44 to +23, now it remains only for investors to believe in these indicators, since most of them left the United Kingdom since the beginning of the referendum.

The market reaction to the statistics was conditionally in favor of the pound sterling, but probably the sacred meaning was different.

In terms of the general information background, we have the long-awaited approval by the British Parliament of the bill on the country's withdrawal from the EU. The last delay was from the House of Lords, the trough delayed the long-awaited moment of approval for all.

"Parliament has passed a bill to withdraw from the European Union, which means that the United Kingdom will leave the EU on January 31 and will move forward as a whole. At times, it seemed like we would never cross the Brexit finish line, but finally we succeeded, "said the British Prime Minister.

Now all that remains is the signature of Queen Elizabeth II, after which the European side will sign the necessary documents in Brussels, and on January 29 the agreement will have to finalize the European Parliament.

In turn, the Chancellor of the Exchequer of Great Britain, Sajid Javid, was inspired by what was happening and said to the United States government during the World Economic Forum that they should wait in line until Britain finishes negotiations with the European Union and after it comes to them, which the Ministry of Finance did not like USA. Subsequently, the British government corrected the words of Javid, saying that there are no plans for priorities and from February 1 they can freely negotiate with any country.

Today, in terms of the economic calendar, we only had applications for US unemployment benefits, where no changes are expected. The main event of the day was the meeting of the ECB, followed by a press conference, where, according to expectations, changes in the strategy of the regulator may take place. This event belongs to the European Union, but do not forget that there is a characteristic correlation between the EUR/USD and GBP/USD currency pairs. As a result of which, there may be synchronous moves.

Further development

Analyzing the current trading chart, we see a very remarkable slowdown with perfectly even borders of 1.3115 / 1.3150, where the quote has been fluctuating for more than 20 hours. In fact, we are faced with local ambiguity, which is caused by a small overbought, as well as third-party factors, as we wrote above.

In terms of the emotional mood of the market, we see a high coefficient of speculative positions, which was caused by yesterday's surge in activity.

By detailing the per minute portion of time, we see that the structure of the candles does not have a doji, which indicates the strength of the current accumulation.

In turn, speculators came to the closure of previously opened long positions in connection with a divergence of opinion and a possible new, more profitable entry point.

Having a general picture of actions, it is possible to assume that market activity will continue to grow, and current accumulation is a temporary point of regrouping of trading forces. Due to doubts about the assurance of the Zigzag-shaped model, it is considered to be the best tactic to work with fluctuations, that is, we can safely talk about the completion of the model in case of a price higher than 1.3150 and fixing at 1.3180. An alternative judgment is considered in the form of preserving the Zigzag-shaped model and changing the beat, where the priority impulse awaits us if the price is fixed lower than 1.3105, with a move to the psychological level of 1.3000. After that, the analysis of price fixing points and quotation behavior is performed.

Based on the above information, we derive trading recommendations:

- Buy positions are considered in case of price fixing higher than 1.3180. Speculative positions may already be from the value of 1.3155.

- Sell positions are considered in case of price fixing lower than 1.3105, towards the psychological level of 1.3000.

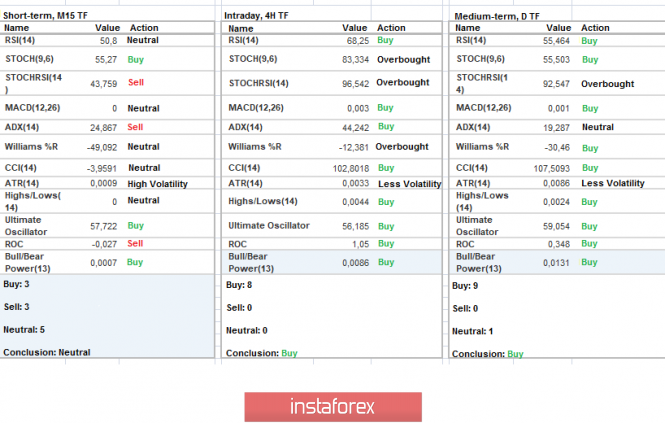

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that the indicators of technical instruments turned upward following the impulse move. In turn, the minute intervals took a neutral position due to the ambiguous range.

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(January 23 was built taking into account the time of publication of the article)

The current time volatility is 32 points, which is an extremely low value. It is likely to assume that volatility will increase locally at the moment of breakdown of the current range.

Key levels

Resistance zones: 1.3180 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Areas: 1.3000; 1.2885 *; 1.2770 **; 1.2700 *; 1.2620; 1.2580 *; 1.2500 **; 1.2350 **; 1.2205 (+/- 10p.) *; 1.2150 **; 1.2000 ***; 1.1700; 1.1475 **.

* Periodic level

** Range Level

*** Psychological level

**** The article is built on the principle of conducting a transaction, with daily adjustment

The material has been provided by InstaForex Company - www.instaforex.com