Today's data on Germany, as well as the minutes of the European Central Bank, clearly indicate the problems that the eurozone continues to experience, which is associated with weak economic prospects, especially compared with the prospects of the United States, which puts pressure on the euro.

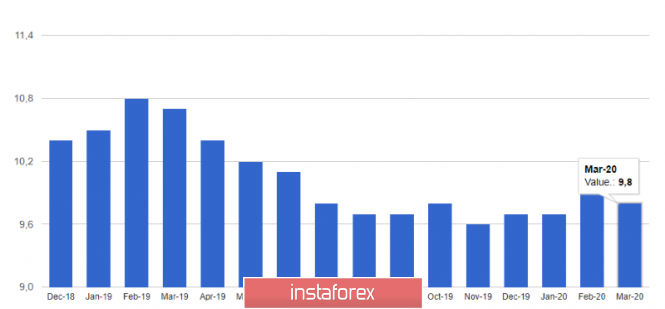

According to a report by the German GfK Institute, German consumer sentiment will slightly fall in March 2020. The fall of the leading index is directly related to the danger of the spread of the coronavirus, which further adds uncertainty to the German economy. It should be noted that the leading indicator of consumer sentiment GfK fell to 9.8 points against 9.9 points in February, while economists expected the March value to be 9.8 points. Subindexes also fell. The decrease is especially noticeable in the index of expectations regarding income and the propensity to buy index. The economic expectations index in February was 1.2 against -3.7 in January.

As for the current minutes of the ECB, the leaders signaled a tendency to maintain negative interest rates at the January meeting, saying that monetary policy should remain very soft for a long period of time, which, of course, did not provide confidence to the euro. However, it is necessary to note some signs of stabilization of economic growth, which were able to discern in the leadership of the ECB. Despite all this, the euro slightly regained its position, as the last "nail in the lid" would be the hints of the regulator on lowering interest rates this spring, which I mentioned several times in my previous reviews. Until this is done, chances for a euro correction to the area of 1.0900 and 1.1000 remain. Any statements to this effect will quickly push EURUSD further to the 2017 lows in the region of 1.0500. The ECB minutes also said that the current actions of the regulator will continue to support the economy. No additional incentive measures have been discussed so far.

GBPUSD

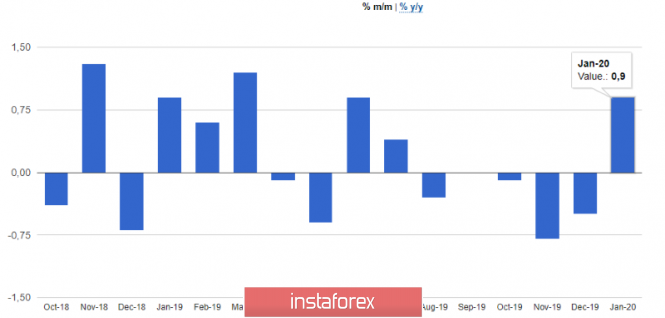

Big pound sellers did exactly the same thing today as they did yesterday. After waiting for good fundamental data on retail sales in the UK, which grew in January 2020, the bears began to actively sell the pound after a slight upward correction, which resulted in a breakthrough of large support areas and a test of new local lows near 1.2850.

According to the National Bureau of Statistics, retail sales rose immediately by 0.9%, while economists had forecast growth of only 0.7%. Let me remind you that there was a drop in this indicator in November and December. Mostly, sales of clothes and shoes contributed to the increase. If we remove gasoline sales from this indicator, then sales compared with the previous month increased by 1.6%. On the positive side, the fact that after the uncertainty of the period with Brexit consumers began to more actively manage their assets, which led to a revival of costs.

Of course, the pressure on the pound, which was formed immediately after a slight increase today in the morning, can be attributed to the uncertainty in trade between the UK and the EU. Formal negotiations will begin in early March this year. It is from them that the state of the UK economy this year will depend.

The material has been provided by InstaForex Company - www.instaforex.com